Fannie Mae 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As The American Dream

Grows, So Do We.

In this year’s annual report,

Fannie Mae’s CEO answers

important questions

about our mission, our

business, and the future of

homeownership in America.

Fannie Mae 2002 Annual Report

Table of contents

-

Page 1

Fannie Mae 2002 Annual Report As The American Dream Grows, So Do We. In this year's annual report, Fannie Mae's CEO answers important questions about our mission, our business, and the future of homeownership in America. -

Page 2

At Fannie Mae, we are in the American Dream business. Our Mission is to tear down barriers, lower costs, and increase the opportunities for homeownership and affordable rental housing for all Americans. Because having a safe place to call home strengthens families, communities, and our nation as a ... -

Page 3

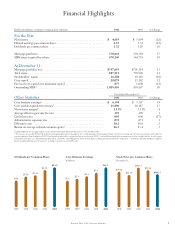

...-related securities guaranteed by Fannie Mae and held by investors other than Fannie Mae. 2 These measures are non-GAAP (generally accepted accounting principles) measures management uses to track and analyze our financial performance. Core business earnings is presented on a net of tax basis... -

Page 4

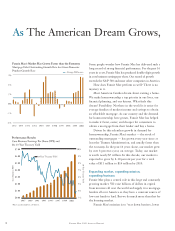

Franklin D. Raines Chairman and Chief Executive Officer 2 F A N N I E M A E 2 0 0 2 A N N U A L R E P O RT -

Page 5

... the building, buying, and financing of homes produced another record year for the industry, especially for the chief source of funds for American families to buy homes, Fannie Mae. I want to tell you about our exceptional performance in 2002 for our mission and business of expanding homeownership... -

Page 6

... corporate mission, business, and culture for an important reason: Trust is uniquely crucial to our company. Fannie Mae's mission is to raise private capital from investors in America and all over the world so that home buyers across our nation have a steady source of low-cost funds to finance homes... -

Page 7

...useful gauge of market confidence in the company; 2. Ensure we have at least three months' worth of liquidity in case our access to the public debt markets were to be disrupted; 3. Take a risk-based capital stress test every quarter and report the results; 4. Every quarter we give our books a credit... -

Page 8

... - the interest of the company or shareholders. Also, it is my duty to ensure that I know how Fannie Mae earns income and the risks we are undertaking in the course of business. Indeed, before it was required of us, Fannie Mae announced that our CEO and Chief Financial Officer would sign and certify... -

Page 9

... and the public we serve requires more than cutting-edge corporate governance and financial disclosure policies. As the scholar Michael Novak has noted, corporate responsibility ultimately requires two essential qualities: personal character and conscience. Fannie Mae's strong, stable, consistent... -

Page 10

...over 8 percent a year, on average. Today, our market is worth nearly $7 trillion. In this decade, our market is expected to grow by 8-10 percent per year for a total value of $11 trillion to $14 trillion by 2010. Expanding market, expanding mission, expanding business Fannie Mae plays a central role... -

Page 11

... helping lenders package home loans into mortgage-backed securities that have our guarantee of credit quality. These businesses require Fannie Mae to adjust to changes in the economy and interest rates that affect mortgage performance, yields, and funding costs. We employ a wide array of technology... -

Page 12

10 F A N N I E M A E 2 0 0 2 A N N U A L R E P O RT -

Page 13

Franklin D. Raines, Chairman and Chief Executive Officer, answers questions about Fannie Mae and the American Dream business. F A N N I E M A E 2 0 0 2 A N N U A L R E P O RT 11 -

Page 14

... The building, buying, and financing of homes, and the growth in home values, has continued to be so strong that housing not only has endured the weakness in the U.S. economy - housing helped the economy to sustain and recover. However, after the technology sector collapsed and the stock market fell... -

Page 15

...and the average mortgage costs $1,000 a month. Moreover, technology-driven efficiency, underwriting precision, and other advances in mortgage finance all have significantly reduced the cost of financing a home and the funds required up front. Housing inventories remain near record lows. One key sign... -

Page 16

... Fannie Mae's business does not rise or fall based on how changes in interest rates affect consumers' decision to finance or refinance a home. That is because Fannie Mae, unlike commercial banks for example, does not make home loans - "originate" mortgages - directly with consumers. Instead, we help... -

Page 17

... core business earnings per share increased by 21 percent during 2002. • The benefits of our disciplined growth strategy were particularly apparent in 2002, when interest rates were exceptionally volatile. In September, interest rates plunged to a 40-year low, and moved 100 basis points in just... -

