E-Z-GO 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

1998 was a defining year for Textron. Against a backdrop of

significant global economic volatility and industry consolidations,

we continued to position the company for long-term success while

delivering on our promise of consistent growth. We achieved:

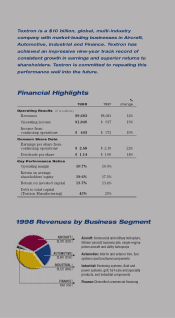

P 22 percent increase in earnings per share – our sixth consecutive

year of double-digit increases, and our ninth consecutive year of

income growth

P 12 percent increase in revenue – our third successive year of

double-digit growth

P Return on equity of 19.6 percent

P 13.7 percent return on invested capital

P Free cash flow of $348 million, up from $234 million in 1997

Most importantly, our shareholders realized total returns of

24 percent. Over the past nine years, total annual returns to Textron

shareholders have averaged 26 percent, compared to 18 percent for

the S&P 500.

These financial achievements are especially impressive when you

consider that in 1998, we acquired and integrated nine companies,

announced two divestitures and put in place the leadership team to

guide our company into the 21st century.

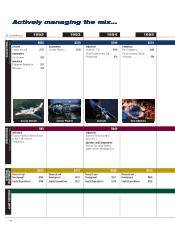

Textron’s outstanding performance was driven by the underlying

strengths of our businesses combined with strategic actions that

demonstrate our discipline in making tough decisions in the best

interests of our shareholders. Most significant among these was

the decision to sell Avco Financial Services, which enables us to

redeploy capital to higher-growth opportunities.

Strategic Divestiture —

Managing the Mix for Higher Growth

In early 1999, we completed the sale of Avco to The Associates First

Capital Corporation for $3.9 billion, arguably one of the most impor-

tant strategic moves in Textron’s 75-year history. Driving this critical

decision was the continued consolidation of the consumer finance

industry, the high premiums placed on successful consumer finance

franchises, and our realization that significant capital investment would

have been needed to generate the required returns from Avco.

Accomplishments

$.70

$2.68

Textron has reported

nine consecutive

years of earnings

growth, including

double-digit gains

in each of the

last six years.

89 90 91 92 93 94 95 96 97 98

EPS From Continuing Operations