Halliburton 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Halliburton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Annual Report

Table of contents

-

Page 1

2015 Annual Report -

Page 2

...of operating efï¬ciency, which bodes well for Halliburton. Ultimately, when this market recovers we believe North America will respond most quickly and offer the greatest upside, and that Halliburton will be positioned to outperform. Jeff Miller President and Chief Health, Safety and Environment Of... -

Page 3

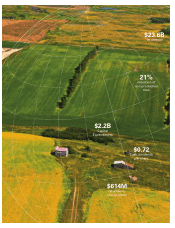

$23.6B in revenue 21% reduction of non-productive time $2.2B Capital Expenditures $0.72 Cash dividends per share $614M returned to shareholders -

Page 4

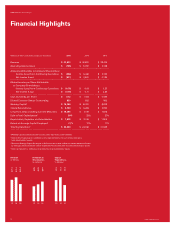

Halliburton 2015 Annual Report Financial Highlights (Millions of dollars and shares, except per share data) 2015 2014 2013 Revenue Operating Income (Loss) $ 23,633 $ (165) $ 32,870 $ 5,097 $ 29,402 $ 3,138 Amounts Attributable to Company Shareholders: Income (Loss) from Continuing ... -

Page 5

...new solutions to address estimated global decline rates of 6 percent. In Latin America, we began ï¬eld management projects with customers in Mexico and Ecuador focused on maximizing production in aged assets. In the Eastern Hemisphere, we completed a successful inï¬eld drilling program in Malaysia... -

Page 6

... level measured by the Baker Hughes U.S. land rig count declined by 64 percent from the 2014 peak, and we experienced substantial declines in our international markets as well. As our customers' capital spend declined, so did Halliburton's activity and the prices paid for our products and services... -

Page 7

... continue to strategically focus on offering services and solutions that improve our customers' cost per produced barrel. The long-term fundamentals and outlook for the industry remain strong. We expect global demand for oil will continue to grow, and supply levels will contract as output from aging... -

Page 8

... performance. Its dynamicallyupdateable model supports E&P business processes to help reduce time for decision-making and increase team collaboration. MicroScoutSM Service, a recent addition to our custom chemistry portfolio, is a hydraulic fracturing treatment designed to deliver proppant into... -

Page 9

NA 7 -

Page 10

... barrel of oil equivalent. To help our customers improve their well economics, Halliburton focuses on reducing uncertainty and increasing reliability. In a Latin America project, Landmark's DecisionSpace® software allowed our clients to reduce drilling days by integrating geological data with well... -

Page 11

INTL 9 -

Page 12

...lower commodity prices. New product revenue as a percent of total sales once again increased over the prior year, continuing a multi-year trend. Halliburton's technologies help customers improve project economics and maximize the value of their oil and gas assets by increasing operating efï¬ciency... -

Page 13

... acoustically actuated Drill Stem Test system powered by Halliburton's DynaLink® Telemetry System. RezConnect provides two-way communication in the wellbore, allowing operators to activate tools remotely, as well as transmit measurement and analysis of well-test data in real-time. DecisionSpace... -

Page 14

Halliburton 2015 Annual Report Leadership Board of Directors David J. Lesar Chairman of the Board and Chief Executive Ofï¬cer, Halliburton Company (2000) Abdulaziz F. Al Khayyal Retired Senior Vice President of Industrial Relations, Saudi Aramco (2014) (C) (D) Alan M. Bennett Retired President ... -

Page 15

... 29, 2016, there were 858,342,017 shares of Halliburton Company Common Stock, $2.50 par value per share, outstanding. Portions of the Halliburton Company Proxy Statement for our 2016 Annual Meeting of Stockholders (File No. 001-03492) are incorporated by reference into Part III of this report. -

Page 16

This Page Intentionally Left Blank -

Page 17

... Item 13. Item 14. PART IV Item 15. SIGNATURES 21 42 43 45 46 47 48 49 50 76 77 Directors, Executive Officers, and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners Security Ownership of Management Changes in Control Securities Authorized for Issuance Under... -

Page 18

... business worldwide in approximately 80 countries. The business operations of our divisions are organized around four primary geographic regions: North America, Latin America, Europe/Africa/CIS, and Middle East/Asia. In 2015, 2014, and 2013, based on the location of services provided and products... -

Page 19

... prices. Research and development costs We maintain an active research and development program. The program improves products, processes, and engineering standards and practices that serve the changing needs of our customers, such as those related to high pressure and high temperature environments... -

