HR Block 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our improved results came

from focusing on business

fundamentals.

33

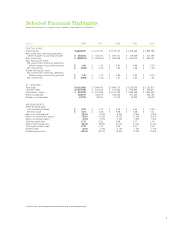

tax of $434 million ($1.33 per diluted share) in FY07, and another net loss of

$309 million ($0.94 per share) in FY08. Losses in discontinued operations, which

were almost entirely a result of the Company’s sub-prime mortgage lending

subsidiary, were $1.6 billion ($4.81 per share) during these two years.

While one cannot ignore nearly $1.6 billion in sub-prime losses merely by branding

them as losses from discontinued operations in accounting terms, it is relevant

to look at the underlying earnings from continuing, non-mortgage operations.

Here the picture for FY 2008 was good, with continuing earnings of just over

$454 million, or $1.39 per diluted share compared with just over $374 million,

or $1.15 per share in FY 2007. The fourth quarter of FY08 was even better, with

$543.6 million, or $1.66 per diluted share, in consolidated net income, compared

to a consolidated net loss of $85.6 million, or $0.26 per diluted share in the prior

year.

Our results for tax season 2008 were the best we have had in many years.

Revenues in Tax Services grew 11.3% to reach $3 billion for the fi rst time. Even

more importantly, pretax income grew 11.4% to more than $785 million. We

increased the number of retail clients by 3.8% overall, and nearly 2% without the

Economic Stimulus Plan (ESP) fi lers included. Two percent may sound small,

but that is a considerable jump in one year on a very large base. We believe

this shows signifi cant traction in the marketplace for our initiatives, and it’s the

principle reason we feel we enter FY 2009 with very positive momentum.

TAX: OUR CORE BUSINESS

In FY08, H&R Block helped a record 23.5 million clients in the U.S., Canada

and Australia meet their tax fi ling obligations quickly and accurately. More than

120,000 trained tax professionals in the fi eld, as well as tax specialists at the H&R