E-Z-GO 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

“Of course I prefer to work through Textron with the funding from

Export-Import Bank because you can provide us with the structure

and the speed we need to close the deal with our customers.”

Leonardo Fiuza

Sales Director, TAM Executive Aviation, Brazil

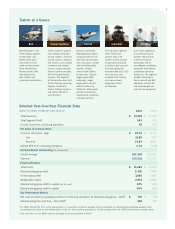

Finance Performance HighlightsFinance Receivables

(In millions)

(In millions) 2010 2009 2008

Segment Revenues $218 $361$723

Segment Profi t (Loss) (237) (294) (50)

For the Finance segment, 2010 was a year of continued

execution of Textron’s strategy to liquidate non-captive

fi nance receivables, while also establishing a strong capital

structure to support the captive fi nance business. By year-

end, the team achieved total liquidations of $2.4 billion

with a cash conversion ratio of 91 percent. Proceeds from

these liquidations continue to be allocated to reduce the

company’s debt.

Efforts in 2010 to ensure a vibrant captive fi nance business

involved leveraging prior success at obtaining affordable

capital from a unique source—export credit agencies—

to support the sale of Textron products. Examples of

progress made during the year include the following:

• Extended a $500 million facility with the Export-Import

Bank of the United States (Ex-Im Bank) for another

18 months to support international sales of Cessna and

Bell products manufactured in the United States.

• Secured an additional $50 million in a new facility

guaranteed by Ex-Im Bank to support international

sales of Bell and Cessna pre-owned aircraft.

• Entered a new relationship with Export Development

Canada and secured a $125 million facility to support

sales of Cessna models equipped with Pratt & Whitney

engines to U.S. customers.

• Also secured a $145 million facility with Export

Development Canada to support Bell product sales

to customers outside of Canada.

As Textron markets recover, the Finance segment plays

an important role in the sale of the company’s products.

The team will continue to look for innovative ways to

support Textron customers by providing fi nancing for

the purchase of its products.

Finance

Captive Balance:

$2,332

Captive Aviation $2,120

Captive Golf Equipment $212

Non-Captive Balance:

$2,294

Timeshare $894

Golf Mortgage/Hotel $876

Structured $317

Distribution and Other $207

Non-CaptiveCaptive