Page 20

...and information statements, and our other SEC filings. The address of that web site is www.sec.gov. We have posted on our web site our Code of Business Conduct, which applies to all of our employees and Directors and serves as a code of ethics for our principal executive officer, principal financial... -

Page 21

... Senior Managing Director of Tax and Internal Audit, Service Corporation International, February 2008 to February 2013 * David J. Lesar (Age 62) Chairman of the Board and Chief Executive Officer of Halliburton Company, since August 2014 Chairman of the Board, President, and Chief Executive Officer... -

Page 22

...2011 Executive Vice President, Secretary and General Counsel of Halliburton Company, since May 2015 Executive Vice President and General Counsel of Halliburton Company, January 2014 to April 2015 Senior Vice President, Law of Halliburton Company, September 2013 to December 2013 Partner, Baker Botts... -

Page 23

... to reach an agreement with one or more buyers of those product lines. If the Regulatory Clearances are not received, or they are not received on terms that satisfy the conditions set forth in the merger agreement, then neither we nor Baker Hughes will be obligated to complete the acquisition. If... -

Page 24

...connection with integrating each company's respective businesses, policies, procedures, operations, technologies and systems. There are a large number of systems that must be integrated, including information management, purchasing, accounting and finance, sales, billing, payroll and benefits, fixed... -

Page 25

... liabilities of Baker Hughes will be recorded, as of the acquisition closing date, at their respective fair values and added to those of Halliburton. Our reported financial condition and results of operations issued after completion of the acquisition will reflect Baker Hughes balances and results... -

Page 26

...debt service payments, thereby reducing the availability of its cash flow to fund working capital, capital expenditures, acquisitions, dividend payments and other general corporate purposes; - result in a downgrade in the rating of our indebtedness, which could limit our ability to borrow additional... -

Page 27

... on our business, consolidated results of operations, and consolidated financial condition. Our operations are becoming increasingly dependent on digital technologies and services. We use these technologies for internal purposes, including data storage, processing, and transmissions, as well as in... -

Page 28

... For example, the Department of Interior has issued regulations that apply to hydraulic fracturing operations on wells that are subject to federal oil and gas leases and that impose requirements regarding the disclosure of chemicals used in the hydraulic fracturing process as well as requirements to... -

Page 29

... fracturing for oil and gas development. In addition, governmental authorities in various foreign countries where we have provided or may provide hydraulic fracturing services have imposed or are considering imposing various restrictions or conditions that may affect hydraulic fracturing operations... -

Page 30

...more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Business Environment and Results of Operations." Any prolonged reduction in oil and natural gas prices will depress the immediate levels of exploration, development, and production activity... -

Page 31

... profits from those countries. In addition, we may accumulate cash in foreign jurisdictions that may be subject to taxation if repatriated to the United States. For further information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Business Environment... -

Page 32

...further information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Business Environment and Results of Operations - International operations - Venezuela." Some of our customers require bids for contracts in the form of long-term, fixed pricing contracts... -

Page 33

... in the realization of savings, the creation of efficiencies, the offering of new products or services, the generation of cash or income, or the reduction of risk. Acquisition transactions may be financed by additional borrowings or by the issuance of our common stock. These transactions may also... -

Page 34

... research and development laboratories, technology centers, and corporate offices. We also have numerous small facilities that include sales, project, and support offices and bulk storage facilities throughout the world. All of our owned properties are unencumbered. The following locations represent... -

Page 35

...Issuer Purchases of Equity Securities. Halliburton Company's common stock is traded on the New York Stock Exchange. Information related to the high and low market prices of our common stock and quarterly dividend payments is included under the caption "Quarterly Data and Market Price Information" on... -

Page 36

... benefit withholding obligations arising from vesting in restricted stock grants. These shares were not part of a publicly announced program to purchase common stock. (b) Our Board of Directors has authorized a plan to repurchase our common stock from time to time. During the fourth quarter of 2015... -

Page 37

... and procedures designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding... -

Page 38

... in rig count over the course of 2015, which in turn resulted in substantial pricing pressure across all of our product service lines. While our global revenue declined 28% in 2015 as compared to 2014, revenue in North America declined 39%. We anticipate 2016 being another challenging year for... -

Page 39

... debt or use cash on hand to finance the remainder of the cash portion of the merger consideration. For additional information on market conditions and the pending acquisition of Baker Hughes, see "Liquidity and Capital Resources," "Business Environment and Results of Operations," Note 2 to the... -

