HR Block 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

types of small acquisitions to build our client base than was desirable. Growing

the customer base organically is our fi rst preference, but we will be more vigi-

lant in looking for add-on opportunities to acquire existing tax and accounting

businesses in the next few years.

From its earliest times, H&R Block has utilized franchising to help spread its

network of offi ces to reach more clients. While other competitors rely almost

exclusively on franchisees, H&R Block has historically utilized a mix of company-

operated and franchisee-operated locations. We believe that approach serves

shareowners well. However, we also recognize the signifi cant benefi ts franchisees

can bring through knowledge of the local community, entrepreneurial spirit and

other tangible and intangible factors. H&R Block benefi ts today from the high

quality of our franchisees who deliver H&R Block quality coast-to-coast. For the

future, we are likely to put greater emphasis on franchising as we expand. This

will be particularly true as we build out alternative distribution channels such as

our Express Tax system, or pursue specialized economic, ethnic or international

markets. We believe that increased franchising will help us enhance growth

and returns on capital without compromising our company-owned system or the

quality our clients expect from us.

RSM MCGLADREY

Another area of opportunity for the future is our wholly owned subsidiary

RSM McGladrey (“RSM”). Through what is know as an “alternative practice

structure,” RSM McGladrey and McGladrey & Pullen LLP (“M&P”), as

independent entities, provided attest, accounting, tax and business consult-

ing services to mutual clients. M&P is a licensed CPA fi rm and provides attest

services only, whereas RSM McGladrey delivers all other services to clients.

RSM McGladrey and M&P offer services to a client base largely comprising

small- and medium-sized, privately held U.S. businesses. Although they are

separate fi rms, RSM McGladrey and M&P jointly market their respective

services to mutual clients. Through H&R Block, RSM McGladrey is the only

major accounting fi rm today with access to public capital, and we believe that

this can be an engine for future expansion. Through RSM McGladrey, we

provide nearly a half billion dollars of tax advice to middle-market businesses

and their owners. RSM McGladrey also delivers business advice in a wide range

of areas, as well as tax and accounting assistance, to the small- and medium-

size businesses that form the heart of the U.S. economy.

RSM McGladrey generates slightly more than 20% of H&R Block’s consolidated

revenues. However, in the past it has sometimes been distracted by peripheral

businesses and unprofi table efforts, such as providing fi nance and accounting

services on an outsourced basis. Consistent with the theme of refocusing on

the basics in our Tax Services business, we are refocusing RSM McGladrey on

its core accounting, tax and consulting services. RSM McGladrey has exited

certain noncore businesses in the last two years, and may exit others in the

future as we intensify focus on becoming the premier provider of business and

tax advice to the small- and medium-sized business sector. At RSM McGladrey,

there may have been more historic focus on expansion of revenues than on

effi ciency. While we want to see RSM McGladrey get bigger, our fi rst priority

is on seeing it get better. That means new tools to provide better service to

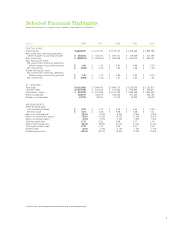

2004 2005 2006 2007 2008

$276 $320 $298

$374

$454

0

CONSOLIDATED NET INCOME

FROM CONTINUING OPERATIONS

IN MILLIONS