Page 18

...the American Dream, because for the current decade and beyond, the demand for homes to buy and rent will grow faster than ever. Fannie Mae's growth is determined chiefly by growth in our market. Our market is called "mortgage debt outstanding." This is the total stock of outstanding mortgage debt in... -

Page 19

... market cycles. That's not the case. For instance, some believe Fannie Mae's growth is based on the level of mortgage originations - the number of home purchase and refinancing loans that lenders make with borrowers. Origination levels can change with ups and downs in the economy and interest rates... -

Page 20

... provided $1.3 trillion for nearly 12 million families under our Commitment. Our American Dream Commitment is an enormous challenge and stretch goal for our company, notwithstanding our great progress so far. Fannie Mae does not lend directly to consumers. We provide the capital for mortgage lenders... -

Page 21

...home through higher cost subprime mortgage loans. Many of these families could qualify for one of Fannie Mae's cheaper conventional rate mortgages and potentially save hundreds of dollars a month in mortgage payments on the same home. Our Expanded Approval mortgage options offer lowerincome families... -

Page 22

... and Results of Operations Financial Statements and Reports 92 Notes to Financial Statements 126 Glossary 127 Fannie Mae Offices 128 Board of Directors and Senior Management 130 Common Stock Information (Unaudited) 121 Independent Auditors' Report 122 Report of Management 123 Quarterly Results... -

Page 23

...of Operations" and our financial statements and related notes, included elsewhere in this report. Dollars and shares in millions, except per common share amounts Income Statement Data: Interest income ...Interest expense ...Net interest income ...Guaranty fee income ...Fee and other income (expense... -

Page 24

... adjustments for tax-exempt income and investment tax credits using the applicable federal income tax rate. This is a non-GAAP measure. 6 Core business earnings less preferred stock dividends divided by average assets. This is a non-GAAP measure. 7 Core business earnings less preferred stock... -

Page 25

...as purchase originations. Single-family mortgage originations in 2002 totaled $2.6 trillion, surpassing 2001's record of $2.0 trillion by 29 percent. Our market-residential mortgage debt outstanding-increased 12 percent in 2002 to 2002 OVERVIEW 2002 was a year of notable achievements for Fannie Mae... -

Page 26

... help lenders streamline their processes and enhance further our credit risk management effectiveness. Today, approximately 60 percent of our total single-family business is processed through DU. In addition, we committed significant resources in 2002 to upgrading our core technology infrastructure... -

Page 27

... interest rates could change cash flows on our mortgage assets and debt in a way that adversely affects Fannie Mae's earnings or long-term value. Credit Guaranty Business: Our Credit Guaranty business has primary responsibility for managing all of our mortgage credit risk. Credit risk is the risk of... -

Page 28

... a taxable-equivalent basis to consistently reflect income from taxable and tax-exempt investments based on a 35 percent marginal tax rate. Table 1 presents Fannie Mae's net interest yield based on our reported net interest income adjusted for tax-exempt investments and average balances of mortgage... -

Page 29

... instruments. 2 Reflects non-GAAP adjustments to permit comparison of yields on tax-exempt and taxable assets based on a 35 percent marginal tax rate. 3 Averages have been calculated on a monthly basis based on amortized cost. 4 Includes average balance of nonaccrual loans of $4.6 billion in... -

Page 30

... non-GAAP adjustments to permit comparison of yields on tax-exempt and taxable assets based on a 35 percent marginal tax rate. Guaranty Fee Income Guaranty fee income reported in our total corporate results and our average guaranty fee rate primarily include guaranty fees we receive on mortgage... -

Page 31

...increase in average outstanding MBS (MBS and other mortgage-related securities guaranteed by Fannie Mae and held by investors other than Fannie Mae) during 2002 and a 12 percent increase during 2001. Our average guaranty fee rate on outstanding MBS during 2002 increased slightly to 19.1 basis points... -

Page 32

... risk to changes in the economic environment, and taking an aggressive approach to problem asset management. Administrative Expenses Administrative expenses include those costs incurred to run our daily operations, such as personnel costs and technology expenses. Administrative expenses increased... -

Page 33

... our income statement over the life of our caps and has no effect on our non-GAAP core business earnings measure. Debt Extinguishments Fannie Mae strategically repurchases or calls debt securities and related interest rate swaps on a regular basis as part of our interest rate risk management efforts... -

Page 34

...in our reported net income from changes in the time value of our purchased options accurately reflects the underlying risks or economics of our hedging strategy. Core business earnings includes amortization of purchased options premiums on a straight-line basis over the original expected life of the... -

