HR Block 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

H&R BLOCK

Preparing America’s Taxes Since 1955

2008 ANNUAL REPORT

Table of contents

-

Page 1

Preparing America's Taxes Since 1955 2008 AN N U A L REPORT H&R BLOCK -

Page 2

Table of Contents Selected Financial Highlights Letter To Shareowners Board of Directors Form 10-K 1 2 16 17 -

Page 3

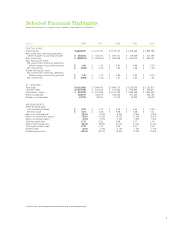

...(loss) AT YEAR END: Total assets Long-term debt Stockholders' equity Shares outstanding Number of shareholders MEASUREMENTS: Other per share data: Cash dividends declared Net book value Return on total revenues (1) Return on stockholders' equity (1) Return on average assets (1) Working capital ratio... -

Page 4

...C. BREEDEN Chairman of the Board Dear Fellow Shareowners This 2008 Annual Report covers a pivotal year in H&R Block's history, as well as an extraordinarily turbulent period in the ï¬nancial markets. The Company went through enormous change during the year; yet we were able to perform well and to... -

Page 5

... share in the prior year. Our results for tax season 2008 were the best we have had in many years. Revenues in Tax Services grew 11.3% to reach $3 billion for the ï¬rst time. Even more importantly, pretax income grew 11.4% to more than $785 million. We increased the number of retail clients by... -

Page 6

... we review, and the average saving for clients who re-ï¬le with us is more than $1,500. For many of our clients, our advice is received faceto-face in an ofï¬ce convenient to their home. Others prefer to prepare their own returns with the aid of our TaxCut® software program. A growing number of... -

Page 7

... years of tax preparation experience. We believe there is a compelling business advantage in being able to offer clients advice and problem-solving from trained and experienced tax professionals. Even in online services, our tax professionals give us an ability to deliver "click-to-chat" customer... -

Page 8

... services' revenues and proï¬ts come from operations in the United States. However, people pay taxes in almost every country, and we know Americans aren't the only people in the world who will ever need assistance with computing and ï¬ling their taxes. RECENT HISTORY For almost a decade, internal... -

Page 9

...sure that we meet and exceed client expectations for the quality of advice, and that they perceive a high level of value from doing business with us. In tax season 2008, we had new ï¬nancial products at lower prices, strong customer focus through products like Second Look and greater efï¬ciency in... -

Page 10

...believe we generated in tax season 2008 with additional products, continued better pricing for consumers, new tools for our tax professionals and strengthened delivery channels to reach an even greater number of clients. At least in terms of focus, the H&R Block Tax Services business is back, and we... -

Page 11

... be more vigilant in looking for add-on opportunities to acquire existing tax and accounting businesses in the next few years. From its earliest times, H&R Block has utilized franchising to help spread its network of ofï¬ces to reach more clients. While other competitors rely almost exclusively on... -

Page 12

... associates, our clients and our shareowners. Going forward we anticipate RSM McGladrey being a major part of H&R Block's strategic focus, complementing our Block-branded Tax Services. FINANCIAL SERVICES In recent years, H&R Block's management put enormous emphasis on ï¬nancial services businesses... -

Page 13

... it had purchased from Block's subsidiary Option One Mortgage Corp or from third parties. The Bank was being used primarily to ï¬nance ownership of whole mortgage loans, or interests of different kinds in mortgage securities. Most of this portfolio was funded with purchased deposits from various... -

Page 14

... the ability to use payroll direct deposit onto an Emerald Card, thereby enabling them to avoid use of "check cashing" ï¬rms entirely. We have also been working to develop new ï¬nancial products through the Bank, such as our H&R Block Emerald Advance Line of Credit. Having the Bank lets us move... -

Page 15

...of a securities brokerage business that became H&R Block Financial Advisors. HRBFA has nearly 1,000 ï¬nancial advisors who seek to offer ï¬nancial advice, ï¬nancial products like annuities and ï¬nancial transaction services to their customers. Roughly 20% of HRBFA's customer base consists of tax... -

Page 16

... accountability of directors to the shareowners whose interests they represent. H&R BLOCK AND COMPETITOR SHARES OF THE TAX INDUSTRY 13.6% 17.8% 4.1% 11.6% 52.9% 2008 H&R Block Digital H&R Block Retail Other Do-It-Yourself All Other Digital All Other Assisted Preparation (Excluding ESP Returns... -

