Halliburton 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Halliburton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

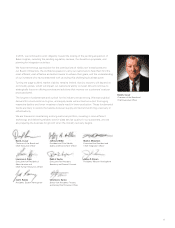

In 2015, we continued to work diligently toward the closing of the pending acquisition of

Baker Hughes, including the pending regulatory reviews, the divestiture proposals, and

planning for integration activities.

We have tremendous appreciation for the contributions of Halliburton’s employees and

our Board of Directors, the confidence placed in us by our customers to help them find the

most efficient, cost-effective and safest means to achieve their goals, and the understanding

of our investors who have persevered with us during this challenging business cycle.

Turning the page to 2016, market visibility remains limited. Activity recovery will depend on

commodity prices, which will impact our customers’ ability to invest. We will continue to

strategically focus on offering services and solutions that improve our customers’ cost per

produced barrel.

The long-term fundamentals and outlook for the industry remain strong. We expect global

demand for oil will continue to grow, and supply levels will contract as output from aging

reservoirs decline and lower investment levels result in lower production. These fundamental

trends are likely to restore the balance between supply and demand and bring a recovery in

oilfield activity.

We are focused on maintaining a strong customer portfolio, investing in more efficient

technology and delivering reliable, best-in-class service quality for our customers, and we

are preparing the business for growth when the industry recovery begins.

David J. Lesar

Chairman of the Board and

Chief Executive Officer

5

David J. Lesar Jeffrey A. Miller Mark A. McCollum

Chairman of the Board and President and Chief Health, Executive Vice President and

Chief Executive Officer Safety and Environment Officer Chief Integration Officer

Lawrence J. Pope Robb L. Voyles James S. Brown

Executive Vice President of Executive Vice President, President, Western Hemisphere

Administration and Secretary and General Counsel

Chief Human Resources Officer

Joe D. Rainey Christian A. Garcia

President, Eastern Hemisphere Senior Vice President, Finance,

and Acting Chief Financial Officer