Page 40

...be paid in 2016. See Note 9 to the consolidated financial statements for further information. Subject to Board of Directors approval, our intention is to pay dividends representing at least 15% to 20% of our net income on an annual basis. Currently, our quarterly dividend rate is $0.18 per share, or... -

Page 41

...the 2014 announcement of the pending Baker Hughes acquisition, Standard & Poor's placed all of our ratings on negative watch, and in October 2015 Moody's placed all of our ratings on review for downgrade. Customer receivables. In line with industry practice, we bill our customers for our services in... -

Page 42

... revenue is derived from the sale of services and products to major, national, and independent oil and natural gas companies worldwide. The industry we serve is highly competitive with many substantial competitors in each segment of our business. In 2015, 2014, and 2013, based on the location... -

Page 43

... Baker Hughes Incorporated rig count information were as follows: Land vs. Offshore United States: Land Offshore (incl. Gulf of Mexico) Total Canada: Land Offshore Total International (excluding Canada): Land Offshore Total Worldwide total Land total Offshore total Oil vs. Natural Gas United States... -

Page 44

... gas prices can impact our customers' drilling and production activities. During 2015, the average full year natural gas-directed rig count in North America decreased 161 rigs, or 33%, while the average full year oil directed rig count decreased 911 rigs, or 52%, from 2014. In the United States... -

Page 45

...during the first quarter of 2015. As of December 31, 2015, our total ...2015, the majority of which are United States dollar-denominated receivables, $175 million has been classified as long-term and included within "Other assets" on our consolidated balance sheets. For additional information, see Part... -

Page 46

... Completion and Production Drilling and Evaluation Total revenue Favorable 2014 (Unfavorable) 20,253 $ (6,571) 12,617 (2,666) 32,870 $ (9,237) Percentage Change (32)% (21) (28)% $ $ 2015 13,682 $ 9,951 23,633 $ By geographic region: Completion and Production: North America Latin America Europe... -

Page 47

...rig count declines, pricing concessions, and reduced stimulation activity. • Latin America revenue decreased 18%, mainly due to reduced activity and pricing in Mexico, primarily associated with pressure pumping services and production solution services, and decreased cementing activity in Colombia... -

Page 48

...rig counts and decreased profitability for well completion services and stimulation activity in the United States land market. • Latin America operating income declined 13%, due to lower pressure pumping services in Argentina and Mexico, reduced cementing services in Colombia, and lower production... -

Page 49

... geographic earnings in which we experienced low levels of United States income during the year, additional valuation allowances booked on foreign deferred tax assets, a $199 million foreign currency exchange loss in Venezuela, and non-deductible costs related to the pending Baker Hughes acquisition... -

Page 50

... 2013 (Unfavorable) 17,506 $ 2,747 11,896 721 29,402 $ 3,468 Percentage Change 16% 6 12% $ $ 2014 20,253 $ 12,617 32,870 $ By geographic region: Completion and Production: North America Latin America Europe/Africa/CIS Middle East/Asia Total Drilling and Evaluation: North America Latin America... -

Page 51

... our product service lines in the Eastern Hemisphere, which were partially offset by lower activity in Latin America. Revenue outside of North America was 46% of consolidated revenue in 2014 and 48% of consolidated revenue in 2013. The $2.0 billion increase in consolidated operating income compared... -

Page 52

... in all of our product services lines in Saudi Arabia and increased demand for drilling services in Thailand and fluids activity in Australia, India and Iraq. • Revenue outside of North America was 68% of total segment revenue in both 2014 and 2013. Operating income decreased 2% compared to... -

Page 53

... prepaid tax assets recorded in Iraq, additional tax expenses related to the settlement of a research and development credit with the United States tax authorities, and tax expenses related to other unrecognized tax benefits. Our effective tax rate for 2013 was also positively impacted by lower... -

Page 54

...matters; - valuations of long-lived assets, including intangible assets and goodwill; - purchase price allocation for acquired businesses; - pensions; - allowance for bad debts; and - percentage-of-completion accounting for long-term, integrated project management contracts. We base our estimates on... -

Page 55

...impairment test our reporting units are the same as our reportable segments, the Completion and Production division and the Drilling and Evaluation division. See Note 1 to the consolidated financial statements for our accounting policies related to long-lived assets and intangible assets, as well as... -

Page 56

... at December 31, 2015 and $298 million at December 31, 2014. In our international plans where employees earn additional benefits for continued service, actuarial gains and losses will be recognized in operating income over a period of two to 20 years, which represents the estimated average remaining... -

