E-Z-GO 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Looking Ahead

As we approach the new millennium, Textron is a company poised for greatness.

We are confident that we will deliver another year of solid, double-digit revenue

and earnings-per-share growth in 1999.

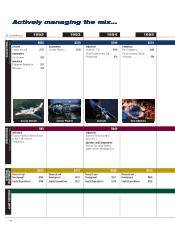

Our strategy is clear. We have a mix of businesses with significant global

growth potential. Our management team is strong. Our leadership transition is

complete. Importantly, we have the infrastructure and processes in place to

help us realize our goals.

Underlying all of these critical elements is our relentless commitment

to continuous improvement and operating excellence. With a strong

balance sheet and the additional financial resources from the sale of Avco,

we are very well-positioned to pursue opportunities that support Textron’s

long-term growth.

I look forward to leading Textron into the next century. Our company has

never been stronger, our people never more committed. Together with your

support and confidence, we will continue to grow our company, build futures

for our people and add value for our shareholders.

Sincerely,

Lewis B. Campbell

Chairman and Chief Executive Officer

89

$100

959493929190 96 98

$776

$440

97

5

Vision

Textron’s Vision is to be:

P

One of the World’s Best

Managed Companies

P

Excellent Managers

of Shareholder

Resources

P

A Multi-industry

Company with Global

Leadership Positions in

Each of Our Businesses

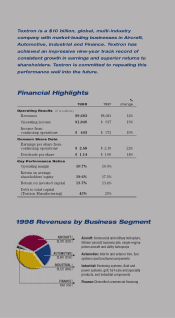

Total Return

to Shareholders

(year-end value of $100 invested at year-end 1989)

Textron: 26% average annual return

S&P 500: Index 18% average annual return