E-Z-GO 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

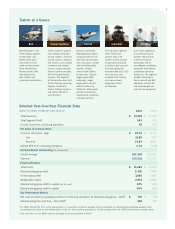

Selected Year-Over-Year Financial Data

(Dollars in millions, except per share amounts) 2010 2009

Total Revenues $ 10,525 $10,500

Total Segment Profi t 553 475

Income (loss) from continuing operations 92 (73)

Per Share of Common Stock

Common stock price: High $25.30

$21.00

Low15.88 3.57

Year-end 23.64 18.81

Diluted EPS from continuing operations*0.30 (0.28)

Common Shares Outstanding (In thousands)

Diluted average* 302,555 262,923

Year-end 275,739 272,272

Financial Position

Total assets $15,282

$18,940

Manufacturing group debt 2,302 3,584

Finance group debt 3,660 5,667

Shareholders’ equity 2,972 2,826

Manufacturing group debt-to-capital (net of cash) 32% 39%

Manufacturing group debt-to-capital 44% 56%

Key Performance Metrics

Net cash provided by operating activities of continuing operations for Manufacturing group—GAAP $730

$738

Manufacturing free cash fl ow—Non-GAAP1692 424

Textron at a Glance

Cessna is the world’s

leading general aviation

company based on unit

sales with two principal

lines of business: aircraft

sales and aftermarket

services. Aircraft

sales include Citation

business jets, Caravan

single-engine utility

turboprops, single-

engine piston aircraft

and lift solutions by

CitationAir. Aftermarket

services include parts,

maintenance, inspection

and repair services.

The Industrial segment

offers three main

product lines: fuel

systems and functional

components produced

by Kautex; golf cars and

turf-care equipment

manufactured by E-Z-GO

and Jacobsen; and

powered tools, testing

and measurement

equipment made

by Greenlee.

Our Finance segment is

a commercial fi

nance

business that consists

of Textron Financial

Corporation and its

consolidated subsidiaries,

along with three fi nance

subsidiaries owned by

Textron Inc. The segment

provides fi nancing for

Cessna aircraft and Bell

helicopters and E-Z-GO

and Jacobsen golf cars

and turf-care equipment.

Textron Systems’ product

lines include unmanned

aircraft systems, land and

marine systems, weapons

and sensors, and a variety

of defense and aviation

mission support products.

Textron Systems includes:

AAI-Unmanned Aircraft

Systems, AAI-Logistics

& Technical Services, AAI-

Test & Training, Lycoming

Engines, Overwatch,

Textron Defense Systems

and Textron Marine &

Land Systems.

Bell Helicopter is one

of the leading suppliers

of helicopters and

related spare parts

and services in the

world and the pioneer

of the revolutionary

tiltrotor aircraft. Bell

manufactures for

both military and

commercial applications.

Bell Textron Systems Cessna Industrial Finance

* For 2009, diluted EPS from continuing operations is calculated using basic average shares outstanding, as utilizing diluted weighted-average shares

outstanding would have an anti-dilutive effect on the loss from continuing operations. Diluted average shares for 2009 represent basic average shares.

1 Free cash fl ow is a non-GAAP measure. See page 10 for reconciliation to GAAP.