Page 57

... completion Revenue from certain long-term, integrated project management contracts to provide well construction and completion services is reported on the percentage-of-completion method of accounting. Progress is generally based upon physical progress related to contractually defined units of work... -

Page 58

... of new information, future events, or for any other reason. You should review any additional disclosures we make in our press releases and Forms 10-K, 10-Q, and 8-K filed with or furnished to the SEC. We also suggest that you listen to our quarterly earnings release conference calls with financial... -

Page 59

... management, including our chief executive officer and chief financial officer, we conducted an evaluation to assess the effectiveness of our internal control over financial reporting as of December 31, 2015 based upon criteria set forth in the Internal Control - Integrated Framework (2013) issued... -

Page 60

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), Halliburton Company's internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of... -

Page 61

... reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by COSO. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Halliburton... -

Page 62

... of dollars and shares except per share data Revenue: Services Product sales Total revenue Operating costs and expenses: Cost of services Cost of sales Impairment and other charges Baker Hughes acquisition-related costs General and administrative Activity related to the Macondo well incident Total... -

Page 63

...) Comprehensive income attributable to noncontrolling interest Comprehensive income (loss) attributable to company shareholders See notes to consolidated financial statements. $ $ $ Year Ended December 31 2015 2014 2013 (667) $ 3,501 $ 2,135 105 (67) (2) 36 (631) $ (4) (635) $ (84) - (7) (91) 3,410... -

Page 64

... revenue Taxes other than income Other current liabilities Total current liabilities Long-term debt Employee compensation and benefits Other liabilities Total liabilities Shareholders' equity: Common shares, par value $2.50 per share (authorized 2,000 shares, issued 1,071 and 1,071 shares) Paid... -

Page 65

... and equipment Purchases of investment securities Sales of investment securities Payments to acquire businesses, net of cash acquired Other investing activities Total cash flows from investing activities Cash flows from financing activities: Proceeds from issuance of long-term debt, net Dividends to... -

Page 66

... 31, 2014 Comprehensive income (loss): Net income (loss) Other comprehensive income Stock plans Cash dividends ($0.72 per share) Other Balance at December 31, 2015 See notes to consolidated financial statements. $ $ $ $ Common Shares 2,682 $ Treasury Stock (4,276)$ Retained Earnings 17,182... -

Page 67

... segment and the Drilling and Evaluation segment. We provide a comprehensive range of services and products for the exploration, development, and production of oil and natural gas around the world. Use of estimates Our financial statements are prepared in conformity with United States generally... -

Page 68

...the fair value of the tangible and identifiable intangible assets acquired. Changes in the carrying amount of goodwill are detailed below by reportable segment. Millions of dollars Balance at December 31, 2013: Current year acquisitions Purchase price adjustments for previous acquisitions Balance at... -

Page 69

... statements of operations in "Other, net" in the year of occurrence. Stock-based compensation Stock-based compensation cost is measured at the date of grant, based on the calculated fair value of the award, and is recognized as expense over the employee's service period, which is generally... -

Page 70

... Baker Hughes in a stock and cash transaction. Baker Hughes is a leading supplier of oilfield services, products, technology and systems to the worldwide oil and natural gas industry. Under the terms of the merger agreement, at the effective time of the acquisition, each share of Baker Hughes common... -

Page 71

... company would complete the sale of divested businesses concurrent with the closing of the Baker Hughes acquisition. Note 3. Impairments and Other Charges We carry a variety of long-lived assets on our balance sheet including property, plant and equipment, goodwill, and other intangibles. We conduct... -

Page 72

... control, specialty chemicals, artificial lift, and completion services. The segment consists of Production Enhancement, Cementing, Completion Tools, Production Solutions, Pipeline & Process Services, Multi-Chem, and Artificial Lift. Production Enhancement services include stimulation services and... -

Page 73

...integrated exploration, drilling and production software, and related professional and data management services for the upstream oil and natural gas industry. Testing and Subsea services provide acquisition and analysis of dynamic reservoir information and reservoir optimization solutions to the oil... -

Page 74

The following tables present information on our business segments. Operations by business segment Millions of dollars Revenue: Completion and Production Drilling and Evaluation Total revenue $ $ Year Ended December 31 2015 2014 2013 13,682 $ 9,951 23,633 $ 20,253 $ 12,617 32,870 $ 17,506 11,896 29,... -