Page 17

... all of them for the work that they do year in and year out. Beyond our tax professionals, associates across the Company have worked extraordinarily hard this year as we changed direction and tried to increase the intensity of our game in many areas. Senior managers and members of the Board have... -

Page 18

..., Inc. Overland Park, KS ROBERT A . G ERA RD General Partner and Investment Manager GFP, L.P. Southampton, NY R O G E R W. H A L E Retired Chairman and Chief Executive Officer LG&E Energy Corp. Louisville, KY LE N J. LA U ER Executive Vice President QUALCOMM, Inc. San Diego, CA D AV ID B. LEWIS... -

Page 19

... Way, Kansas City, Missouri 64105 (Address of principal executive offices, including zip code) (816) 854-3000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock... -

Page 20

2008 FORM 10-K AND ANNUAL REPORT TABLE OF CONTENTS Introduction and Forward-Looking Statements Item Item Item Item Item Item 1. 1A. 1B. 2. 3. 4. PART I Business Risk Factors Unresolved Staff Comments Properties Legal Proceedings Submission of Matters to a Vote of Security Holders 1 1 10 14 14 15 18... -

Page 21

... accounting, tax and business consulting firm primarily serving middle-market companies under the RSM McGladrey name. Our Consumer Financial Services segment is engaged in offering brokerage services, along with investment planning and related financial advice through H&R Block Financial Advisors... -

Page 22

... at company-owned retail tax offices, royalties from franchise retail tax offices, sales of Peace of Mind (POM) guarantees, sales of tax preparation and other software, fees from online tax preparation, participation in refund anticipation loans (RALs) and Emerald Advance lines of credit. Segment... -

Page 23

... high-cost check-cashing fees. The card can be used for everyday purchases, bill payments, and ATM withdrawals anywhere MasterCard» is accepted. Additional funds can be added to the card account year-round through direct deposit or at participating retail locations. The H&R Block Prepaid Emerald... -

Page 24

... preparation business are involved in providing electronic filing and RAL services to the public. Commercial tax return preparers and electronic filers are highly competitive with regard to price and service. In terms of the number of offices and personal tax returns 4 H&R BLOCK 2008 Form 10K -

Page 25

... we operate the largest tax return preparation businesses in Canada and Australia. Our digital tax solutions businesses compete with a number of companies. Intuit, Inc. is the largest supplier of tax preparation software and is also our primary competitor in the online tax preparation market. There... -

Page 26

..., asset allocation strategies, and other investment tools and information. HRB Bank offers traditional banking services including checking and savings accounts, lines of credit, individual retirement accounts, certificates of deposit and prepaid debit card accounts. 6 H&R BLOCK 2008 Form 10K -

Page 27

...services to tax clients of H&R Block. HRB Bank offers the H&R Block Prepaid Emerald MasterCard» and Emerald Advance lines of credit through our Tax Services segment, and also holds certain FDIC-insured deposits for customers of HRBFA. In fiscal years 2008 and 2007, HRB Bank purchased mortgage loans... -

Page 28

SEASONALITY OF BUSINESS - HRB Bank's operating results are subject to seasonal fluctuations primarily related to the offering of the H&R Block Prepaid Emerald MasterCard» and Emerald Advance lines of credit. These services are offered to Tax Services' clients, and therefore peak in January and ... -

Page 29

...sold to HRB Bank during fiscal years 2008 and 2007. HRB Bank holds the loans for investment purposes. Servicing. Loan servicing involves collecting and remitting mortgage loan payments, making required advances, accounting for principal and interest, holding escrow for payment of taxes and insurance... -

Page 30

...The H&R Block, Inc. Compensation Committee Charter. If you would like a printed copy of any of these corporate governance documents, please send your request to the Office of the Secretary, H&R Block, Inc., One H&R Block Way, Kansas City, Missouri 64105. Information contained on our website does not... -

Page 31

... and many firms not otherwise in the tax return preparation business are involved in providing electronic filing, RALs and other related services to the public. Commercial tax return preparers and electronic filers are highly competitive with regard to price and service. 11 H&R BLOCK 2008 Form 10K -

