Einstein Bros 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014 10:09:09 AM]

Approximately 2% of our 2010 total revenue was generated by our franchise and license operations.

• Einstein Bros. franchising: We offer Einstein Bros. franchises to qualified area developers. As of December 28, 2010, we were registered to offer Einstein Bros. franchises in 49 states and the

District of Columbia. During 2010, we continued to actively market the Einstein Bros. brand franchise rights to sign multi-location deals. As of December 28, 2010, we have 20 development

agreements in place for 104 total restaurants, 19 of which have already opened. Based upon the development agreements, we expect the remaining 85 new restaurants will open on various dates

through 2017.

We utilize a franchise area development model for the Einstein Bros. brand in which we assign franchise rights to develop restaurants within a defined geographic region within a specified

period of time. We are targeting potential franchisees who have the existing infrastructure, operational experience and financial strength to develop several restaurants in a designated market.

The franchise agreement requires an up-front fee of $35,000 per restaurant and a 5% royalty based on net sales. Our Einstein Bros. franchise restaurants that have been open for one year

generally have average unit volumes of approximately $988,000.

• Manhattan Bagel franchising: We currently have a franchise base in our Manhattan Bagel brand that generates a recurring revenue stream through royalty fee payments and revenue from the

sale to our franchisees of products made from our proprietary recipes. The typical Manhattan Bagel franchise agreement requires an up-front fee of $25,000 per restaurant and a 5% royalty

based on net sales. Our Manhattan Bagel franchise base provides us with the ability to grow this brand with minimal commitment of capital by us, and creates a built-in customer base for our

manufacturing operations. Our Manhattan Bagel franchise restaurants that have been open for one year generally have average unit volumes of approximately $551,000.

• Licensing: We have license relationships that include Aramark, Sodexho, AAFES, HMS Host, Compass, and SSP. Our licensees are located primarily in colleges and universities, hospitals,

airports and military bases. Our license agreements vary by venue, but typically have a five-year term and provide that the licensee pays us an up-front license fee of $12,500 and a weighted

average royalty fee of 6.2%. Our license restaurants generally have average unit volumes of approximately $489,000, reflecting the predominance of college campus locations with a profitable

but condensed selling season.

• Status of development plans or expansion: We are planning to expand our presence through a significant expansion of franchise and license restaurants. We are continuously signing new

franchise development agreements and there could be the potential to sell existing company-owned restaurants to prospective franchisees. This strategy allows us to generate additional revenues

without incurring significant additional expense, capital commitments or many of the other risks associated with opening new company-owned restaurants. In 2010 we opened 14 franchised

locations and 35 licensed locations and sold one company-owned restaurant to a franchisee. We are currently planning to open 20 to 26 franchise restaurants and 45 to 50 license restaurants in

2011. In support of our strategy to only license the Einstein Bros. brand, we recently converted our final Noah’ s licensed restaurant to the Einstein Bros. brand in 2010.

• Product supply: Our franchisees and licensees are required to purchase proprietary products through our designated suppliers or directly from us. Our Manhattan Bagel franchisees are not

required to buy all of their non-proprietary products directly from us, but rather their product sources must be approved by us.

6

Table of Contents

• Seasonality: This segment is subject to the same seasonal fluctuations as our company-owned restaurant segment. Additionally, as many of our license locations are on college and university

campuses, they are impacted by school schedules which typically include a summer break and the December holiday season. Because of the seasonality of the business and the industry, results

for any quarter are not necessarily indicative of the results that may be achieved for any other quarter or the full fiscal year.

• Government regulation: Our franchise operations are subject to Federal Trade Commission (the “FTC”) regulation and various state laws which regulate the offer and sale of franchises. Several

state laws also regulate substantive aspects of the franchisor/franchisee relationship. The FTC requires us to furnish to prospective franchisees a franchise disclosure document containing

prescribed information. A number of states in which we might consider franchising also regulate the sale of franchises and require registration of the disclosure document with state authorities.

Our ability to sell franchises in those states is dependent upon obtaining approval of our disclosure document by those authorities.

• Competition: We compete against similar fast-casual and quick-casual restaurants which franchise and license their brands in the states in which we operate.

Corporate Support

• Principal products/services sold: The support center is not a profit center and is designed to manage and support all of our company-owned restaurants, the manufacturing facility and

commissaries and support our franchisees and licensees as well as general corporate governance.

Financial information about geographic areas:

Our manufacturing operations sell bagels to a wholesaler and a distributor who take possession in the United States and sell outside of the United States. As the product is shipped FOB domestic dock,

and invoiced and paid in U.S. dollars, there are no international risks of loss or foreign exchange currency issues. Sales shipped internationally are included in manufacturing and commissary revenue, and were

approximately $4.8 million, $5.3 million and $5.3 million for 2008, 2009 and 2010, respectively. All other revenues were from external customers domiciled in the United States of America.

Available Information:

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended. We therefore file periodic reports, proxy statements and other information with the Securities

Exchange Commission (the “SEC”). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330.

In addition, the SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically.

Additionally, copies of our reports on Forms 10-K, 10-Q and 8-K and any amendments to such reports are available for viewing and copying through our internet site (www.einsteinnoah.com), free of

charge, as soon as reasonably practicable after filing such material with, or furnishing it to the SEC. We typically post information about the Company on our website under the Financials & Media tab.

We also make available on our website and in print to any stockholder who requests it, the Charters for our Audit and Compensation Committees, as well as the Code of Conduct that applies to all

directors, officers, and associates of our company. Amendments to these documents or waivers related to the Code of Conduct will be made available on our website as soon as reasonably practicable after their

execution.

7

Table of Contents

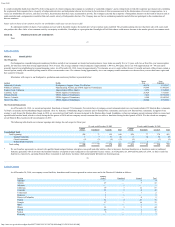

Executive Officers:

Name Age Position

Jeffery J. O’ Neill 54 President, Chief Executive Officer and Director

Daniel J. Dominguez 65 Chief Operating Officer

Emanuel P.N. Hilario 43 Chief Financial Officer

James P. O’ Reilly 44 Chief Concept Officer

Rhonda J. Parish 54 Chief Legal Officer and Secretary

Jeffrey J. O’Neill. Mr. O’ Neill joined us in December 2008 when he was appointed President and Chief Executive Officer. Previously, Mr. O’ Neill worked for Priszm Income Fund from April 2005 to

November 2008. Priszm is a publicly traded Canadian restaurant income trust with a portfolio of popular brands such as Pizza Hut and Taco Bell and is one of the largest independent KFC franchisees in the

world. Mr. O’ Neill joined Priszm as President and Chief Operating Officer and was promoted to Chief Executive Officer in January 2008. Mr. O’ Neill began his career in Brand Marketing with The Quaker

Oats Company. In April 1999, he joined PepsiCo as the President of Pepsi Cola Canada. In 2002, PepsiCo acquired the Quaker Oats Company and in January 2003, Mr. O’ Neill returned to his old company in

Chicago to help lead the integration of the Quaker Oats/Gatorade acquisition. Mr. O’ Neill has an Honors Bachelor of Business degree from the University of Ottawa.

Daniel J. Dominguez. Mr. Dominguez was appointed Chief Operating Officer in December 2005. Mr. Dominguez joined us in November 1995 and served as Senior Vice President of Operations for