Equifax 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

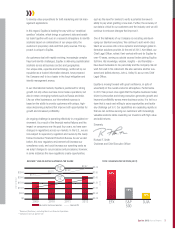

Key Performance Indicators. Management focuses on a variety of

key indicators to monitor operating and financial performance. These

performance indicators include measurements of operating revenue,

change in operating revenue, operating income, operating margin,

net income, diluted earnings per share, cash provided by operating

activities and capital expenditures. Key performance indicators for the

twelve months ended December 31, 2012, 2011 and 2010, include

the following:

Key Performance Indicators

Twelve Months Ended

December 31,

(Dollars in millions,

except per share data) 2012 2011 2010

Operating revenue $2,160.5 $1,959.8 $1,859.5

Operating revenue change 10% 5% 8%

Operating income $ 489.0 $ 471.0 $ 430.0

Operating margin 22.6% 24.0% 23.1%

Net income attributable

to Equifax $ 272.1 $ 232.9 $ 266.7

Diluted earnings per share

from continuing

operations $ 2.22 $ 1.87 $ 1.86

Cash provided by operating

activities $ 496.3 $ 408.7 $ 352.6

Capital expenditures $ 66.0 $ 75.0 $ 99.8

Operational and Financial Highlights.

• On December 28, 2012, as a part of our long-term growth

strategy of expanding our USCIS business, we acquired

CSC Credit Services for $1.0 billion. We financed the acquisition

with available cash, the issuance of $500 million of 3.30% ten-year

senior notes, and commercial paper borrowings under our CP

program. The results of this acquisition are included in our USCIS

segment and are not material for 2012.

• We repurchased 1.9 million shares of our common stock on the

open market for $85.1 million during 2012.

Business Environment and Company Outlook

We expect U.S. mortgage refinancing activity to remain strong

through the first half of 2013 but then trend down in the second half

of 2013. We also expect a continuation of modest economic growth

in most of our served markets. The environment will continue to be

challenging as various countries deal with their particular political, fis-

cal, and economic issues. However, we continue to expect that our

ongoing investments in new product innovation, business execution,

enterprise growth initiatives, technology infrastructure, strategic

acquisitions, and continuous process improvement will enable us, in

a modestly growing economy, to deliver long term average organic

revenue growth ranging between 6% and 8% with additional growth

of 1% to 2% derived from strategic acquisitions. We also expect to

grow earnings per share at a somewhat faster rate than revenue as a

result of both operating and financial leverage. In 2013, we expect

total revenue growth from continuing operations of 10% to 12%, as

the impact of our acquisition of the CSC Credit Services business will

more than outweigh the negative impact of the expected decline in

U.S. mortgage volumes.

13

Equifax 2012 Annual Report