Page 35

... income taxes ...Provision for federal income taxes ...Net income ... $ $ 1 Reported net income for 2002 and 2001 includes the effect of FAS 133, which was adopted on January 1, 2001. 2 Credit-related expenses include the income statement line items "Provision for losses" and " Foreclosed property... -

Page 36

... tax rate of 35 percent. Core business earnings does not exclude any other accounting effects related to the application of FAS 133 or any other non-FAS 133 related adjustments. The guaranty fee income that we allocate to the Credit Guaranty business for managing the credit risk on mortgage-related... -

Page 37

... increase in both years was primarily attributable to growth in net interest income resulting from the low rate environment that contributed to strong mortgage portfolio growth and a reduction in our average cost of debt relative to our mortgage asset yields. Tighter mortgage-to-debt spreads reduced... -

Page 38

...FAS 133 in 2001. 2 Reflects non-GAAP adjustments to permit comparison of yields on tax-exempt and taxable assets based on a 35 percent marginal tax rate. 3 Averages have been calculated on a monthly basis based on amortized cost. 4 Includes average balance of nonaccrual loans of $4.6 billion in 2002... -

Page 39

... in 2001. Growth in mortgage debt outstanding, combined with our ability to offer reliable, low-cost mortgage funds, helped us grow our average net mortgage portfolio by 12 percent in 2002 despite a record level of liquidations. The Portfolio Investment business also capitalized on opportunities... -

Page 40

... margin remained elevated in 2002 as the unusually steep yield curve and low interest rate environment persisted, and we called or otherwise retired additional high-cost debt. Primary investing activities for the Portfolio Investment business include purchasing mortgage loans, mortgagerelated... -

Page 41

...93,912 Adjustable-rate ...22,991 Total conventional single-family ...730,558 Total single-family...769,309 Multifamily: Government insured or guaranteed ...8,723 Conventional ...19,268 Total multifamily ...27,991 Total mortgage portfolio ...797,300 Unamortized premium (discount) and deferred price... -

Page 42

... 6,001 Single-family: Government insured or guaranteed ...Conventional: Long-term, fixed-rate ...Intermediate-term, fixed-rate ...Adjustable-rate ...Total conventional single-family ...Total single-family ...Multifamily ...Total ...Average net yield ...Repayments as a percentage of average mortgage... -

Page 43

...652) (178) $(2,244) Fair Value $ 274,829 115,106 57,603 $ 447,538 Available-for-sale: MBS 2 ...REMICs and Stripped MBS ...Other mortgage-related securities ...Total ...1 Amortized cost includes unamortized premiums, discounts, and other deferred price adjustments. 2 Excludes REMICs and Stripped MBS... -

Page 44

... Unrealized Losses Weighted- Average Maturity in Months Dollars in millions Amortized Cost Fair Value % Rated A or Better Held-to-maturity: Repurchase agreements ...Eurodollar time deposits ...Auction rate preferred stock ...Federal funds ...Commercial paper ...Other ...Total ... $20,732 1,398... -

Page 45

... Unrealized Losses Weighted- Average Maturity in Months Dollars in millions Amortized Cost Fair Value % Rated A or Better Available-for-sale: Asset-backed securities ...Floating-rate notes1 ...Corporate bonds ...Taxable auction notes ...Auction rate preferred stock ...Commercial paper ...Other... -

Page 46

... yield on liquid investments during 2002, 2001, and 2000 was 2.34 percent, 4.63 percent, and 6.60 percent, respectively. The average yield decreased during 2002 and 2001 because of the sharp drop in short-term interest rates. Debt Securities As part of our disciplined interest rate risk management... -

Page 47

... at the end of each year, and the average cost. 2002 Average Outstanding During Year Amount Maximum Outstanding at Any Month-end Dollars in millions Outstanding at December 31 Amount Cost1 Cost1 Short-term notes ...$290,091 Other short-term debt ...12,522 Current portion of borrowings due after... -

Page 48

... and exclude long-term debt securities that have been economically converted into short-term funding through interest rate swaps. 3 Represents the redemption value of outstanding debt at year-end. Excludes the effect of amortization of premiums, discounts, issuance costs, and hedging results. "Long... -

Page 49

... of Fannie Mae's average book of business to .5 basis points in 2002, from .6 basis points in 2001 and .7 basis points in 2000. In the third quarter of 2002, we announced increases in the upfront price adjustment Fannie Mae charges on cash-out refinance mortgages with loan-to-value (LTV) ratios... -

