Equifax 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

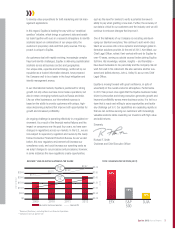

A Few Highlights from 2012

The U.S. Consumer Information Solutions (USCIS) business

unit became a stronger enterprise-wide distribution channel by

cross-selling products enriched with income, employment and

wealth data, as well as small business commercial credit in-

formation, providing our customers with premier, differentiated

decision-making insights.

Workforce Solutions expanded its employment and income

verification products into the credit card, auto, and student

lending markets, and introduced unique products for govern-

ment agencies to establish entitlement program eligibility.

The business unit grew The Work Number® database to

222 million total files and 55 million active files at year-end

and is on a path to reach 250 million total files over the

course of the next few years.

Through outstanding execution and continuous customer feed-

back, the North America Personal Solutions (PSOL) business

unit increased average revenue per customer, drove improved

traffic and conversion rates, and accelerated the testing and

successful deployment of new product offerings.

Our North America Commercial Solutions (NACS) business unit,

which provides solutions for lenders and companies serving

small and medium businesses, grew its market share in core

financial and telecommunications markets while innovating to

expand into new vertical markets.

Our International business, with operations and investments

in 17 countries outside the U.S., continued as a strong growth

engine for the Company, delivering new products, strengthen-

ing existing market positions through acquisition and operational

execution, and acquiring new customers. These efforts enabled

International to drive growth even in geographies where there

was flat to negative GDP.

Only from Equifax

Customers see Equifax as a unique problem-solver, not only

because of our unmatched data assets but also for the industry

expertise and analytical insights we provide to improve their

decisioning activities and business processes.

Our Suspicious ID™ fraud mitigation solution is a prime

example. Unlike other fraud prevention solutions that report

data periodically, Suspicious ID interprets fraudulent activity

patterns in real time by monitoring unusual credit activities

across our entire network of financial services organizations

as well as other related industries — delivering a new level

of service and protection for our customers. Suspicious ID

effectively takes Equifax data assets and extends fraud

prevention beyond traditional methods.

Building our inventory of differentiated data assets and applying

them to achieve a 360-degree view of the consumer fuels our

New Product Innovation (NPI) process. Through NPI we bring 60-

75 new products to market each year, broadly dispersed across

both business units and geographies. NPI contributes approxi-

mately three points to our revenue growth each year.

Each business unit made important gains in broadening and

deepening its relationships in key vertical markets, leverag-

ing investments Equifax has made in assembling and develop-

ing sector-specific talent, insights and resources. The ability to

combine unique data with formidable analytics is as valuable in

decision-intensive fields such as insurance, telco and marketing

as it is in financial services, offering paths to growth across a

widening range of customers.

Our merger and acquisition activity continues to focus on

acquiring new data and analytics capabilities as well as comple-

mentary business assets and technology; strengthening our

position in desirable geographic markets; and scaling existing

operations. Late in 2012, we purchased CSC Credit Services,

our last and largest affiliate with consumer credit files in 15

states that cover approximately 20% of the U.S. population. We

expect the value of these assets to be a catalyst for improved

operating margins and long-term growth in our USCIS business

unit.

Complementing our focus on growth initiatives is an ongoing

emphasis on LEAN process improvement to achieve operational

excellence. These programs had a positive impact on our

expense base of more than $20 million in 2012.

Insights: The Future

In the next few years, our analytics capabilities will be an

increasingly significant force in expanding the solutions Equifax

can create for customers as we place higher emphasis on

driving insights that address their challenges and opportunities.

Strategic investments in talent and technology, which together

leverage a broader and more diverse set of data, will lead to the

creation of new decision-making solutions for customers across

all of our markets.

“Big Data” is very much a part of this analytics-rich future.

We have a long heritage in handling vast amounts of data

with extensive and robust capabilities in structured data. More

recently, Big Data has come to include enormous amounts of

digitally-generated unstructured information. So we are partner-

ing with key players that manage and analyze unstructured data

2 Equifax 2012 Annual Report