Einstein Bros 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K

http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014 10:09:09 AM]

10-K 1 d10k.htm FORM 10-K

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One):

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2010

OR

¨TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-33515

EINSTEIN NOAH RESTAURANT GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware 13-3690261

(State or other jurisdiction

of incorporation or organization)

(I.R.S. Employer

Identification No.)

555 Zang Street, Suite 300, Lakewood, Colorado 80228

(Address of principal executive offices) (Zip Code)

Registrant’ s telephone number, including area code: (303) 568-8000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: Name of each exchange on which registered:

Common Stock, $.001 par value The NASDAQ Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’ s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments of this Form 10-K. x

Indicate by check mark whether the registrant is large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant as of the last business day of the second fiscal quarter, June 29, 2010 was $62,454,390 (computed by

reference to the closing sale price as reported on the NASDAQ Global Market). As of March 11, 2011 there were 16,687,215 shares of the registrant’ s Common Stock, par value of $0.001 per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III is incorporated herein by reference from the registrant’ s definitive proxy statement for the 2011 annual meeting of stockholders, which will be filed with the SEC

within 120 days after the close of the 2010 fiscal year.

Table of Contents

EINSTEIN NOAH RESTAURANT GROUP, INC.

FORM 10-K

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS 2

ITEM 1A. RISK FACTORS 9

ITEM 1B. UNRESOLVED STAFF COMMENTS 17

ITEM 2. PROPERTIES 18

ITEM 3. LEGAL PROCEEDINGS 19

ITEM 4. REMOVED AND RESERVED 19

PART II

ITEM 5. MARKET FOR REGISTRANT’ S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 20

ITEM 6. SELECTED FINANCIAL DATA 22

ITEM 7. MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 24

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 47

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 48

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE 100

ITEM 9A. CONTROLS AND PROCEDURES 100

ITEM 9B. OTHER INFORMATION 101

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 102

ITEM 11. EXECUTIVE COMPENSATION 102

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 102

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE 102

Table of contents

-

Page 1

...proxy statement for the 2011 annual meeting of stockholders, which will be filed with the SEC within 120 days after the close of the 2010 fiscal year. Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. FORM 10-K TABLE OF CONTENTS PART I ITEM 1. ITEM 1A. ITEM 1B. ITEM 2. ITEM 3. ITEM 4. BUSINESS... -

Page 2

... for breakfast and lunch, including fresh-baked bagels and hot breakfast sandwiches, freshly prepared lunch sandwiches, cream cheese and other spreads, specialty coffees and teas, soups, salads and other unique menu offerings. During fiscal years 2008, 2009 and 2010, Einstein Bros. company-owned... -

Page 3

... our Einstein Bros. brand in Asia. Commissaries: Currently we operate five commissaries geographically located to best serve our existing company-owned, franchised and licensed restaurants. These operations primarily provide our restaurants with critical food products such as sliced meats, cheeses... -

Page 4

.... In 2010 we opened 14 franchised locations and 35 licensed locations and sold one company-owned restaurant to a franchisee. We are currently planning to open 20 to 26 franchise restaurants and 45 to 50 license restaurants in 2011. In support of our strategy to only license the Einstein Bros. brand... -

Page 5

... performance, restaurant openings or closings, operating margins, the availability of acceptable real estate locations, the sufficiency of our cash balances and cash generated from operating and financing activities for our future liquidity and capital resource needs, the impact on our business as... -

Page 6

... at times affect regions in which our company-owned, franchised and licensed restaurants are located, regions that produce raw ingredients for our restaurants, or locations of our distribution network. As a result of the seasonality of our business and our industry, our quarterly and yearly results... -

Page 7

... December 28, 2010, a total of 318, or 43.4%, of all restaurants were located in five states (California, Colorado, Florida, Illinois and Texas). As a result, we are particularly susceptible to adverse trends and economic conditions in these states, including their labor markets. In addition, given... -