Page 50

... issue REMICs backed by single-class MBS, SMBS, Government National Mortgage Association (Ginnie Mae) mortgage-related securities, other REMIC securities, or whole loans that are not owned or guaranteed by Fannie Mae. The Portfolio Investment business receives transaction fees for structuring REMICs... -

Page 51

... investors other than Fannie Mae. Total MBS, which includes guaranteed MBS and other mortgage-related securities held in our mortgage portfolio, grew 19 percent to $1.538 trillion at year-end 2002 from $1.290 trillion at year-end 2001. MBS issues acquired by investors other than Fannie Mae increased... -

Page 52

... OF CRITICAL ACCOUNTING POLICIES Fannie Mae's financial statements and reported results are based on GAAP, which requires us in some cases to use estimates and assumptions that may affect our reported results and disclosures. We describe our significant accounting policies in the Notes to Financial... -

Page 53

...pre-tax reported income and core business earnings in each of the past three years. Management believes the combined balance of our allowance for loan losses and guaranty liability for MBS are adequate to absorb losses inherent in Fannie Mae's book of business. Deferred Price Adjustments When Fannie... -

Page 54

...discount increases the yield above the coupon amount. In addition, we may charge an upfront payment in lieu of a higher guaranty fee for certain loan types that have higher credit risk. To facilitate the pooling of mortgages into a Fannie Mae MBS, we also may adjust the monthly MBS guaranty fee rate... -

Page 55

...age of the net discount position in 2002 is the primary driver of the positive impact on guaranty fee income from an instantaneous 100 basis point decrease in interest rates. Time Value of Purchased Options Fannie Mae issues various types of debt to finance the acquisition of mortgages. We typically... -

Page 56

...Percentage of Total Stockholders' Equity 2002 2% 1 2001 2% 1 2000 NA NA 2002 $543 271 2001 $493 246 2000 NA NA 10% change in time value ...5% change in time value ... 1 Reflects after-tax effect of time value adjustment based on applicable federal income tax rate of 35 percent. Table 20 reveals... -

Page 57

...a straight-line basis over the original expected life of the option in measuring core business earnings and do not include mark-to-market changes in the fair value of purchased options. the goals and objectives. Management establishes reference points for the key performance measures that we use to... -

Page 58

... rate risk profile. Our projections of future business activity used in these simulations are reported to senior management and our Board of Directors and provide the basis for Fannie Mae's current earnings forecasts. We determine the amount of net interest income at risk by assuming a sudden change... -

Page 59

..., which we report to the public on a monthly basis, represent the extent to which our core net interest income over the next one-year and four-year periods is at risk due to a plus or minus 50 basis point parallel change in the current Fannie Mae yield curve and from a 25 basis point change in the... -

Page 60

... monthly net interest income at risk for each of the last three years under both a 50 basis point change across the Fannie Mae yield curve and a 25 basis point change in the slope of the Fannie Mae yield curve. Compared to 2001 and 2000, the net interest income at risk was at somewhat higher levels... -

Page 61

Table 21 presents our net interest income at risk based on an instantaneous 100 basis point increase and a 50 basis point decrease in interest rates. The risk measure is an extension of our voluntary monthly net interest income at risk disclosure, and we use the same data, assumptions, and ... -

Page 62

... callable debt or purchase interest-rate derivatives with embedded options. We may also change the mix of assets we purchase to manage convexity risk. For example, ARMs, shorter-term fixed rate mortgages, and some seasoned loans have less prepayment risk relative to new 30-year fixed rate mortgages... -

Page 63

... ...Assuming a 50 basis point decrease in interest rates ... Changes in net asset value incorporate various factors, including • estimated changes in the values of all mortgage assets and the debt funding these assets, • estimated changes in the value of net guaranty fee income from off-balance... -

Page 64

... an orderly and cost-effective debt issuance schedule so we can fund daily loan purchase commitments without significantly increasing our interest rate risk or changing the spread of our funding costs versus other market interest rates. Most of the mortgages that Fannie Mae commits to purchase are... -

Page 65

... Fannie Mae the right to enter into a swap at a future date. Interest rate caps provide ceilings on the interest rates of variable-rate debt. Purchased options are another important risk management tool we use to reduce the cash flow mismatches driven by the prepayment option in mortgages. American... -

Page 66

... the value of related collateral, is the appropriate measure of the actual credit risk of derivative contracts. We believe the risk of loss on Fannie Mae's derivatives book is low for three primary reasons: (1) our stringent counterparty eligibility standards; (2) our conservative collateral policy... -