Page 32

Our digital tax solutions businesses compete with a number of companies. Price and marketing competition for tax preparation services increased in recent years. See clients served statistics included in Item 7, under "Tax Services." BUSINESS SERVICES Our alternative practice structure involves ... -

Page 33

... our level of net interest income and our effective management of the impact of changing interest rates and varying asset and liability maturities. HRB Bank raises funds by, among other things, accepting deposits from depositors, which we use to make loans to customers and invest in debt securities... -

Page 34

... tax offices are operated under leases throughout Canada. RSM's executive offices are located in leased offices in Bloomington, Minnesota. Its administrative offices are located in leased offices in Davenport, Iowa. RSM also leases office space throughout the U.S. 14 H&R BLOCK 2008 Form 10K -

Page 35

... in lawsuits regarding our Peace of Mind program (collectively, the "POM Cases"). The POM Cases are described below. Lorie J. Marshall, et al. v. H&R Block Tax Services, Inc., et al., Civil Action 2003L000004, in the Circuit Court of Madison County, Illinois, is a class action case filed on... -

Page 36

...early stages of the Express IRA litigation. SECURITIES LITIGATION - On April 6, 2007, a putative class action styled In re H&R Block Securities Litigation was filed against the Company and certain of its officers in the United States District Court for the Western District of Missouri. The complaint... -

Page 37

... activities and sold its loan servicing business during fiscal year 2008, it remains subject to investigations, claims and lawsuits pertaining to its loan origination and servicing activities that occurred prior to such termination and sale. These investigations, claims and lawsuits include actions... -

Page 38

... plaintiffs, and cases in which plaintiffs seek to represent a class of others similarly situated. Some of these investigations, claims and lawsuits pertain to RALs, the electronic filing of customers' income tax returns, the POM guarantee program, wage and hour claims and investment products. We... -

Page 39

...- The following graph compares the cumulative five-year total return provided shareholders on H&R Block, Inc.'s common stock relative to the cumulative total returns of the S&P 500 index and the S&P Diversified Commercial & Professional Services index. An investment of $100, with reinvestment of all... -

Page 40

... RESULTS OF OPERATIONS Our company has subsidiaries that provide tax, investment, retail banking and business services and products. We are the only major company offering a full range of software, online and in-office tax preparation solutions, combined with personalized financial advice concerning... -

Page 41

Consolidated Results of Operations Data Year Ended April 30, (in 000s, except per share amounts) 2008 2007 2006 REVENUES: Tax Services Business Services Consumer Financial Services Corporate and eliminations $ 2,988,617 941,686 459,953 13,621 $ 4,403,877 $ 2,685,858 932,361 388,090 14,965 $ ... -

Page 42

... reported in discontinued operations for fiscal years 2007 and 2006. Tax Services - Operating Statistics Year Ended April 30, CLIENTS SERVED: United States: Company-owned operations Franchise operations Early-season loan only (2) Digital tax solutions (3) International (4) (in 000s, except average... -

Page 43

... primarily due to $24.1 million in fees earned in connection with the Emerald Advance loan program, also under a revenue and expense sharing agreement with HRB Bank. Additionally, $16.2 million of the increase is due to sales of commercial tax preparation software, TaxWorks», which was acquired in... -

Page 44

... from our online tax preparation and e-filing services and a $12.2 million increase in the recognition of deferred fee revenue from our POM guarantees. Additionally, this segment earned customer fees in connection with an agreement with HRB Bank for our new H&R Block Emerald Prepaid MasterCard... -

Page 45

... hours (000s) Chargeable hours per person Net billed rate per hour Average margin per person Business Services - Operating Results Year Ended April 30, Tax services Business consulting Accounting services Capital markets Leased employee revenue Reimbursed expenses Other Total revenues Compensation... -

Page 46

...fee-based accounts, online account access, equity research and focus lists, model portfolios, asset allocation strategies, and other investment tools and information. HRB Bank offers traditional banking services including checking and savings accounts, lines of credit, individual retirement accounts... -

Page 47

... Financial Services - Operating Statistics Year Ended April 30, BROKER-DEALER: Traditional brokerage accounts (1) New traditional brokerage accounts funded by tax clients Cross-service revenue as a percent of total production revenue (2) Average assets per traditional brokerage accounts Average... -