Page 75

... States. No other country accounted for more than 10% of our revenue or property, plant, and equipment during the periods presented. Operations by geographic region Millions of dollars Revenue: North America Latin America Europe/Africa/CIS Middle East/Asia Total Year Ended December 31 2015 2014 2013... -

Page 76

...2015 2014 $ 1,747 $ 2,606 548 754 122 211 $ 2,417 $ 3,571 Millions of dollars Finished products and parts Raw materials and supplies Work in process Total We reclassified $576 million of our inventory to assets held for sale as of December 31, 2015. See Note 2 for further information. Additionally... -

Page 77

...a new five-year revolving credit agreement, with an initial capacity of $3.0 billion, increasing to $4.5 billion upon closing of the Baker Hughes acquisition and satisfaction of the conditions provided in the credit agreement. The credit agreement is for working capital or general corporate purposes... -

Page 78

... of Transocean Ltd. and had been drilling the Macondo exploration well in the Gulf of Mexico for the lease operator, BP Exploration & Production, Inc. (BP). We performed a variety of services on that well for BP. There were eleven fatalities and a number of injuries as a result of the Macondo... -

Page 79

... 2002, a class action lawsuit was filed against us in federal court alleging violations of the federal securities laws after the Securities and Exchange Commission (SEC) initiated an investigation in connection with our change in accounting for revenue on long-term construction projects and related... -

Page 80

... States Supreme Court reversed the Fifth Circuit ruling that the Fund needed to prove loss causation in order to obtain class certification and the case was returned to the lower courts for further consideration. In January 2012, the district court issued an order certifying the class. In April 2013... -

Page 81

... (provision) for income taxes on continuing operations were: Millions of dollars Current income taxes: Federal Foreign State Total current Deferred income taxes: Federal Foreign State Total deferred Income tax benefit (provision) Year Ended December 31 2015 2014 2013 $ 635 $ (636) 51 50 (18) 262... -

Page 82

... geographic earnings in which we experienced low levels of United States income during the year, additional valuation allowances booked on foreign deferred tax assets, a $199 million foreign currency exchange loss in Venezuela, and nondeductible costs related to the pending Baker Hughes acquisition... -

Page 83

...31 2015 2014 1,071 1,071 (215) (223) 856 848 Millions of shares Issued In treasury Total shares of common stock outstanding Our Board of Directors has authorized a program to repurchase our common stock from time to time. The program does not require a specific number of shares to be purchased and... -

Page 84

...Stock Plan for Non-Employee Directors and our Employee Stock Purchase Plan (ESPP). Each of the active stock-based compensation arrangements is discussed below. Stock options The majority of our options are generally issued during the second quarter of the year. All stock options under the Stock Plan... -

Page 85

... years. Cash received from option exercises was $167 million during 2015, $332 million during 2014, and $277 million during 2013. The fair value of options at the date of grant was estimated using the Black-Scholes option pricing model. The expected volatility of options granted was a blended rate... -

Page 86

...for future issuance. The fair value of ESPP shares was estimated using the Black-Scholes option pricing model. The expected volatility was a one-year historical volatility of our common stock. The assumptions and resulting fair values were as follows: Year Ended December 31 2015 2014 2013 35% 23% 27... -

Page 87

...our cash flows from the sale and purchase of services and products in foreign currencies will be adversely affected by changes in exchange rates. We use forward contracts and options to manage our exposure to fluctuations in the currencies of certain countries in which we do business internationally... -

Page 88

...'s profitability, balance sheet, and capacity for timely payment of financial commitments is unlikely to be materially adversely affected by foreseeable events. Note 15. Retirement Plans Our company and subsidiaries have various plans that cover a significant number of our employees. These plans... -

Page 89

... additional information about our international pension plans. December 31 2015 2014 20 $ 155 1,042 $ 867 964 $ 846 22 325 1,232 884 1,120 860 Millions of dollars Amounts recognized on the Consolidated Balance Sheets Accrued employee compensation and benefits $ Employee compensation and benefits... -

Page 90

...determine net periodic benefit cost of our international pension plans for the years ended December 31 were as follows: 2015 4.1% 5.9% 5.3% 2014 4.8% 6.4% 5.4% 2013 4.8% 6.4% 5.5% Discount rate Expected long-term return on plan assets Rate of compensation increase Assumed long-term rates of return... -

Page 91

...) and the International Accounting Standards Board (IASB) issued a comprehensive new revenue recognition standard that will supersede existing revenue recognition guidance under United States generally accepted accounting principles (U.S. GAAP) and International Financial Reporting Standards (IFRS... -