Page 67

... to credit loss on derivative instruments by calculating the replacement cost, on a present value basis, to settle at current market prices all outstanding derivative contracts in a gain position. Fannie Mae's exposure on derivative contracts (taking into account master settlement agreements that... -

Page 68

...25 10 0 (see Table 29) We mark our collateral position daily against exposure using both internal and external pricing models and compare these calculations to our counterparties' valuations. Both Fannie Mae and our derivative counterparties transfer collateral within two business days based on the... -

Page 69

... of credit authority approved by the Credit Risk Policy Committee. Our business unit credit officers report directly to the business unit leaders and indirectly to the Chief Credit Officer. In addition, we have corporate credit risk management teams that report to the Chief Credit Officer and work... -

Page 70

... ...Mortgage credit book of business ... December 31, 2001 Single-family Conventional Mortgage portfolio1: Mortgage loans ...Fannie Mae MBS ...Agency mortgage securities2 ...Other mortgage-related securities3 ...Mortgage revenue bonds ...Outstanding MBS4 ...Other5 ...Mortgage credit book of business... -

Page 71

... multifamily loans, we manage and discuss these two types of loans separately. Single-family The single-family mortgage credit book primarily consists of loans, MBS in our mortgage portfolio, MBS and other mortgage-related securities guaranteed by Fannie Mae and held by other investors (outstanding... -

Page 72

... prediction model created by Fannie Mae, to monitor the performance and risk of each loan and identify loans requiring problem loan management. Risk Profiler uses credit risk indicators such as mortgage payment record, updated borrower credit data, current property values, and mortgage product... -

Page 73

... of our single-family mortgage credit book of business. • Loan-to-value (LTV) ratio: LTV ratio is the ratio of UPB to the value of the property that serves as collateral. Original LTV is based on the value reported to Fannie Mae at acquisition of the loan. Current LTV is based on current UPB and... -

Page 74

... single-family mortgage credit book of business. The credit quality of borrowers in our book remained high at December 31, 2002, as evidenced by an average credit score of 714 at the time of loan purchase or guaranty. • Loan purpose: Loan purpose indicates how the borrower intends to use the funds... -

Page 75

... risk characteristics. As we work to expand Fannie Mae's presence, activities, and customer base in underserved markets through products such as Expanded Approval/Timely Payment RewardsTM, the overall credit risk profile of our conventional single-family mortgage credit book of business may change... -

Page 76

... ...Total ...Weighted average ...Average loan amount ...Product type3: Long-term, fixed-rate ...Intermediate-term, fixed-rate ...Adjustable-rate ...Total ...Property type: 1 unit ...2-4 units ...Total ...Occupancy type: Principal residence ...Second/vacation home ...Investor ...Total ...Credit score... -

Page 77

... total number of loans outstanding. The rate at which new loans become seriously delinquent and the rate at which existing seriously delinquent loans are resolved significantly affects the level of future credit losses. Effective December 31, 2002, we changed how we report our single-family serious... -

Page 78

... various credit risk management strategies throughout a loan's life helped minimize single-family credit losses in 2002 despite weak economic conditions. book of business decreased by .2 basis points in 2002 to .4 basis points despite weaker economic conditions. TABLE 38: SINGLE-FAMILY CREDIT-LOSS... -

Page 79

...1. Managing the profile and quality of mortgages in the multifamily mortgage credit book. Numerous characteristics impact the mortgage credit risk on a particular multifamily loan. These characteristics include the type of mortgage loan, the type and location of the property, the condition and value... -

Page 80

.... We carefully monitor the relevant local market economic indicators that may signal changing risk or return profiles in the book and cause a change in risk management policies, credit enhancements, or guaranty fees. For example, we closely monitor rental payment trends and vacancy levels in local... -

Page 81

... third party asset managers through periodic financial and operational assessments. Approximately 33 percent of our equity investments in low-income housing tax credit properties have an economic return guaranteed by an investment-grade counterparty. Internal Revenue Service requirements govern the... -

Page 82

... approves these internal controls. Non-derivative institutional counterparty risk primarily includes exposure created by mortgage insurance policies, other credit enhancement arrangements with lenders and others, mortgage servicing contracts with lenders, and liquidity investments in corporate... -

Page 83

... servicers to maintain a minimum reserve servicing fee rate to compensate a replacement servicer in the event of a servicing contract breach. We also manage this risk by requiring servicers to follow specific servicing guidelines and by monitoring each servicer's performance using loan-level data... -

Page 84

...control breakdowns. Fannie Mae's Office of Auditing also independently tests the adequacy of, and adherence to, internal controls and related policies and procedures. We actively manage Fannie Mae's operations risk through numerous oversight functions, such as: • Exception reporting and management... -

