Fannie Mae 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4FANNIE MAE 2002 ANNUAL REPORT

Fannie Mae produced this record year

in spite of a weak economy and volatile

markets for a very simple reason:

Our business is structured and managed

to maintain disciplined growth and

to keep expanding homeownership in

America throughout all economic

conditions, both good and challenging.

Daniel H. Mudd

Vice Chairman and

Chief Operating Officer

Performance for Fannie Mae shareholders

is crucial to our mission

Fannie Mae’s performance for you, our shareholders, is

crucial to our company. Your ownership makes possible

our mission and business of expanding homeownership

in this country, offering every family regardless of their

means a better chance to achieve the American Dream.

By growing our earnings and providing you with a good

return, we can grow our capital. By growing our capital,

we can grow our business. As Fannie Mae’s business

grows, so do the benefits we provide — lower-cost

mortgage funds — to more and more families in America.

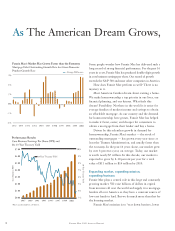

For example, our disciplined business growth has

steadily increased our core business earnings from 39

cents a share in 1987 to $6.31 in 2002, and we just

increased the dividend on our common stock by 18 percent,

which reflects our confidence in our earnings going forward.

At the same time, our disciplined growth also lowers

conventional conforming mortgage rates. You can see

this result in the mortgage rate charts published every

Saturday in the real estate section of most newspapers.

The mortgages Fannie Mae finances are always cheaper

than the jumbo loans listed there, and much cheaper

than subprime loans; we save home buyers anywhere

from $11,000 to as much as $200,000 over the life of

their loans. Furthermore, since 1987, the maximum loan

amount eligible for Fannie Mae’s financing has more

than doubled from around $150,000 to over $300,000,

which means more homeowners can benefit from

our service.

Thus, Fannie Mae’s disciplined growth brings the

interests of shareholders and the interests of home buyers

into perfect alignment. Our mission and our business

complement each other. Your ownership of Fannie Mae

makes more homeownership possible for more Americans.

Fannie Mae’s governance principles: openness,

integrity, responsibility, accountability

What fuels the success of our mission and business are the

principles that underly our approach to corporate governance

and management: Openness. Integrity. Responsibility.

Accountability. Fannie Mae puts a premium on upholding

these simple, core principles in our corporate mission,

business, and culture for an important reason: Trust is

uniquely crucial to our company.

Fannie Mae’s mission is to raise private capital from

investors in America and all over the world so that home

buyers across our nation have a steady source of low-cost

funds to finance homes. So we must earn and ensure the

trust of investors, shareholders, and other stakeholders

every day.

To earn and ensure that trust, Fannie Mae operates

by the following principles of corporate governance:

Openness. Fannie Mae’s standard is to maintain

best-in-class financial disclosures.

Our goal is to provide investors, shareholders, and other

stakeholders with the clear, comprehensive information they

need to understand and have confidence in Fannie Mae and

make our financial disclosures easy to obtain and use. In our

financial disclosures, we strive to provide more than is

required, and anticipate and address fundamental questions

about our company and business.

Our focus on transparency is not a new phenomenon

for Fannie Mae.

In 2000, we revealed the 14 decision factors of our auto-

mated mortgage underwriting system, Desktop Underwriter,

so that lenders and borrowers could better understand

our loan decision process and remedy any issues that arise

with a loan application. We even started using our own

credit assessment model so we could reveal those factors too.