Page 92

... within those fiscal years, and will be applied prospectively. Early adoption is permitted. We are currently evaluating the impact that this update will have on our consolidated financial statements. Business Combinations In September 2015, the FASB issued an accounting standards update to simplify... -

Page 93

... share Revenue Operating income (loss) Income (loss) from continuing operations Basic income (loss) per share from continuing operations Diluted income (loss) per share from continuing operations Cash dividends per share Net working capital Total assets Long-term debt (including current maturities... -

Page 94

... income per share attributable to company shareholders: Income from continuing operations Income from discontinued operations Net income Cash dividends paid per share Common stock prices (1) High Low (1) New York Stock Exchange - composite transactions high and low intraday price. Fourth 5,082... -

Page 95

... III Item 10. Directors, Executive Officers, and Corporate Governance. The information required for the directors of the Registrant is incorporated by reference to the Halliburton Company Proxy Statement for our 2016 Annual Meeting of Stockholders (File No. 001-03492) under the captions "Election... -

Page 96

... or the required information is shown in the consolidated financial statements or notes thereto. Exhibits: 2. 3. Exhibit Number 2.1 Exhibits Agreement and Plan of Merger, dated as of November 16, 2014, among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated (incorporated by... -

Page 97

... reference to Exhibit 4.7 to Halliburton's Form 10-K for the year ended December 31, 1998, File No. 001-03492). Fourth Supplemental Indenture dated as of September 29, 1998 between Halliburton and The Bank of New York Trust Company, N.A. (as successor to Texas Commerce Bank National Association), as... -

Page 98

... of Exhibit 4.23). Form of Global Note for Halliburton's 4.50% Senior Notes due 2041 (included as part of Exhibit 4.23). Seventh Supplemental Indenture, dated as of August 5, 2013, between Halliburton Company and The Bank of New York Mellon Trust Company, N.A., as successor trustee to JPMorgan Chase... -

Page 99

... 2045 (included as part of Exhibit 4.31). Halliburton Company Restricted Stock Plan for Non-Employee Directors (incorporated by reference to Appendix B of the Predecessor's proxy statement dated March 23, 1993, File No. 001-03492). Dresser Industries, Inc. Deferred Compensation Plan, as amended and... -

Page 100

...205842). Form of Non-Employee Director Restricted Stock Unit Agreement (Director Plan) (incorporated by reference as Exhibit 99.8 of Halliburton's Form S-8 filed July 24, 2015, Registration No. 333-205842). First Amendment to Halliburton Company Supplemental Executive Retirement Plan, as amended and... -

Page 101

...Form of Non-Employee Director Restricted Stock Unit Agreement (Stock and Incentive Plan) (incorporated by reference as Exhibit 99.9 of Halliburton's Form S-8 filed July 24, 2015, Registration No. 333-205842). Second Amendment to Restricted Stock Plan for Non-Employee Directors of Halliburton Company... -

Page 102

... of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Mine Safety Disclosures. Notice of Extension dated July 10, 2015 of the Agreement and Plan of Merger among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated dated November 16, 2014, extending... -

Page 103

... for the quarter ended September 30, 2015, File No. 001-03492). Notice of Extension dated December 15, 2015 of the Agreement and Plan of Merger among Halliburton Company, Red Tiger LLC and Baker Hughes Incorporated dated November 16, 2014, extending termination date to April 30, 2016. XBRL Instance... -

Page 104

... the undersigned authorized individuals on this 5th day of February, 2016. HALLIBURTON COMPANY By /s/ David J. Lesar David J. Lesar Chairman of the Board and Chief Executive Officer As required by the Securities Exchange Act of 1934, this report has been signed below by the following persons in... -

Page 105

... Landis Martin Jeffrey A. Miller Jeffrey A. Miller Debra L. Reed Debra L. Reed Title Director * Director * Director * Director * Director * Director * Director * Director * Director * President and Director * Director /s/ Robb L. Voyles *By Robb L. Voyles, Attorney-in-fact 88 -

Page 106

This Page Intentionally Left Blank -

Page 107

...Relations, shareholders may call the Company at 888.669.3920 or 281.871.2688, or send a message via email to: [email protected] 21% reduction of non-productive time $2.2B Capital Expenditures $0.72 Cash dividends per share $614M returned to shareholders Design: Savage Brands, Houston TX -

Page 108

281.871.2699 www.halliburton.com © 2016 Halliburton. All Rights Reserved. Printed in the USA H012109