Page 8

... timely or to detect and prevent fraud. A significant financial reporting failure or material weakness in internal control over financial reporting could cause a loss of investor confidence and decline in the market price of our stock. 16 Table of Contents Risk Factors Relating to Our Common Stock... -

Page 9

...PROPERTIES Lakewood, Colorado Whittier, California Walnut Creek, California Carrolton, Texas Orlando, Florida Denver, Colorado Grove City, Ohio Our Current Restaurants Headquarters, Support Center, Test Kitchen Manufacturing Facility and USDA Approved Commissary Administration Office-Noah' s USDA... -

Page 10

Form 10-K Louisiana Maryland Massachusetts Michigan Minnesota Mississippi Missouri Nevada New Hampshire New Jersey New Mexico New York North Carolina Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia Washington Wisconsin Total ITEM 3. LEGAL PROCEEDINGS - ... -

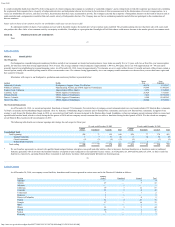

Page 11

...Statements of Operations Data: Revenues Cost of goods sold Labor costs Rent and related expenses Other operating costs Marketing costs Manufacturing and commissary costs General and administrative expenses California wage and hour settlements Senior management transition costs Restructuring expenses... -

Page 12

..., made-to-order breakfast and lunch sandwiches on a variety of bagels, breads or wraps, gourmet soups and salads, assorted pastries, premium coffees and an assortment of snacks. Our manufacturing and commissary operations prepare and assemble consistent, high-quality ingredients that are delivered... -

Page 13

...expand our company-owned restaurants in 2010 as well as our franchise and license locations. We targeted our marketing investments at coupons and print and radio advertising. In the second quarter we launched our Bagel Thin lunch sandwiches which helped bolster the lunch daypart. From an operational... -

Page 14

...-wide sales include sales at all restaurants, whether operated by the Company, franchisees or licensees. Management reviews the increase or decrease in comparable store sales to assess business trends. Comparable store sales exclude closed locations. We use company-owned store sales, franchise and... -

Page 15

...) December 28, December 29, 2010 2009 Company-owned restaurant sales Percent of total revenues Cost of sales: Cost of goods sold Labor costs Rent and related expenses Other operating costs Marketing costs Total company-owned restaurant costs Total company-owned restaurant gross profit $ 370,412 90... -

Page 16

... in our bagel manufacturing facility. Franchise and License Operations 52 weeks ended (dollars in thousands) December 29, December 28, 2009 2010 Increase/ (Decrease) 2010 vs. 2009 Franchise and license related revenues Percent of total revenues Number of franchise and license restaurants 31... -

Page 17

... operating expenses (income) Adjusted EBITDA 33 $ 90,363 $ 10,623 5,135 9,918 17,769 966 929 477 (531) 45,286 6,114 (71,560) 16,627 - - - 725 $ 42,269 $ Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. NON-GAAP FINANCIAL INFORMATION 52 weeks ended December 29, 2009 December 28, 2010... -

Page 18

... 2008 2009 December 30, 2008 Company-owned restaurant sales Percent of total revenues Cost of sales: Cost of goods sold Labor costs Rent and related expenses Other operating costs Marketing costs Total company-owned restaurant cost of sales Total company-owned restaurant gross profit $ 376,664 91... -

Page 19

... franchise locations over the last twelve months. Comparable store sales for the franchisees and licensees of the Manhattan Bagel and Einstein Bros. brands increased 1.1% in 2009. During 2009 we revised a development agreement with one of our franchisees to modify the number of franchise restaurants... -

Page 20

... excludes pre-opening expenses. Restaurant operating profit $165 thousand plus 2010 average restaurant rent expense of $72 thousand per year. Average rent expense capitalized at 8 times plus cash investment cost of $460 thousand. $ $ $ $ $ 869 165 19% 460 36% 237 1,036 23% Company-Owned Cash... -

