Equifax 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to develop value propositions for both marketing and risk man-

agement applications.

In this regard, Equifax is leading the way with our “analytical

sandbox” initiative, which brings a customer’s data and analyt-

ics team together with ours in a research atmosphere to identify

solutions based on combinations of our unique data, the

customer’s proprietary data and third-party sources. This ap-

proach is unique to Equifax.

As customers deal with rapidly evolving, increasingly complex

fraud and identity challenges, Equifax is delivering sophisticated

solutions across all business sectors and geographies.

Our unique data, expertise and technology, reinforced by our

reputation as a trusted information steward, have prepared

the Company well to be a leader in the fraud mitigation and

identity management arenas.

In our International markets, Equifax is positioned for strong

growth not only where we have more mature operations, but

also in newer, emerging markets such as Russia and India.

Like our other businesses, our international success is

based on the ability to provide customers with unique, high-

value decisioning solutions that improve both opportunities for

growth and increased profitability.

An ongoing challenge is operating effectively in a regulated en-

vironment. As a result of the financial market failures and the

impact on consumers over the past four years, we have seen

changes in regulations across our markets. In the U.S., we are

now subject to supervisory regulation and review by the newly

formed Consumer Financial Protection Bureau. As we’ve said

before, this new regulatory environment will increase our

compliance costs, and could increase our operating costs as

we adopt changes to our processes and procedures. However,

in some instances the new regulations create opportunities,

such as the need for lenders to verify a potential borrower's

ability to pay when granting a new loan. Further, the accuracy of

our data is critical to our customers and the industry, and we will

continue to embrace changes that improve it.

One of the hallmarks of our Company is recruiting and devel-

oping our talented executives. We continue to add world-class

talent as we evolve into a more dynamic and strategic global in-

formation solutions provider. At the end of 2012, Kent Mast, our

Chief Legal Officer, retired. Kent worked with and for Equifax for

over 40 years, serving as outside counsel before joining Equifax

full-time. His knowledge, wisdom, insights – and friendship –

have been invaluable to me personally and the Company. We all

wish him well in his retirement. We also welcome another sea-

soned and skilled attorney, John J. Kelley III, as our new Chief

Legal Officer.

Equifax is moving forward with great confidence, in spite of

uncertainty in the overall economic atmosphere. Performance

in 2012 has proven once again that the Equifax business model,

driven by innovation and strong execution, generates growth and

improved profitability across many business cycles. It is led by a

team that is ready and willing to seize opportunities and tackle

any challenge put to it. Our capabilities are expanding rapidly so

that we can continue serving our customers with increasingly

valuable solutions while rewarding our investors with high-value

and solid returns.

Sincerely,

Richard F. Smith

Chairman and Chief Executive Officer

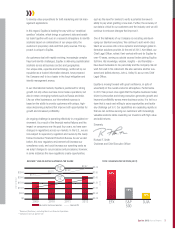

TOTAL SHAREHOLDER RETURN (2012)

EFX DJIAS&P

500

42%

16%

10%

REVENUE* AND ADJUSTED EARNINGS PER SHARE

*Revenue ($ millions), excluding Brazil and Divested Operations

**Compound annual growth rate

$3.00

$2500 $2.50

$2000 $2.00

$1500 $1.50

$1000 $1.00

$500 $0.50

$0 $0.00

2009 2010 2011 2012

$2.17

$2.31 $2.52

$2.97

Adjusted for Continuing Operations Adjusted EPS

CAGR

9%

CAGR**

11%

REVENUE

EPS

3Equifax 2012 Annual Report