Fannie Mae 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FANNIE MAE 2002 ANNUAL REPORT 17

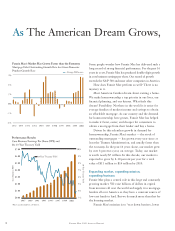

immigration, which is expected to

create 13-15 million new households.

Already our market has grown

by over 10 percent in 2001 and over

12 percent in 2002. If our market

grows as expected throughout the

decade, it will more than double in

size, going from $5.6 trillion in 2000

to $11-$14 trillion by 2010. So you

see, if Fannie Mae merely grew at the

pace of our market, we could grow by

8-10 percent per year for the rest of

the decade — a rate that is faster than

GDP growth, and thus faster than

most of the S&P 500.

But we have grown faster than

our market for many years, largely

because we specialize in the most

popular mortgage in the fastest-

growing segment of our market, the

long-term, fixed-rate mortgage.

By the way, as big as Fannie Mae

is, our share of the market is relatively

small. We own only 11 percent

of mortgages in the market, and

guarantee the credit on another 15

percent. That gives us plenty of room

to grow within our growing market.

Now, given that we are a financial

company, some people think

Fannie Mae’s growth potential goes

up and down, driven by market cycles.

That’s not the case.

For instance, some believe

Fannie Mae’s growth is based on the

level of mortgage originations —

the number of home purchase and

refinancing loans that lenders make

with borrowers. Origination levels

can change with ups and downs in

the economy and interest rates. But

Fannie Mae’s growth is not tied to

the ups and downs in originations.

We don’t originate mortgages —

lenders do. We help to manage

the stock of outstanding mortgages

that lenders have originated.

So originations affect us to the extent

they increase the stock of mortgage

debt outstanding. That is why,

over the past 16 years, as mortgage

originations have gone up and down,

we’ve still grown each year.

Some also say Fannie Mae’s growth

is determined by interest rates. But

we deliberately manage our business

to minimize the impact of changing

interest rates. For example, when we

purchase long-term mortgages

from lenders, we generally fund the

purchase by selling long-term debt

securities, and we add options to the

securities that allow us to adjust the

term if interest rates move. That way,

we can maintain a relative match

between the interest rate we receive

from holding the mortgage, and the

interest rate we pay the investor for

funding the mortgage. In fact, over

the past 16 years, interest rates have

gone up and down and we’ve still

grown.

Finally, some believe our growth

is driven by the health of the economy.

But in fact, because of our underwriting

precision, geographic distribution,

equity in the home, and use of credit

enhancements, mortgage delinquencies

have gone up and down over the past

16 years and we’ve still grown.

The important thing to remember

is that Fannie Mae can keep growing

— in all business cycles and economic

conditions — because our market

keeps growing.