Page 48

...interest earned on sweep accounts of approximately $8 million. Net interest income on banking activities increased $30.4 million from the prior year due to interest income received on our new Emerald Advance loan products and an increase in average mortgage loans held for 28 H&R BLOCK 2008 Form 10K -

Page 49

... of net interest revenue on banking activities: (dollars in 000s) Year Ended April 30, Mortgage loans held for investment Emerald Advance lines of credit Other investments Deposits 2008 $1,169,644 63,743 196,262 1,094,161 Average Balance 2007 $746,387 - 117,350 700,707 Average Rate Earned (Paid... -

Page 50

Other service revenues increased $36.4 million due to revenues earned from our H&R Block Prepaid Emerald MasterCard» program, coupled with positive sweep account rate variances and higher underwriting fees. Net interest income on banking activities totaled $24.0 million for fiscal year 2007. The ... -

Page 51

...industry resulted in lower demand for non-prime loans and a higher yield requirement by investors that purchase the loans. As a result, mortgage loans originated during this period were valued at less than par by the time they were sold in the secondary market. Loans sales from January to April 2008... -

Page 52

... industry has experienced significant adverse trends for an extended period. If adverse trends continue for a sustained period or at rates worse than modeled by us, HRB Bank may be required to record additional loan loss provisions, and those losses may be significant. 32 H&R BLOCK 2008 Form 10K -

Page 53

... sold in the secondary market in the form of a whole-loan sale or mortgage-backed security. In whole-loan sale transactions, OOMC generally guarantees the first payment to the purchaser. If this payment is not collected, it is referred to as an early payment default. In the event of an early payment... -

Page 54

... 2006. In fiscal year 2007, we recorded $154.9 million in goodwill impairments related to the sale or wind-down of businesses reported as discontinued operations. INCOME TAXES - We account for income taxes in accordance with Statement of Financial Accounting Standards No. 109, "Accounting for Income... -

Page 55

... year ended April 30, 2008, follows. Generally, interest is not charged on intercompany activities between segments. Our consolidated statements of cash flows are located in Item 8. (in 000s) Tax Services Cash provided by (used in): Operations Investing Financing Net intercompany (1) Business... -

Page 56

... year 2008, Consumer Financial Services provided $217.8 million in investing activities primarily due to principal payments received on mortgage loans held for investment. Cash used in financing activities of $404.9 million is primarily due to customer deposits. To manage short-term liquidity, Block... -

Page 57

...2008 to support off-season working capital requirements in our Tax Services and Business Services segments and operating losses from our mortgage businesses. At April 30, 2008, we maintained $2.0 billion in revolving credit facilities to support issuance of commercial paper and for general corporate... -

Page 58

...COMMERCIAL COMMITMENTS A summary of our obligations to make future payments as of April 30, 2008, is as follows: (in 000s) Total Long-term debt (including interest) Customer deposits Acquisition payments Short-term borrowings Media advertising purchase obligation Capital lease obligations Operating... -

Page 59

...not limited to, commercial income tax return preparers, income tax courses, the electronic filing of income tax returns, the facilitation of RALs, loan originations and assistance in loan originations, mortgage lending, privacy, consumer protection, franchising, sales methods, brokers, brokerdealers... -

Page 60

... and rates for fiscal years 2008 and 2007: (dollars in 000s) April 30, Average Balance Interest-earning assets: Loans, net(1) Available-for-sale investment securities Federal funds sold FHLB stock Non-interest-earning assets Total HRB Bank assets Interest-bearing liabilities: Customer deposits FHLB... -

Page 61

... shows HRB Bank's average deposit balances and the average rate paid on those deposits for fiscal years 2008 and 2007: (dollars in 000s) Year Ended April 30, Money market and savings Interest-bearing checking accounts IRAs Certificates of deposit Non-interest-bearing deposits $ Average Balance 653... -

Page 62

... revenue sharing with Tax Services on Emerald Advance activities. ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK GENERAL INTEREST RATE RISK - We have a formal investment policy that strives to minimize the market risk exposure of our cash equivalents and available-for-sale... -

Page 63

...securities. HRB Bank's liabilities consist primarily of transactional deposit relationships, such as prepaid debit card accounts and checking accounts. Other liabilities include money market accounts, certificates of deposit and collateralized borrowings from the FHLB. Money market accounts re-price... -