Page 21

... by Operating Activities $ 33,700 (16,896) 16,804 (31,135) (14,331) 24,216 $ 9,885 $ 43,769 (15,737) 28,032 (26,149) 1,883 9,885 $ 11,768 Our company-owned restaurant sales and franchise and license related revenue increased overall in 2010 compared to 2009. Our interest expense declined... -

Page 22

... our sales and income. We have experienced only a modest impact from inflation. However, the impact of inflation on labor, food and occupancy costs could, in the future, affect our operations. We pay many of our associates based on hourly rates slightly above the applicable minimum federal, state or... -

Page 23

...balances may be recognized as gift card breakage and recorded as a reduction to deferred revenue and an increase to company-owned restaurant revenues. For 2009 and 2010, we recognized $0.2 million in gift card breakage in each year. The Company also recognized $0.4 million in revenue in 2010 related... -

Page 24

... three years in the period ended December 28, 2010. Our audits of the basic financial statements include the financial statement schedule listing in the index appearing under Item 15(2). These financial statements and financial statement schedule are the responsibility of Einstein Noah' s management... -

Page 25

...in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Einstein Noah as of December 28, 2010 and December 29, 2009, and the related consolidated statements of operations, stockholders' (deficit) equity, and cash flows for... -

Page 26

... Franchise and license related revenues Total revenues Cost of sales (exclusive of depreciation and amortization shown separately below): Company-owned restaurant costs Cost of goods sold Labor costs Rent and related expenses Other operating costs Marketing costs Total company-owned restaurant costs... -

Page 27

... OF BUSINESS AND BASIS OF PRESENTATION The consolidated financial statements of Einstein Noah Restaurant Group, Inc. and its wholly-owned subsidiaries (collectively, the "Company") have been prepared in conformity with accounting principles generally accepted in the United States of America... -

Page 28

...various restaurant concepts under the brand names of Einstein Bros. Bagels ("Einstein Bros."), Noah' s New York Bagels ("Noah' s"), and Manhattan Bagel Company ("Manhattan Bagel"). The Company has a 52/53-week fiscal year ending on the Tuesday closest to December 31. Fiscal years 2008, 2009 and 2010... -

Page 29

...bagel ingredients, are stated at the lower of cost or market, with cost being determined by the first-in, first-out method. Leases and Deferred Rent Payable The Company leases all of its restaurant properties. Leases are evaluated and classified as operating or capital leases for financial reporting... -

Page 30

... the Einstein Bros., Noah' s and Manhattan Bagel brands. Information regarding revenue and costs of sales for each business segment has been reported in the consolidated statements of operations for the years ended December 30, 2008, December 29, 2009 and December 28, 2010. The Company' s president... -

Page 31

... and its annual tax expense. 63 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements This DTL should have been presented as a DTL on the Company' s previous balance sheet. Likewise, as a result of understating its provision for income... -

Page 32

...(291,707) (29,982) 172,929 $ 16,331 16,331 (16,331) (16,331) - Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements As Reported 52 weeks ended December 30, 2008 As Restated Difference 52 weeks ended 52 weeks ended December 30, December... -

Page 33

... expense included in cost of sales. 66 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements 6. GOODWILL, TRADEMARKS AND OTHER INTANGIBLES The Company' s goodwill was $5.0 million for both fiscal years 2009 and 2010. The Company... -

Page 34

... date, debt issuance costs will be expensed in the period that the debt is retired. 68 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements In conjunction with the entry into the New Credit Facility, the Company terminated its prior... -

Page 35

... Denny agreed that the Company would redeem shares in accordance with a designated schedule with the final payment occurring June 30, 2010. The first redemption payment 70 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements was made on... -

Page 36

... laws and the terms of the Company' s senior credit facility. 71 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Series A Junior Participating Preferred Stock In June 1999, the Company' s Board of Directors authorized the issuance... -

Page 37

... of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements The following table summarizes information about stock options outstanding at December 28, 2010: Options Outstanding Wt.Avg. Exercise Price Wt.Avg. Remaining Life (Years) Options Exercisable... -