Page 85

... the financial statements and assessing compliance with our net worth and insurance coverage requirements to assess eligibility and capability of doing business with us; • testing cash and custodial accounting controls to ensure both Fannie Mae and borrower funds are held in qualified institutions... -

Page 86

...necessary controls for liquidity risk management, and the role of public disclosure and regulatory oversight. We monitor our liquidity position through a combination of daily, weekly, and monthly reports to help set strategies and make funding decisions. Our analyses include • projected cash flows... -

Page 87

.... OFHEO's new risk-based capital rule establishes a risk weight for Fannie Mae's assets. FAS 115 specifically identifies "a significant increase in the risk weights of debt securities used for regulatory risk-based capital purposes" as a change in circumstance under which a company may reclassify... -

Page 88

... senior debt holders and is intended to serve as a consistent and early market signal of credit risk for investors. By the end of 2003, we intend to issue sufficient subordinated debt to bring the sum of total capital and outstanding subordinated debt to at least 4 percent of on-balance-sheet assets... -

Page 89

...to lower our debt costs begin to diminish. We anticipate some increase in our effective average guaranty fee rates because of recent pricing trends. We also believe that while credit expenses may move higher in 2003, they will remain at historically low levels. Should economic conditions deteriorate... -

Page 90

... in accounting principle ...Net earnings ...Diluted earnings per common share: Earnings before cumulative effect of change in accounting principle ...Cumulative effect of change in accounting principle ...Net earnings ...Cash dividends per common share ...Weighted-average common shares outstanding... -

Page 91

... 31, Dollars in millions, except share stated values 2002 2001 Assets Mortgage portfolio: Mortgage-related securities: Held-to-maturity ...Available-for-sale ...Total ...Loans held-for-investment: ...Allowance for loan losses ...Unamortized premiums (discounts) and deferred price adjustments, net... -

Page 92

Statements of Changes in Stockholders' Equity Dollars and shares in millions Net Common Shares Outstanding Preferred Stock Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive (Loss) Income Treasury Stock Total Stockholders' Equity Balance, January 1, 2000 ...... -

Page 93

... debt ...Proceeds from zero-coupon swap calls ...Net payments to purchase or settle hedge instruments ...Net payments from stock activities ...Net cash provided by financing activities ...Net increase (decrease) in cash and cash equivalents ...Cash and cash equivalents at beginning of year ...Cash... -

Page 94

... the current presentation. Principles of Consolidation We regularly invest in qualified low-income housing tax credit partnerships as a limited partner. In accordance with American Institute of Certified Public Accountants (AICPA) Statement of Position 78-9, Accounting for Investments in Real Estate... -

Page 95

...net" line item on the income statement. The new cost basis is not changed for subsequent recoveries in fair value. We also provide a guaranty liability on mortgage-related securities held in the mortgage portfolio that are guaranteed by Fannie Mae because we have the risk of loss of individual loans... -

Page 96

... guaranty fees monthly based on a fixed rate multiplied by the outstanding balance of the guaranteed MBS and other mortgage-related securities. We apply the effective yield method of accounting and amortize any upfront guaranty fee price adjustments over the estimated life of the loans underlying... -

Page 97

... "Foreclosed property income" line items within our previously reported income statements. These reclassifications have no impact on previously reported net income, total credit-related expenses, or the balance of the allowance for losses. Acquired Property We measure foreclosed assets at fair value... -

Page 98

... and taxable income. We measure these deferred amounts using the current marginal statutory tax rate. We generally recognize investment and other tax credits when we record these items on the tax return. Comprehensive Income Comprehensive income is the change in equity, on a net of tax basis... -

Page 99

...model. The following table summarizes the major assumptions used in the model. 2002 Risk-free rate1 ...Volatility ...Dividend 2 ...Average expected life ...3.235-4.995% 31-33% $1.32 6 yrs. 2001 3.885-5.155% 33-34% $1.20 5 yrs. 2000 5.085-6.815% 29-34% $1.12 5 yrs. 1 The synthetic 6-year zero-coupon... -

Page 100

...-rate ...Total conventional single-family ...Total single-family ...Multifamily: Government insured or guaranteed ...Conventional ...Total multifamily ...Unamortized premium (discount) and deferred price adjustments...Allowance for loan losses3 ...Total mortgages...Mortgage-related securities Single... -

Page 101

... date and this standard applied to all assets held by Fannie Mae. FAS 115 specifically identifies "a significant increase in the risk weights of debt securities used for regulatory risk-based capital purposes" as a change in circumstance under which a company may reclassify securities from held-to... -