Page 64

... trading portfolio at quoted market prices and the market value of our trading portfolio at April 30, 2008, was approximately $8.8 million, net of $0.2 million in securities sold short. Fixed-income securities totaling $1.6 million at April 30, 2008 have returns linked to the equity market, and are... -

Page 65

... information. Our system of internal control over financial reporting also includes formal policies and procedures, including a Code of Business Ethics and Conduct program designed to encourage and assist all employees and directors in living up to high standards of integrity. The Audit Committee... -

Page 66

... in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated June 30, 2008 expressed an unqualified opinion on the Company's internal control over financial reporting. June 30, 2008 46 H&R BLOCK 2008 Form 10K -

Page 67

... Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended April 30, 2008 of the Company and our report dated June 30, 2008, expressed an unqualified opinion on those financial statements and financial statement... -

Page 68

...Also, in our opinion, the related financial statement schedule, when considered in relation to the basic consolidated financial statements taken as a whole, presents fairly, in all material respects, the information set forth therein. Kansas City, Missouri June 29, 2007 48 H&R BLOCK 2008 Form 10K -

Page 69

...Year Ended April 30, REVENUES: Service revenues Other revenues: Product and other revenues Interest income OPERATING EXPENSES: Cost of services Cost of other revenues Selling, general and administrative Operating... accompanying notes to consolidated financial statements. H&R BLOCK 2008 Form 10K 49 -

Page 70

... operations, held for sale Total assets LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES: Commercial paper and other short-term borrowings Customer banking deposits Accounts payable to customers, brokers and dealers Accounts payable, accrued expenses and other current liabilities Accrued salaries... -

Page 71

... Accrued salaries, wages and payroll taxes Accrued income taxes Other noncurrent liabilities Other, net Net cash provided by (used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Available-for-sale securities: Purchases of available-for-sale securities Sales of and payments received... -

Page 72

...sale securities - Stock-based compensation - Shares issued for: Option exercises - Nonvested shares - ESPP - Acquisitions - Acquisition of treasury shares - Cash dividends paid - $0.56 per share - Balances at April 30, 2008... notes to consolidated financial statements. 52 H&R BLOCK 2008 Form 10K -

Page 73

... U.S. Specifically, we offer: tax return preparation; accounting, tax and consulting services to business clients; investment services through a registered broker-dealer; traditional retail banking services; tax preparation and related software; and refund anticipation loans offered by a third-party... -

Page 74

... investment in the stock of the Federal Home Loan Bank (FHLB) is carried at cost, as they are restricted securities, which are required to be maintained by H&R Block Bank (HRB Bank) for borrowing availability. The cost of the stock represents its redemption value, as there is no ready market value... -

Page 75

... costs associated with software developed or purchased for internal use. These costs are typically amortized over 36 months using the straight-line method. We capitalized interest costs during construction of our corporate headquarters facility for qualified expenditures based upon interest rates in... -

Page 76

.... REVENUE RECOGNITION - Service revenues consist primarily of fees for preparation and filing of tax returns, both in offices and through our online programs, fee associated with our Peace of Mind (POM) guarantee program, fees for consulting services and brokerage commissions. Service revenues are... -

Page 77

...product is sold to the end user, either through retail, online or other channels. Revenue from the sale of TaxWorks» software, which is designed for small to mid-sized CPA firms who file taxes for individuals and businesses, is deferred and recognized over the period for which customer upgrades and... -

Page 78

...financial statements. As discussed in note 14, we adopted the provisions of FIN 48 effective May 1, 2007. NOTE 2: BUSINESS COMBINATIONS During fiscal year 2007, we acquired TaxWorks LLC, a provider of commercial tax preparation software targeting the independent tax preparer market. The initial cash... -

Page 79

... is considered the contractual maturity date. HRB Bank is required to maintain a restricted investment in FHLB stock for borrowing availability. The cost of this investment, $7.5 million, represents its redemption value, as these investments do not have a ready market. H&R BLOCK 2008 Form 10K 59 -

Page 80

... scheduled cash flows through the estimated maturity using estimated market discount rates that reflect the interest rate risk inherent in the loans, reduced by an allocation of the allowance for loan losses. Activity in the allowance for mortgage loan losses for the years ended April 30, 2008 and... -

