EMC 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 EMC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

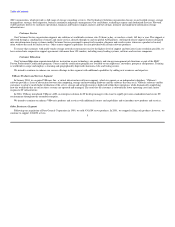

Our common stock, par value $.01 per share, trades on the New York Stock Exchange under the symbol EMC.

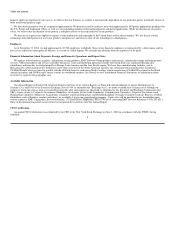

The following table sets forth the range of high and low sales prices of our common stock on the New York Stock Exchange for the past two years during

the fiscal periods shown.

Fiscal 2004 High Low

First Quarter $ 15.80 $ 12.11

Second Quarter 13.75 9.97

Third Quarter 11.61 9.24

Fourth Quarter 14.96 11.69

Fiscal 2003 High Low

First Quarter $ 8.59 $ 5.98

Second Quarter 11.45 7.20

Third Quarter 13.96 9.61

Fourth Quarter 14.65 12.11

We had 20,851 holders of record of our common stock as of March 1, 2005.

We have never paid cash dividends on our common stock. While subject to periodic review, the current policy of our Board of Directors is to retain cash

and investments primarily to provide funds for our future growth. Additionally, we use cash to repurchase our common stock.

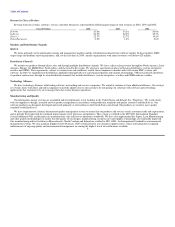

ISSUER PURCHASES OF EQUITY SECURITIES IN THE FOURTH QUARTER OF 2004

Maximum Number

Total Number of (or Approximate

Shares Purchased as Dollar Value) of

Part of Publicly Shares that May Yet

Total Number of Average Price Announced Plans or Be Purchased Under

Period Shares Purchased (1) Paid per Share Programs the Plans or Programs

October 1, 2004 – October 31, 2004 1,000,000 $ 12.64 1,000,000 199,894,700

November 1, 2004 – November 30, 2004 5,883,600 $ 13.09 5,883,600 194,011,100

December 1, 2004 – December 31, 2004 2,650,000 $ 14.53 2,650,000 191,361,100

Total 9,533,600 $ 13.44 9,533,600 191,361,100

(1) All shares were purchased in open-market transactions pursuant to a previously announced authorization by our Board of Directors in October 2002 to

repurchase 250.0 million shares of our common stock. In addition, in May 2001, our Board authorized the repurchase of up to 50.0 million shares of our

common stock, which shares were repurchased in 2001 and 2002. These repurchase authorizations do not have a fixed termination date.

14