Fifth Third Bank 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ANNUAL REPORT | 5

in the branch, we’re accelerating the self-service transition where it makes sense. We’re working

to educate customers by using in-branch ATMs and a smaller, more cost-eective branch format

with about half the stang of a traditional branch. Our banking centers remain the most visible

brand identier in our communities and they also

will remain a key source of deposits and cross-selling.

Our customers have indicated that branch proximity

and convenience are still top factors in selecting a

bank, and a vast majority of our consumer checking

households, as well as Private Bank, small business,

and business banking customers have visited a

banking center in the past six months. Prudently

balancing the lower branch trac with branch

presence and the consultative expertise we can oer there will be a key priority for Fih ird and

the industry in coming years.

Our customers have told us how much they appreciate our employees and the way they listen

to them, get to know them, and respond to their needs. e friendly Fih ird face, the spirit

behind our pin, and the commitment to improving lives are among the hallmarks of our brand.

ey’re at the foundation of our relationships with customers, businesses, and communities, and

the strength of those relationships is paramount to our success. at’s why I believe that the people

who represent our Company are Fih ird Bank’s most valuable asset. In 2013, for the second

time, we were recognized by the Gallup organization with a Gallup Great Workplace Award for

our engaged and productive workforce. It takes a team eort to dierentiate our Company through

strong results. We can all be proud of what we accomplished in 2013, both in terms of engagement

and nancial performance.

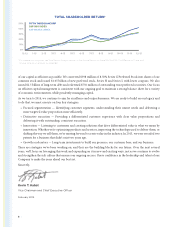

Our solid nancial performance has produced high rates of internal capital generation, which

have been supplemented by gains on our position in the payment processing company, Vantiv,

Inc. is has proven to be a strategic advantage for Fih ird and we’ve recognized about

$2.9 billion in total pre-tax gains from the sale of the processing business in 2009 to today,

including gains in 2013 of $327 million on the sale of a portion of our Class A shares of Vantiv

common stock and $206 million on the valuation of the warrant we hold in Vantiv. We continue

to own a 25 percent interest in Vantiv, whose market capitalization was $5.4 billion at year-end.

Fih ird has beneted tremendously from its investment in Vantiv, and while we would expect

to manage our position downward over time in a disciplined way, it continues to give us signicant

capital exibility.

Fih ird’s strong earnings generation provides the ability to distribute excess capital to

shareholders while maintaining already strong capital levels. In 2013, we increased our annual

dividend 31 percent from the prior year, to a level consistent with the Federal Reserve’s near-

term dividend payout ratio guidance of 30 percent. Including common stock repurchases, we

returned a net $1.3 billion to shareholders. We’ve reduced our share count by 7 percent from the

peak in 2012 while growing tangible book value per share by 12 percent over that same period.

Despite these returns, our capital levels remain very strong overall, with a Tier 1 common ratio* of

9.4 percent as well as a Tier 1 risk-based capital ratio of 10.4 percent at year-end compared with

the 6 percent regulatory well-capitalized minimum.

Our capital position also is well-aligned with new capital rules that were approved by U.S. banking

regulators in July, with a Basel III pro form Tier 1 common ratio estimate of 9.0 percent at year-end.

In light of the new rules, we took a number of important steps in 2013 to make the composition

Fifth Third’s strong earnings generation

provides the ability to distribute excess

capital to shareholders while maintaining

already strong capital levels.

* Non-GAAP measure. For further information, see the Non-GAAP Financial Measures section of MD&A.