Fifth Third Bank 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 |

of our capital as ecient as possible. We converted $398 million of 8.50% Series G Preferred Stock into shares of our

common stock and issued $1.05 billion of new preferred stock, Series H and Series I, with lower coupons. We also

issued $2.5 billion of long-term debt and redeemed $750 million of outstanding trust preferred securities. Our focus

on ecient capital management is consistent with our ongoing goal to maintain a strong balance sheet for a variety

of economic environments, while prudently managing capital.

As we turn to 2014, we continue to aim for excellence and outperformance. We are ready to build on our legacy and

to do that, we must execute on four key strategies:

• Focused segmentation — Identifying customer segments, understanding their unmet needs and delivering a

more targeted value proposition more eciently.

• Distinctive execution — Providing a dierentiated customer experience with clear value propositions and

delivering it with outstanding, consistent execution.

• Innovation — Listening to customers and creating solutions that drive dierentiated value is what we mean by

innovation. Whether we’re optimizing products and services, improving the technology used to deliver them, or

shiing the way we sell them, we’re moving forward to create value in the industry. In 2013, we were awarded two

patents for a business that didn’t exist two years ago.

• Growth accelerators — Long-term investments to build our presence, our customer base, and our business.

ese are strategies we’ve been working on, and they are the building blocks for our future. Over the next several

years, we’ll focus on leveraging this work and expanding on it in new and exciting ways, just as we continue to evolve

and strengthen the risk culture that ensures our ongoing success. I have condence in the leadership and talent of our

Company to make the years ahead our best yet.

Sincerely,

Kevin T. Kabat

Vice Chairman and Chief Executive Officer

February 2014

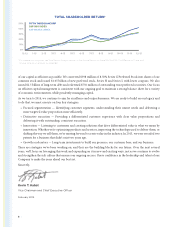

* For comparison purposes, see Total Return Analysis section in the Annual Report on Form 10-K for Fifth Third Bancorp’s 5-year and

10-year total return analysis on page 182.

TOTAL SHAREHOLDER RETURN*

50%

40%

30%

20%

10%

0%

12-12 1-13 2-13 3-13 4-13 5-13 6-13 7-13 8-13 9-13 10-13 11-13 12-13

FIFTH THIRD BANCORP

S&P 500 INDEX

S&P BANKS INDEX