Fluor 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Fluor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

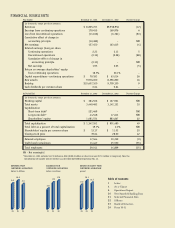

11.5

9.7

8.6 10.0

FL UOR CORPORATION 2003 A N NUAL REPORT

cent increase in new business. In addition, we booked sev-

eral major new oil and gas projects, increasing new awards

by more than 80 percent, reflecting tangible evidence that

the anticipated cycle of substantial capital investment in

this global market has begun.

10.8 10.6

01 02 03 01 02 03

CONSOLIDATEDNEWAWARDS CONSOLIDATEDBACKLOG

dollarsinbillions dollarsinbillions

B U S I N E S S S T R AT E G Y A N D O U T L O O K

Fluor’s market diversity has long been a key strength in

reducing the impact of cyclicality in individual markets

and enhancing consistency in long-term performance. Our

broad geographic scope and experience across the breadth

of the markets that we serve, combined with our financial

strength, provides a competitive advantage that is virtually

unmatched within our industry.

Over the past few years, we have concentrated our

attention on executing our diversification strategy to

achieve more consistent growth, deliver solid returns

on capital and enhance shareholder value. Our portfolio

management approach allows us to quickly and efficiently

move resources between markets to take advantage of cycli-

cal upturns and reduce costs in the downturns. Combined

with our actions to increase our most stable businesses in

proportion to our overall business mix, we have achieved a

good balance across our entire business portfolio and are

extremely well positioned in each of our market areas.

We have continued our unrelenting focus on market

selectivity, execution excellence, financial discipline, risk

management and meeting our clients’ needs. We remain

absolutely committed to these principles and believe that

they provide the strong foundation for our current and

future success.

Looking ahead to 2004, we expect to build on the

growth achieved in new awards and backlog during 2003,

driven by anticipated increases in capital spending by a

number of major clients. We remain convinced that the

market for our services, particularly in the global oil and

gas industry, is in the early stages of a long-term cycle of

investment that will continue to unfold over the next three

to five years. We are actively tracking a number of large,

complex projects in geographically challenging locations,

PAGE 2

which plays to Fluor’s strengths, along with a growing list

of more moderate-sized prospects. In addition, a contin-

uation of the global economic recovery, which began to

strengthen late in the year, should add further momentum

to our positive outlook for new capital investment across

a majority of our markets.

Complementing our pursuit of organic growth

within each of our business segments, is our ongoing

search for niche acquisitions to further penetrate and

expand our share in targeted markets. During 2003, we

completed three acquisitions, two focused on expand-

ing our growth potential in the Government market, and

another directed at enhancing our turnaround services

offering in the O&M market.

In last year’s report, I outlined our goal to increase the

proportion of revenue and operating earnings from these

two less cyclical markets to approximately 40 percent of

Fluor’s total business mix. Significant progress was made

toward this objective in 2003, with the combined revenues

of these businesses increasing to 32 percent from 19 per-

cent a year ago, while operating earnings grew to 36 percent

of the total from 30 percent last year.

Additionally, in February 2004, we completed a fourth

acquisition, further strengthening our capabilities and

presence in the Government market. Fluor’s Del-JenSM unit

acquired Trend Western Technical Corporation, which

specializes in logistics services and base operations sup-

port. Trend Western has previously teamed with Del-Jen,

and will be fully integrated into the company, enabling the

combined entity to provide a full spectrum of support ser-

vices to the Department of Defense at military installations

worldwide. We intend to continue to pursue well-managed

and accretive acquisition candidates that complement and

enhance our long-term growth potential.

Overall, we believe significant progress was made

during the year in executing our business strategy and we

are cautiously optimistic about our prospects in the coming

year. We expect that 2004 will be a year of transition, as we

move from the completion of a cycle of power projects to a

new cycle of oil and gas projects.

This shift from the conclusion of a cycle to the begin-

ning of a new one has implications for the company’s near-

term earnings outlook. Because projects often take two to

three years or longer to complete, revenues and earnings

recognized in the early stages of project execution reflect

the lower volume of work performed during engineering

and project planning. As projects get closer to comple-

tion the volume of work performed is at a peak, resulting

in higher revenue and profit recognition. This means that