Fannie Mae 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134

|

|

16

“Fannie Mae

is big—how

can you keep

growing?”

Fannie Mae can keep

growing because our

market keeps growing.

We like to say that as

the American Dream

grows, so do we. In

fact, our challenge will

be to keep up with the

American Dream,

because for the current

decade and beyond, the

demand for homes to

buy and rent will grow

faster than ever.

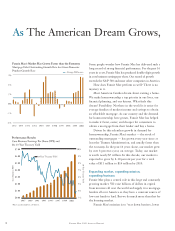

Fannie Mae’s growth is determined

chiefly by growth in our market.

Our market is called “mortgage debt

outstanding.” This is the total stock

of outstanding mortgage debt in

America. And mortgage debt out-

standing has been — and will remain

— one of the strongest growth

markets in the economy.

In fact, our market typically grows

faster than the economy. Our market

has grown every year since the

Federal Reserve began tracking it

in the early 1950s.

During the 1990s, our market

grew by about 7 percent annually.

During this decade, the demand for

mortgage capital is expected to grow

at a stronger pace of 8-10 percent

per year. An important driver is

strong growth in population and