Halliburton 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Halliburton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2015, lower oil and gas prices led to substantial reductions in global upstream oil

and gas activity levels resulting in the most challenging year in decades. Halliburton’s

commitment to superior execution, our broad service offerings, and our long-standing

customer relationships enable us to manage through business cycles and prepare for the

market’s eventual recovery.

The downturn materialized very quickly, beginning in late 2014. As of December 31, 2015, the

activity level measured by the Baker Hughes U.S. land rig count declined by 64 percent from

the 2014 peak, and we experienced substantial declines in our international markets as well.

As our customers’ capital spend declined, so did Halliburton’s activity and the prices paid

for our products and services.

But this is a market that Halliburton knows well, and we have experienced these cycles

before. We have focused relentlessly on managing our costs. While this required difficult

staffing decisions, we are committed to aligning our cost structure with the market, and we

believe the actions and decisions taken in 2015 will enable Halliburton to emerge from this

downturn prepared to deliver competitive growth and returns.

Our playbook for a downturn is simple – we control what we can control, preserve our market

position and live within our cash flow. We continued to execute our key strategies in the

unconventionals, deep water and mature fields markets on a near real-time basis. We also

looked beyond the cycle, investing in strategic initiatives and preparing for future recovery.

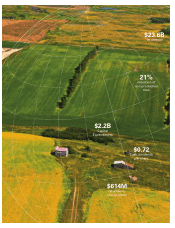

Our international operations performed well given the global industry headwinds. Revenues

were lower than in 2014, compared with an 18 percent decline in the international drilling and

completion spend by our customers. However, aggressive cost control enabled the company

to maintain our international margins even with downward pressure on prices.

Halliburton traditionally has been aligned with operators that have strong balance sheets

and fairway acreage in the most important oil and gas basins in North America and across the

globe. We are engaged with our customers in their efforts to reduce the cost of producing

each barrel of oil equivalent, and have continued to offer them products, services and

technologies that are more efficient, reduce non-productive time and improve performance.

Frac of the Future™ is a prime example. While industry crew sizes have increased in recent

years because of higher hydraulic fracturing intensity, Halliburton’s average crew size has

been essentially flat. At year end, Frac of the Future™ spreads represented 60 percent of our

fleet – a more efficient, low-cost delivery platform that offers a clear competitive advantage

both in challenging times and during the recovery.

We drive this improvement by lowering costs at every step. We help operators optimize bit

designs and fluid compositions, reduce drilling days, and improve surface efficiency. We also

help increase estimated ultimate recoveries by collaborating with our customers to identify

the best targets and utilize the right chemistry to produce more barrels.

Halliburton is the execution company, and 2015 marked another year of improvement in

safety and service quality metrics, with significant, double-digit reductions from 2014 in both

areas. Even while the market is forcing us to streamline our footprint in the field, we are

improving our performance rates.

To Our Shareholders

Halliburton 2015 Annual Report

www.halliburton.com

4

We are engaged with our

customers in their efforts to

reduce the cost of producing

each barrel of oil equivalent,

and have continued to offer

them products, services and

technologies that are more

efficient, reduce non-productive

time and improve performance.

“