Page 38

...Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements The following table summarizes information about stock SARs outstanding at December 28, 2010: SARs Outstanding Wt.Avg. Exercise Price Wt.Avg. Remaining Life (Years) SARs Exercisable Wt... -

Page 39

...of the Company' s unrecognized tax benefits for the year ended December 28, 2010: Unrecognized tax benefits (in thousands) Balance-December 30, 2008 Additions based on 2009 stock option exercises $ 3,892 2,338 http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014 10... -

Page 40

... 3) (in thousands) December 28, 2010 Current deferred tax assets and liabilities, net Operating loss carryforwards Senior management transition costs Allowance for doubtful accounts Deferred revenue §481(a) tax accounting method change Interest rate swap Accrued expenses, net Total gross current... -

Page 41

...are included in accrued expenses and other current liabilities in our consolidated balance sheets. 82 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements 19. SEGMENTS Financial results for fiscal years 2008, 2009 and 2010 are as follows... -

Page 42

...-owned restaurant sales Manufacturing and commissary revenues Franchise and license related revenues Total revenues Cost of sales: Company-owned restaurant costs Manufacturing and commissary costs Franchise and license related costs Total cost of sales Operating expenses Other expenses Provision for... -

Page 43

... the debt redemption and the Company' s New Credit Facility, the Company wrote off $1.0 million of debt issuance costs during the fourth quarter ended 2010. 85 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements The following sets forth... -

Page 44

... sales Manufacturing and commissary revenues Franchise and license related revenues Total revenues Cost of sales: Company-owned restaurant costs Manufacturing and commissary costs Total cost of sales Gross profit Operating expenses: General and administrative expenses California wage and hour... -

Page 45

... As reported As restated Revenues: Company-owned restaurant sales Manufacturing and commissary revenues Franchise and license related revenues Total revenues Cost of sales: Company-owned restaurant costs Manufacturing and commissary costs Total cost of sales Gross profit Operating expenses: General... -

Page 46

... of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements April 1, 2008 As Reported July 1, September 30, 2008 2008 (in thousands, except earnings per share information) December 30, 2008 Consolidated Statements of Operations Provision for income... -

Page 47

...Deferred income tax expense Net cash provided by operating activities 94 $ (342) 342 - $ (684) 684 - $ (1,026) 1,026 - $ (1,368) 1,368 - Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements As Reported Fiscal Year Ended December 29... -

Page 48

...Contents EINSTEIN NOAH RESTAURANT GROUP, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements March 31, 2009 As Reported June 30, September 29, 2009 2009 (in thousands, except earnings per share information) December 29, 2009 Consolidated Statements of Operations Provision (benefit) for... -

Page 49

...that have occurred since December 28, 2010 that required recognition or disclosure in these financial statements. 98 Table of Contents EINSTEIN NOAH RESTAURANT GROUP, INC. Schedule II-Valuation and Qualifying Accounts Balance at beginning of period Balance at end of period Additions (a) Deductions... -

Page 50

... 120 days after the close of the 2010 fiscal year, and is hereby incorporated by reference. Information regarding executive officers is included in Part I of this Form 10-K, as permitted by General Instruction G(3). http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014... -

Page 51

...effective date and to whom it applies on its website or in a report on Form 8-K filed with the SEC. ITEM 11. EXECUTIVECOMPENSATION This information will be included in our 2011 Proxy Statement, which will be filed within 120 days after the close of the 2010 fiscal year, and is hereby incorporated by... -

Page 52

...2010, by and among the Registrant, the Guarantors named therein and Bank of America, N.A.* Rhonda J. Parish Offer of Employment dated January 13, 2010*+ List...the Registrant' s Annual Report on Form 10-K for the year ended December 28, 2010* Certification of Chief Financial Officer of the Registrant ... -

Page 53

Form 10-K S. Garrett Stonehouse, Jr. /S / THOMAS J. M UELLER Thomas J. Mueller Director 106 http://www.sec.gov/Archives/edgar/data/949373/000119312511067286/d10k.htm[9/11/2014 10:09:09 AM]