Page 81

... to the construction of our corporate headquarters. NOTE 7: GOODWILL AND INTANGIBLE ASSETS Changes in the carrying amount of goodwill by segment for the year ended April 30, 2008, are as follows: (in 000s) April 30, 2007 Tax Services Business Services Consumer Financial Services Total $ 415,077 404... -

Page 82

... DEPOSITS The components of customer banking deposits at April 30, 2008 and 2007 are as follows: (in 000s) April 30, Outstanding Balance Money-market deposits Savings deposits Checking deposits: Interest-bearing Non-interest-bearing IRAs and other time deposits: Due in 2009 Due in 2010 Due in 2011... -

Page 83

... collateralized by land and buildings. The obligation is due in 13 years. We entered into a committed line of credit agreement with HSBC Finance Corporation effective January 10, 2008 for use as a funding source for the purchase of RAL participations. This line provides funding totaling $3.0 billion... -

Page 84

... stock-based compensation to be included as a financing activity in the statements of cash flows. As a result, we classified $3.2 million as a cash inflow from financing activities rather than as an operating activity for both fiscal years 2008 and 2007. We realized tax benefits from stock option... -

Page 85

..."Accounting under Statement 123 for Certain Employee Stock Purchase Plans with a Look-Back Option." The fair value of the option includes the value of the 10% discount and the look-back feature. We expense the grant-date fair value over the six-month vesting period. A summary of options for the year... -

Page 86

The following assumptions were used to value options during the periods: Year Ended April 30, Options - management and director: Expected volatility Expected term Dividend yield Risk-free interest rate Weighted-average fair value Options - seasonal: Expected volatility Expected term Dividend yield ... -

Page 87

... held-for-sale in the prior year. The loss from discontinued operations for fiscal year 2008 of $763.1 million is net of tax benefits of $412.8 million. We believe the net deferred tax asset at April 30, 2008 of $400.5 million is, more likely than not, realizable. 67 H&R BLOCK 2008 Form 10K -

Page 88

... for the years 1999-2005 are currently under examination by the Internal Revenue Service (IRS). Tax years prior to 1999 are closed by statute. Historically, tax returns in various foreign and state jurisdictions are examined and settled upon completion of the exam. 68 H&R BLOCK 2008 Form 10K -

Page 89

... of other revenues on our consolidated income statements. (in 000s) Year Ended April 30, 2008 2007 2006 Interest income: Mortgage loans, net Emerald Advance lines of credit, net Investment securities Margin receivables Other Operating interest expense: Borrowings Deposits Net interest income... -

Page 90

... offer guarantees under our POM program to tax clients whereby we will assume the cost, subject to certain limits, of additional tax assessments, up to a cumulative per client limit of $5,000, attributable to tax return preparation error for which we are responsible. We defer all revenues and direct... -

Page 91

... in the number of plan participants and an aging employee base. During fiscal year 2006, we entered into a transaction with the City of Kansas City, Missouri, to provide us with sales and property tax savings on the furniture, fixtures and equipment for our corporate headquarters facility. Under... -

Page 92

...by federal and state taxing authorities in connection with tax returns prepared for clients; (3) indemnification of our directors and officers; and (4) third-party claims relating to various arrangements in the normal course of business. Typically, there is no stated maximum payment related to these... -

Page 93

... "HRB," or are otherwise affiliated or associated with H&R Block Tax Services, Inc., and that sold or sells the POM product. The defendants filed a motion to decertify the classes, which is set to be heard in July 2008. Discovery is proceeding. No trial date has been set. 73 H&R BLOCK 2008 Form 10K -

Page 94

...early stages of the Express IRA litigation. SECURITIES LITIGATION - On April 6, 2007, a putative class action styled In re H&R Block Securities Litigation was filed against the Company and certain of its officers in the United States District Court for the Western District of Missouri. The complaint... -

Page 95

... activities and sold its loan servicing business during fiscal year 2008, it remains subject to investigations, claims and lawsuits pertaining to its loan origination and servicing activities that occurred prior to such termination and sale. These investigations, claims and lawsuits include actions... -

Page 96

... to our business, including claims and lawsuits (collectively, "Other Claims") concerning investment products, the preparation of customers' income tax returns, the fees charged customers for various products and services, losses incurred by customers with respect to their investment accounts... -

