Fifth Third Bank 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT | 5

activities fell outside of our current risk parameters and

were willing to sacrice near-term earnings for long-

term growth and a less volatile, more consistent earnings

stream over time. For example, in March, we decided

to exit the broker mortgage business given regulatory

concerns and the prevailing market environment at the

time. is business generated a little more than 30 percent

of our mortgage originations in 2013; while it is dicult

to walk away from that kind of contribution, this decision

strengthens our controls and simplies our operations in

mortgage lending. Another decision we made was to end

enrollment of new customers and make changes to the

structure for existing customers in our deposit advance

product. We believe there is a need for a short-term, small-

dollar credit product within the banking industry and

we continue to proactively engage with key stakeholders

to review alternative solutions. We are also taking a

measured approach to lending. We are scaling back in

areas that we don’t believe have a compelling risk/return

prole, like certain segments of commercial lending, and

we have maintained our disciplined pricing methodology

in indirect auto lending.

Even as we scaled back, we increased portfolio loan

balances to $90.1 billion, up 2 percent from 2013, with 4

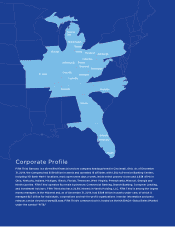

BRANCH BANKING

A strong Retail Bank is critical to our future. Consumer banking

continues to go through significant transformations. Some of our

changes thus far have been due to strategies we had planned and

executed, especially those geared toward providing consultative

and differentiated service. Others were driven by evolving consumer

behavior and our desire to offer our customers options in line with their

preferences. Amidst all of the changes, our affiliate model continues

to provide a competitive advantage for us. Our local teams are able to

connect with the unique and diverse areas of our footprint to create a

more personal banking experience.

While our banking centers represent the physical manifestation of our

brand in the community, our enhanced online and mobile presence is

becoming an increasingly valued tool for our customers. We will continue

to integrate our delivery channels to bring a consistent experience that

drives efficiencies and revenue opportunities for the Bank.

We are focused on reducing reliance on the aspects of consumer banking

that are exposed to regulation or which present return challenges. We

will benefit from the integrated, multi-channel delivery model that we

made enhancements to throughout this past year. Likewise, our focused

segmentation strategy is helping us to deliver new value propositions

with a fair-value exchange as we continue to emphasize the importance

of our relationship-banking orientation.

2014 HIGHLIGHTS

Total Revenue Average Loans

Average Core

Deposits

Banking Centers

ATMs Online

Banking

Customers

Mobile

Banking

Customers

$2.3

billion

$16.6

billion

$47.9

billion

$1.6

million

1,302

2,638

approximately

900,000