Einstein Bros 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014 10:09:09 AM]

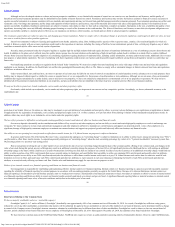

Reconciliation of Non-GAAP Measures to GAAP Measures

52 weeks ended

December 29,

2009

December 28,

2010

(As Restated)

(dollars in thousands)

Net income $ 90,363 $ 10,623

Adjustments to net income:

Interest expense, net 6,114 5,135

Provision (benefit) for income taxes (71,560) 9,918

Depreciation and amortization 16,627 17,769

Write-off of debt issuance costs upon redemption of term loan — 966

Adjustment for Series Z modification — 929

Restructuring expense — 477

Other operating expenses (income) 725 (531)

Adjusted EBITDA $ 42,269 $ 45,286

33

Table of Contents

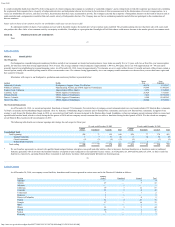

EINSTEIN NOAH RESTAURANT GROUP, INC.

NON-GAAP FINANCIAL INFORMATION

52 weeks ended

December 29,

2009

December 28,

2010

(As Restated)

(in thousands, except earnings per share and

related share information)

Net income available to common stockholders $ 90,363 $ 11,308

Adjustments for:

Less: Change in tax valuation allowance (79,321) —

Add: Reversing effect of residual tax amount in other comprehensive income related to cash flow hedge — 500

Add: Write-off of debt issuance costs upon redemption of term loan — 966

Add: Restructuring expenses — 477

Less: Tax effects related to debt issuance costs and restructuring expenses — (564)

Add: Adjustment for Series Z modification — 929

Less: Accretion of premium on Series Z preferred stock — (1,072)

Less: Amortization of discount on Series Z preferred stock — 143

Adjusted net income $ 11,042 $ 12,687

Weighted average number of common shares outstanding:

Basic 16,175,391 16,532,420

Diluted 16,526,869 16,804,726

Net income per share available to common stockholders—Basic $ 5.59 $ 0.68

Adjustments for:

Less: Change in tax valuation allowance $ (4.91) $—

Add: Reversing effect of residual tax amount in other comprehensive income related to cash flow hedge $— $ 0.03

Add: Write-off of debt issuance costs upon redemption of term loan $— $ 0.06

Add: Restructuring expenses $— $ 0.02

Less: Tax effects related to debt issuance costs and restructuring expenses $— $ (0.03)

Add: Adjustment for Series Z modification $— $ 0.06

Less: Accretion of premium on Series Z preferred stock $— $ (0.06)

Less: Amortization of discount on Series Z preferred stock $— $ 0.01

Adjusted net income per common share—Basic $ 0.68 $ 0.77

Net income per share available to common stockholders—Diluted $ 5.47 $ 0.67

Adjustments for:

Less: Change in tax valuation allowance $ (4.80) $—

Add: Reversing effect of residual tax amount in other comprehensive income related to cash flow hedge $— $ 0.02

Add: Write-off of debt issuance costs upon redemption of term loan $— $ 0.06

Add: Restructuring expenses $— $ 0.02

Less: Tax effects related to debt issuance costs and restructuring expenses $— $ (0.04)

Add: Adjustment for Series Z modification $— $ 0.06

Less: Accretion of premium on Series Z preferred stock $— $ (0.05)

Less: Amortization of discount on Series Z preferred stock $— $ 0.01

Adjusted net income per common share—Diluted $ 0.67 $ 0.75

34

Table of Contents

Results of Operations for 2009 as compared to 2008

Consolidated Results

52 weeks ended

(dollars in thousands)

Increase/

(Decrease)

Percentage of

total revenues

December 30,

2008

December 29,

2009

2009

vs. 2008

December 30,

2008

December 29,

2009

(As Restated) (As Restated) (As Restated) (As Restated)

Revenues $ 413,450 $ 408,562 (1.2%)

Cost of sales 331,682 330,830 (0.3%) 80.2% 81.0%

Total gross profit 81,768 77,732 (4.9%) 19.8% 19.0%

Operating expenses 54,152 52,815 (2.5%) 13.1% 12.9%