Page 97

... designed for small to mid-sized CPA firms who file taxes for individuals and businesses. This segment also offers online do-it-yourself-tax preparation and online tax advice to the general public through various websites. Revenues of this segment are seasonal in nature. 77 H&R BLOCK 2008 Form 10K -

Page 98

... card accounts. HRB Bank offers the H&R Block Prepaid MasterCard» and Emerald Advance lines of credit through our Tax Services segment. HRB Bank also holds previously purchased mortgage loans for investment purposes. HRB Bank is dependent upon H&R Block and its affiliates for shared administrative... -

Page 99

... businesses as discontinued operations in the consolidated financial statements. All periods presented reflect our discontinued operations. See additional discussion in note 19. (in 000s, except per share amounts) Fiscal Year 2008 Revenues Income (loss) from continuing operations before taxes... -

Page 100

... S TAT E M E N T S Year Ended April 30, 2008 Total revenues Cost of services Cost of other revenues Selling, general and administrative Total expenses Operating income (loss) Interest expense Other income, net Income (loss) from continuing operations before taxes (benefit) Income taxes (benefit) Net... -

Page 101

...2008 Cash & cash equivalents Cash & cash equivalents - restricted Receivables from customers, brokers and dealers, net Receivables, net Mortgage loans held for investment Intangible assets and goodwill, net Investments in subsidiaries Other assets Total assets Short-term borrowings Customer deposits... -

Page 102

... CONSOLIDATING STATEMENTS OF CASH FLOWS Year Ended April 30, 2008 Net cash provided by (used in) operating activities: Cash flows from investing: Mortgage loans originated for investment, net Purchase property & equipment Payments for business acquisitions Net intercompany advances Investing cash... -

Page 103

... discontinued operations Other, net Net cash provided by (used in) investing activities Cash flows from financing: Repayments of commercial paper Proceeds from commercial paper Repayments of other short-term borrowings Proceeds from other short-term borrowings Customer banking deposits Repayments... -

Page 104

... CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING - During the quarter ended April 30, 2008, there were no changes that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. ITEM 9B. OTHER INFORMATION None. 84 H&R BLOCK 2008 Form 10K -

Page 105

... Tax Services Senior Vice President, Human Resources President, RSM McGladrey Business Services, Inc. ITEM 11. EXECUTIVE COMPENSATION The information called for by this item is contained in our definitive proxy statement filed pursuant to Regulation 14A not later than 120 days after April 30, 2008... -

Page 106

... Long-Term Executive Compensation Plan, as amended as of February 1, 2008. H&R Block Severance Plan. Severance and Release Agreement between Robert Dubrish and Option One Mortgage Corporation dated March 11, 2008. Employment Agreement dated July 12, 2005 between H&R Block Digital Tax Solutions, LLC... -

Page 107

... of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated on June 30, 2008. Alan M. Bennett Interim Chief Executive Officer (principal executive officer) Becky S. Shulman... -

Page 108

... and the Bank of New York, filed as Exhibit 4(a) to the Company's current report on Form 8-K dated April 13, 2000, file number 1-6089, is incorporated herein by reference. 4.3 Officer's Certificate, dated October 26, 2004, in respect of 5.125% Notes due 2014 of Block Financial Corporation, filed as... -

Page 109

... dated as of September 23, 2005, among HSBC Bank USA, National Association, HSBC Taxpayer Financial Services Inc., H&R Block Digital Tax Solutions, LLC, and H&R Block Services, Inc., filed as Exhibit 10.15 to the quarterly report on Form 10-Q for the quarter ended October 31, 2005, file number... -

Page 110

... report on Form 10-Q for the quarter ended January 31, 2007, file number 1-6089, is incorporated by reference.** 10.36 First Amended and Restated HSBC Settlements Products Servicing Agreement dated as of November 13, 2006 among Block Financial Corporation, HSBC Bank USA, National Association... -

Page 111

... of our 2008 Form 10-K as filed with the Securities and Exchange Commission. Requests should be directed by telephone to Investor Relations, 1-800-869-9220, option 8, or by mail to One H&R Block Way, Kansas City, Missouri 64105. For more information about H&R Block, visit our Web site at www.hrblock... -

Page 112

H&R BLOCK H & R BL OCK I N C. One H&R Block Way Kansas City, MO 64105 816.854.3000 www.hrblock.com Cert no. BV-COC-080115