HR Block 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

THOMAS A. ALLANSON

President, Digital

JOAN K. COHEN

President, H&R Block Financial Advisors

STEVE TAIT

President, RSM McGladrey

and approximately 30% and 60% increases in revenues and pretax profi ts,

respectively. About half of this profi t increase fl owed from favorable currency

adjustments, but we still increased pretax profi t nearly 30% year-on-year with-

out currency effects. This highlights an opportunity for the future, as today most

of our tax services’ revenues and profi ts come from operations in the United

States. However, people pay taxes in almost every country, and we know Americans

aren’t the only people in the world who will ever need assistance with computing

and fi ling their taxes.

RECENT HISTORY

For almost a decade, internal focus on the tax business at H&R Block had been

affected as the Company pursued a diversifi cation strategy in fi nancial services

that failed to deliver on its expected benefi ts. For at least part of this time, the

tax business seemed to drift, and overall corporate overhead costs spiraled up-

ward.

The net impact of everything over the recent past was weakened long-

term competitiveness, persistent under-performance in total shareowner

returns, and fi nally a sharp loss of share value. The share price of $19.32 on the

day I was named Chairman was almost exactly the same as the share price of

$19.31 on April 30, 2003, representing a tremendous loss of value compared with

market performance during those years.

Just over 84% of shareowners voted for a new approach in the proxy contest leading

up to the 2007 Annual Meeting. This led to a change in leadership and direction. In

the months since the election, the Company has been working furiously to realign

strategy, improve operations, and focus intently on serving the needs of our clients.

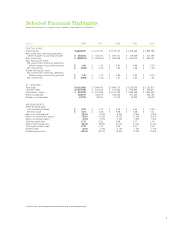

CONSOLIDATED NET INCOME

2004 2005 2006 2007 2008

$694 $624 $490

$(434) $(309)

0

IN MILLIONS