Page 102

...market yield curve and reflects current option adjusted spreads in its discount factors. To model prepayments, we use our proprietary prepayment models to develop an estimated prepayment level for each point in time along each scenario. Retained Interests In some cases, we create REMICs using assets... -

Page 103

... Administration loans that are reported in the balance sheet under "Acquired property and foreclosure claims, net." 2002 2001 Prepayment speed assumptions: Impact on year-end fair value from 5 percent adverse change in 12 month CPR prepayment speed ...$ (68) Impact on year-end fair value from... -

Page 104

... schedule of available-for-sale nonmortgage investments at December 31, 2002 and 2001. 2002 Gross Unrealized Gains Gross Unrealized Losses Dollars in millions Amortized Cost Fair Value Available-for-sale: Asset-backed securities ...Floating-rate notes1 ...Corporate bonds ...Taxable auction notes... -

Page 105

... and remaining maturity as well as the amortized cost, fair value, and yield of our asset-backed securities at December 31, 2002 and 2001. 2002 2001 Yield Amortized Cost Fair Value Yield Dollars in millions Amortized Cost Fair Value Available-for-sale: Due within one year ...Due after one year... -

Page 106

... been calculated on a monthly average basis. 2 Information on average amount and cost of debt outstanding during the year and maximum amount outstanding at any month-end is not meaningful. See "Borrowings Due After One Year" for additional information. Amounts payable for federal funds purchased... -

Page 107

...discounts, premiums, issuance costs, hedging results, and the effects of currency and debt swaps. Averages have been calculated on a monthly average basis. 2 Represents change in the fair value of hedged debt in fair value hedges. We consolidated our outstanding debt agreements for various funding... -

Page 108

... to approve Fannie Mae's issuance of debt obligations. Deferred tax assets: Derivatives in loss positions, net ...$ 9,423 Outstanding MBS and REMIC fees ...1,337 Allowance for loan losses and guaranty liability for MBS ...325 Other items, net ...160 Deferred tax assets ...Deferred tax liabilities... -

Page 109

...effect of change in accounting principle ...Preferred stock dividend ...Net income available to common stockholders ...Weighted average common shares ...Dilutive potential common shares1 ...Average number of common shares outstanding used to calculate earnings per common share ...Earnings per common... -

Page 110

...of Directors approved the EPS Challenge Option Grant in January 2000 for all regular full-time and part-time employees. At that time, all employees, other than management group employees, received an option grant of 350 shares at a price of $62.50 per share, the fair market value of the stock on the... -

Page 111

... corporate plan are based on years of service and compensation using the average pay during the 36 consecutive highest-paid months of the last 120 months of employment. Our policy is to contribute an amount no less than the minimum required employer contribution under the Employee Retirement Income... -

Page 112

... ...Discount rate used to determine projected benefit obligation at year-end ...Average rate of increase in future compensation levels ...Expected long-term weighted-average rate of return on plan assets ...7.25% 2001 7.75% 2000 8.00% 6.75 6.50 8.50 7.25 6.50 9.50 7.75 6.50 9.00 Fannie Mae also... -

Page 113

... manages Fannie Mae's mortgage credit risk by managing the profile and quality of mortgages in the mortgage credit book of business, using credit enhancements to reduce our losses, assessing the sensitivity of credit losses to changes in economic conditions, and aggressively managing problem assets... -

Page 114

... property income." c This amount represents the straight-line amortization of purchased options expense that we allocate to interest expense over the original expected life of the options. We include this amount in core business earnings instead Dollars in millions Reconciling Items Related... -

Page 115

... initial call date. Redeemable every two years thereafter. 4 Initial rate. Variable dividend rate that resets every two years thereafter at the two-year U.S. Dollar Swap Rate plus 1.38 percent with a cap of 8 percent per year. In general, our preferred stock has no par value, has a stated value and... -

Page 116

... and Hedging Activities Fannie Mae issues various types of debt to finance the acquisition of mortgages. We typically use derivative instruments to hedge against the impact of interest rate movements on our debt costs to preserve mortgage-to-debt spreads. We do not engage in trading or other... -

Page 117

...interest rates increases the risk of mortgage assets repricing at lower yields while fixed-rate debt remains at above-market costs. We limit the interest rate risk inherent in our fixed-rate debt instruments by using fair value hedges to convert fixed-rate debt to variable-rate debt. Risk Management... -

