Hamilton Beach 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction

The global reach of NACCO Industries,

Inc. and its subsidiaries helped the

Company achieve financial results in 2011

that were substantially higher than 2010.

These strong results were driven primarily

by improvements in global lift truck

markets and enhanced by a significant

one-time event.

The year began with the settlement

of litigation initiated by NACCO in 2006

against Applica Incorporated (“Applica”)

and individuals and entities affiliated with

Applica’s shareholder, Harbinger Capital

Partners Master Fund I Ltd. In February

2011, NACCO received a payment of $60

million ($39.0 million after taxes of $21.0

million) in connection with this settlement.

The settlement was a favorable lead-in

to a strong financial year. As we predicted

last year, lift truck markets around the world

continued to improve in 2011, resulting

in significant volume increases at NACCO

Materials Handling Group (“NMHG”).

However, most of this market improvement

occurred in the first three quarters of the

year, and as the year came to a close, lift

truck market growth began to moderate.

The improvement in the lift truck markets

at NMHG was tempered by weak mass-

consumer markets at Hamilton Beach

Brands (“HBB”) and Kitchen Collection and

reduced customer requirements for coal

and limerock at The North American Coal

Corporation (“NACoal”), as well as globally

increasing commodity costs and adverse

changes in foreign currency exchange

rates primarily at NMHG. The mid-market

consumer, which is the primary consumer

for HBB and Kitchen Collection, continued

to struggle with high unemployment rates

and financial concerns. At NACoal, excess

rain and snow in the Western United States

resulted in more hydropower, rather than

coal, being utilized to create energy, and a

customer’s continued struggle with power

plant operation issues caused a number of

unplanned outages throughout the year. In

addition, the southern Florida construction

market, which uses limerock, remained

weak. Finally, adding to the lower market

demand, NACoal’s contract to supply coal

to the San Miguel power plant expired at

the end of 2010.

Given 2011 market conditions,

excellent results were achieved at NMHG

but results at HBB, Kitchen Collection and

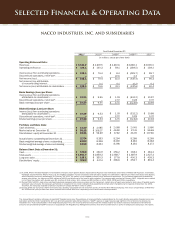

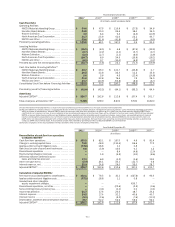

NACoal were disappointing. Consolidated

revenues for NACCO increased to $3.3

billion in 2011 from $2.7 billion in 2010,

with the increase primarily driven by volume

improvements at NMHG partially offset by

fewer deliveries by NACoal and reduced

volumes due to fewer retail placements

at HBB.

Net income(1) increased substantially

to $162.1 million, or $19.28 per diluted

share, in 2011 from $79.5 million, or

$9.53 per diluted share, in 2010. Net

income for 2011 includes the receipt of

the Applica litigation settlement in the first

quarter of 2011. This settlement was

partially offset by litigation costs of $2.8

million, or $1.8 million after taxes of $1.0

million, also incurred in the first quarter

of 2011. Net income in 2010 includes

expenses of $18.8 million, or $12.2 million

after tax of $6.6 million, for Applica litiga-

tion costs. Excluding the settlement and

litigation costs, consolidated adjusted

income(2) for the year ended December 31,

2011 was $124.9 million, or $14.85 per

diluted share, compared with consolidated

adjusted income in 2010 of $91.7 million,

or $10.99 per diluted share.

Lif t Truc k s

M i n i n g

H o u s e w a r e s

To Our Stockholders

Three

(1) For purposes of this annual report, discussions about net income refer to net income attributable to stockholders.

(2) “Consolidated adjusted income” in this letter refers to net income results that exclude the Applica settlement and related litigation

costs. (For reconciliations from GAAP results to the adjusted non-GAAP results, see page eighteen.) Management believes a discussion

of consolidated adjusted income is more reflective of NACCO’s underlying business operations and assists investors in better

understanding the results of operations of NACCO and its subsidiaries.

Top: The new Hyster®J30-40XNT

3-wheel electric lift truck, with a lifting

capacity of 3,000 to 4,000 pounds, has

a compact design and tight turning

radius for limited space.

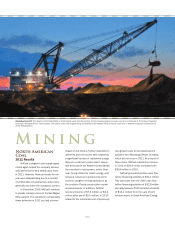

Center: Early morning mining operations

at The Coteau Properties Company’s

Freedom Mine in North Dakota.

Bottom: The newest model of the

Hamilton Beach®BrewStation®12-cup

coffee maker.