Fifth Third Bank 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Fifth Third Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR FIFTH THIRD SHAREHOLDERS,

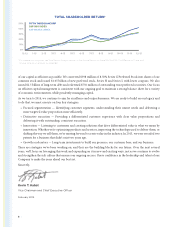

2013 marked our 155th anniversary and we capped it with the strongest results Fih ird has ever

reported. Net income available to common shareholders of $1.8 billion marks the highest earnings in

our history, up 17 percent from 2012, driven by solid revenue growth and well-controlled expenses.

Earnings per diluted share of $2.02 increased 22 percent from the prior year and return on average

assets increased 14 basis points to 1.5 percent. Our record performance exemplies our focus on

delivering steady, reliable growth and creating long-term value for our shareholders. Additionally,

Fih ird’s stock price exceeded a ve-year high and, on a full-year basis, outperformed both the

S&P Banks index and the broader S&P 500 index. Our one-year total shareholder return (stock price

plus dividends) was 42 percent in 2013, versus 23 percent in 2012. As we demonstrated in 2013,

consistency and improvement in our results depend on proactive leadership, strategic agility, and

distinctive execution.

It indeed was a strong and protable year for the Bank — one which clearly showed our continued

growth and achievement as well as the solid foundation upon which that’s built. Our success is due

to the guidance of our Board of Directors and the hard work of our employees to execute every day

on our Vision to become the one bank that

people most value and trust. Our focus has

paid o with new products, partnerships,

and achievements. Along the way, we’ve

grown our talent, our business, our good

reputation, and our positive impact — all

while working to achieve the appropriate

balance between risk and reward.

A strong, ongoing commitment to risk

management is central to our culture,

and in 2013 we took important steps

to strengthen the infrastructure of our

Company. We have never stopped investing

in our revenue-generating capabilities and

A Message To Our Shareholders

Kevin T. Kabat

Vice Chairman and

Chief Executive Officer

2013 ANNUAL REPORT | 1

NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

$ IN MILLIONS

2010 2011 2012 2013

$2,000

$1,500

$1,000

$500

$0

AFTER TAX VANTIV GAINS NET INCOME EX-VANTIV