Fannie Mae 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

FANNIE MAE 2002 ANNUAL REPORT

Letter to Shareholders

To Our Shareholders: In a challenging year for corporate America and

the U.S. economy, the nation’s housing sector continued to be robust

as the building, buying, and financing of homes produced another

record year for the industry, especially for the chief source of funds

for American families to buy homes, Fannie Mae.

I want to tell you about our exceptional performance in

2002 for our mission and business of expanding home-

ownership in America. However, I also recognize the

need for companies and their chief executive officers

to help restore and strengthen shareholder trust and

confidence in corporate America. Certainly, Fannie Mae

is no exception. Indeed, investor trust in our company is

crucial to our business and mission as we raise capital

from investors to finance homes.

Fannie Mae aspires to be a model company that

inspires the confidence of our shareholders. As I describe

our corporate performance for 2002, I also want to share

with you Fannie Mae’s cutting-edge corporate governance

practices that exemplify our values. It is our exceptional

values that make our exceptional performance as a

company possible.

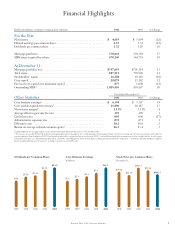

Fannie Mae’s 2002 financial performance:

among our best years in history

Fannie Mae’s core business results for 2002 were among

the best in the company’s history.

•Total business volume grew by 38 percent for a new

record of nearly $850 billion.

•Total book of business grew by over 16 percent.

•Mortgage portfolio grew by nearly 12 percent.

•Outstanding mortgage-backed securities grew

by nearly 20 percent.

•Core taxable-equivalent revenue grew to $12 billion,

nearly 17 percent growth.

•Core business earnings per share (formerly, operating

earnings per share) grew by over 21 percent.

Fannie Mae produced this record year in spite of a weak

economy and volatile markets for a very simple reason:

Our business is structured and managed to maintain disci-

plined growth and to keep expanding homeownership in

America throughout all economic conditions, both good

and challenging.

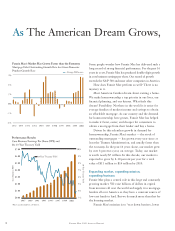

What does “disciplined growth” mean at Fannie Mae?

For Fannie Mae, growth means that our core business

earnings have grown faster than the Standard & Poor’s

500 index and the Nasdaq over the past 16 years.

For the past 16 years, Fannie Mae has produced double-

digit increases in core business earnings per share,

putting us among the best of the S&P 500 companies.

Fannie Mae’s strong, steady growth is based on the

strong, steady growth of our market, which is the

stock of outstanding mortgages to be managed. That is

why we say, “As the American Dream grows, so do we.”

During this decade, Fannie Mae’s market is projected

to grow by 8-10 percent per year, which is faster than

the 7 percent annual growth of the 1990s, and faster

than most “growth” industries. Already our market

grew by over 10 percent in 2001 and over 12 percent in

2002. Moreover, Fannie Mae has grown faster than the

market because we specialize in funding and managing

the most popular, consumer friendly mortgage —

the long-term, fixed-rate mortgage.

Fannie Mae’s growth, however, is “disciplined,”

meaning that we put a premium on stable financial

performance and consistent return to investors under all

economic conditions. The result has been extraordinarily

low volatility and high stability in core business earnings

growth for 16 years in a row. The fact that 2002 was an

exceptional year for Fannie Mae in spite of the slow economy

and unusually volatile interest rates is a testament to our

disciplined growth model.