Page 118

... of single-family loans exceeds the value of the underlying properties, then we have credit enhancements with maximum coverage totaling $66.1 billion in primary mortgage insurance, $7.0 billion in pool insurance, and $31.5 billion in full recourse to lenders on single-family loans. If the collateral... -

Page 119

... rate risk relating to loans purchased pursuant to those commitments. Credit Enhancements Credit enhancements typically represent credit enhancement and liquidity support for taxable or tax-exempt housing bonds issued by state and local governmental entities to finance multifamily housing for low... -

Page 120

... cost of finding a replacement servicer, which could be substantial for loans that require a special servicer. Our ten largest single-family mortgage servicers serviced 63 percent of our single-family book of business at both year-end 2002 and year-end 2001. Our fifteen largest multifamily mortgage... -

Page 121

... from the weighted-average coupon rate less servicing fees. We described the method for estimating this guaranty fee and the credit risk associated with the mortgage portfolio under "Guaranty fee income." We then employed an option-adjusted spread (OAS) approach to estimate fair values for MBS held... -

Page 122

... credit loss exposure for guaranteed MBS and other mortgage-related securities as a component of the net MBS guaranty fee. We estimated the fair value of net currency swap payables based on the expected cash flows or quoted market values of these instruments. Mortgage Purchase Commitments Mortgage... -

Page 123

Independent Auditors' Report To the Board of Directors and Stockholders of Fannie Mae: We have audited the accompanying balance sheets of Fannie Mae as of December 31, 2002 and 2001, and the related statements of income, changes in stockholders' equity, and cash flows for each of the years in the ... -

Page 124

... of Fannie Mae exercises its oversight of financial reporting and related controls through an Audit Committee, which is composed solely of directors who are not officers or employees of the corporation. The Audit Committee meets with management and the internal Office of Auditing periodically... -

Page 125

... of tax effect ...Net income ...Preferred stock dividends ...Net income available to common stockholders ...Diluted earnings per common share: Earnings before cumulative effect of change in accounting principle ...Cumulative effect of change in accounting principle ...Net earnings ...Cash dividends... -

Page 126

...of change in accounting principle ...Net earnings ...Cash dividends per common share ...Mortgages purchased: Single-family ...Multifamily ...Total mortgages purchased ...Average net yield on mortgages purchased ...Debt issued: Short-term debt ...Long-term debt ...Total ...Average cost of debt issued... -

Page 127

...-for-sale ...Total ...Loans held-for-investment ...Allowance for loan losses ...Unamortized premiums (discounts) and deferred price adjustments, net ...Loans held-for-sale...Mortgage portfolio, net...Other assets ...Total assets ...Debentures, notes, and bonds, net: Due within one year ...Due... -

Page 128

...Taxable-equivalent revenues: Total revenues adjusted to reflect the benefits of tax-exempt income and investment tax credits based on applicable federal income tax rates. Underwriting: The process of evaluating a loan application to determine the risk involved for the lender. It involves an analysis... -

Page 129

...Locations One South Wacker Drive Suite 1300 Chicago, IL 60606 1900 Market Street Suite 800 Philadelphia, PA 19103 950 East Paces Ferry Road Suite 1900 Atlanta, GA 30326 Two Galleria Tower 13455 Noel Road Suite 600 Dallas, TX 75240 135 North Los Robles Avenue Suite 300 Pasadena, CA 91101 Partnership... -

Page 130

... Technology Officer Fannie Mae eBusiness Renie Yoshida Grohl Senior Vice President and Deputy General Counsel Daniel H. Mudd Vice Chairman and Chief Operating Officer Jeffery R. Hayward Senior Vice President Single-Family Mortgage Business-Chicago Adolfo Marzol Executive Vice President Finance... -

Page 131

... A. Quinn Senior Vice President Single-Family Mortgage Business Jayne J. Shontell Senior Vice President Investor Relations Barry Zigas Senior Vice President National Community Lending Center Richard S. Lawch Senior Vice President Multifamily Chief Operating Officer Anthony F. Marra Senior Vice... -

Page 132

...For written correspondence, contact Jayne Shontell, Senior Vice President, Investor Relations, Fannie Mae, 3900 Wisconsin Avenue, NW, Washington, DC 20016. You also may call 202-752-7000 for more information. Fannie Mae will provide, without charge, copies of its most recent Annual Report on Form 10... -

Page 133

Design: Schum & Associates, www.schum.com Photography: Rhoda Baer -

Page 134

3900 Wisconsin Avenue, NW Washington, DC 20016-2892 CA293U 04/03 ©2003, Fannie Mae All rights reserved This Annual Report was printed in the U.S.A on recycled paper and is recyclable.