E-Z-GO 1998 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1998 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have started to redeploy the $2.9 billion in after-tax proceeds by allocat-

ing 40% to share buyback and 60% to acquisitions. Between the announcement

of the deal in August and year-end, we repurchased 10.2 million shares — the

balance to be completed by mid-1999 — and spent $570 million on acquisi-

tions. At our present pace, we expect full redeployment of this capital by 2000.

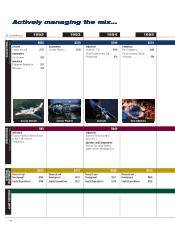

Our disciplined approach to acquisitions has served us well over the past

five years, and our rigorous criteria will be our guidepost as we intensify

activity in 1999. We will maintain a keen focus on making strategic, “bolt-on”

acquisitions that complement our existing businesses and meet our well-

defined financial requirements.

It is important to note that by repurchasing shares prior to the actual

closing of the transaction, our debt-to-capital ratio and return on equity

were temporarily inflated. Return on invested capital, which is not affected

by leverage, is a more consistent measure and will therefore become our

primary benchmark for how effectively we invest capital and create value

for our shareholders.

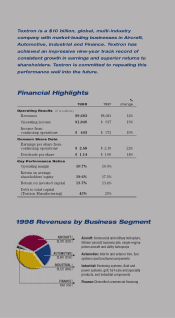

Market-leading Businesses Fuel Growth

Our established goal of 8-11 percent top-line growth continues to be one of

the key drivers of our performance. In 1998, revenues increased 12 percent,

supported equally by strategic acquisitions and internal growth — a balance

we plan to maintain going forward.

Last year, our company spent $1.1 billion on nine acquisitions. We expect

to sustain this level of acquisition activity through 2001, complemented by

aggressive internal growth focused on developing innovative products and

technologies, and penetrating new markets.

Our Aircraft segment delivered a 5 percent increase in revenue and

8 percent improvement in operating profit, reflecting the continued strength

of Cessna Aircraft. The introduction of four new aircraft highlights the power

of Cessna’s internal growth strategy, a cornerstone to this segment’s future

success. Bell Helicopter continues to invest in the development of break-

through tiltrotor technology, which promises to be a key growth driver early

in the next century. Thanks to its impressive array of new products and tech-

nologies, the Aircraft segment now enjoys an unprecedented backlog of $5.9

billion – an indicator of the tremendous future that lies ahead.

Automotive posted a strong year, with revenue increasing 13 percent and

operating profit up 19 percent, led by Kautex’s outstanding growth and

improving margins in our trim business. Looking ahead, our focus remains

Acquisition Criteria

Textron applies rigorous

financial and strategic

standards when evaluating

acquisitions. Our philosophy

is to “buy good businesses

and make them better.”

Key Criteria:

P

Strategically “fit” with

other Textron businesses

P

Offer clear, long-term

growth prospects while

strengthening Textron’s

market leadership

positions

P

Contribute to EPS

immediately, or have

significant earnings

growth potential

P

Achieve economic profit

within three years

P

Have the potential to

reach or exceed

15% ROIC

2