Halliburton 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Halliburton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

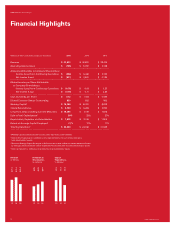

Financial Highlights

Halliburton 2015 Annual Report

www.halliburton.com

2

(Millions of dollars and shares, except per share data) 2015 2014 2013

Revenue $ 23,633 $ 32,870 $ 29,402

Operating Income (Loss) $ (165) $ 5,097 $ 3,138

Amounts Attributable to Company Shareholders:

Income (Loss) from Continuing Operations $ (666) $ 3,436 $ 2,106

Net Income (Loss) $ (671) $ 3,500 $ 2,125

Diluted Income per Share Attributable

to Company Shareholders:

Income (Loss) from Continuing Operations $ (0.78) $ 4.03 $ 2.33

Net Income (Loss) $ (0.79) $ 4.11 $ 2.36

Cash Dividends per Share $ 0.72 $ 0.63 $ 0.525

Diluted Common Shares Outstanding 853 852 902

Working Capital1 $ 16,250 $ 8,781 $ 8,678

Capital Expenditures $ 2,184 $ 3,283 $ 2,934

Long-Term Debt, including Currrent Maturities $ 15,346 $ 7,779 $ 7,816

Debt to Total Capitalization2 50% 33% 37%

Depreciation, Depletion and Amortization $ 1,835 $ 2,126 $ 1,900

Return on Average Capital Employed3 (1)% 17% 11%

Total Capitalization4 $ 30,850 $ 24,196 $ 21,569

1 Working Capital is defined as total current assets less total current liabilities.

2 Debt to Total Capitalization is defined as total debt divided by the sum of total debt plus

total shareholders’ equity.

3 Return on Average Capital Employed is defined as net income before net interest expense divided

by average capital employed. Capital employed includes total debt and total shareholders’ equity.

4 Total Capitalization is defined as total debt plus total shareholders’ equity.

Revenue

in billions

$29.4

13 15

$32.9

$23.6

14

Dividends to

Shareholders

in millions

$465

13 15

$533

$614

14

Capital

Expenditures

in billions

$2.9

13 15

$3.3

$2.2

14