E-Z-GO 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 1998

Consistent Growth

Table of contents

-

Page 1

Annual Report 1998 Consistent Growth -

Page 2

-

Page 3

Textron delivers Consistent Growth by leveraging its present strengths, building upon its past accomplishments, and focusing on a clear vision for the future. Strengths Balanced Mix of Market-leading Businesses Innovative New Products and Technologies Disciplined Strategic Acquisition Process ... -

Page 4

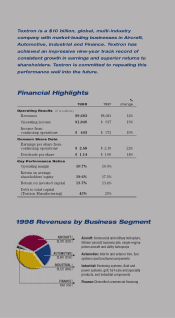

... in earnings and superior returns to shareholders. Textron is committed to repeating this performance well into the future. Financial Highlights 1998 Operating Results ($ in millions) 1997 % change Revenues Operating income Income from continuing operations Common Share Data $9,683 $1,040 $ 443... -

Page 5

...percent. Over the past nine years, total annual returns to Textron shareholders have averaged 26 ... especially impressive when you consider that in 1998, we acquired and integrated nine companies, ...-growth opportunities. Accomplishments Textron has reported nine consecutive years of earnings growth... -

Page 6

... Growth Our established goal of 8-11 percent top-line growth continues to be one of the key drivers of our performance. In 1998, revenues increased 12 percent, supported equally by strategic acquisitions and internal growth - a balance we plan to maintain going forward. Ç Achieve economic profit... -

Page 7

... in size over the next five years. Ç The Fluid and Power Systems group reached an important milestone in 1998 with the acquisition of David Brown Group plc, which propelled the group's annualized revenues to $1 billion and provides an important platform for the future. Ç The Golf, Turf-Care and... -

Page 8

... create the Executive Ç Double-Digit Earnings per Share Growth Performance: Double-digit gains in each of the last six years, 22% in 1998 Ç Annual Revenue Growth Leadership Team, comprised of the top 10 leaders at Textron. In today's rapidly evolving business environment, it is imperative that... -

Page 9

... 94 95 96 97 98 (year-end value of $100 invested at year-end 1989) Lewis B. Campbell Chairman and Chief Executive Officer Textron: 26% average annual return S&P 500: Index 18% average... -

Page 10

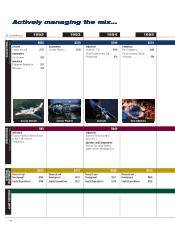

Actively managing the mix...($ in millions) ( pro forma revenues) 1992 $850 1993 $320 Automotive Acustar Plastics ...$320 1994 $190 Industrial Avdel plc, U.K...$180 ORAG International, Ltd, Switzerland ...$10 1995 $310 Industrial Elco Industries ...$260 Friedr. Boesner GmbH, Germany ...$50 ... -

Page 11

..., U.K...$20 Industrial Burkland Inc...$20 Mapri Industries, S.A., Brazil ...$90 Maag Pump Systems, Switzerland and Maag Italia SpA, Italy ...$60 1998 $1,020 Automotive Midland Industrial Plastics, U.K...$80 Industrial Ransomes plc, U.K...$240 Sükosim, Germany ...$60 Ring Screw Works ...$190 Peiner... -

Page 12

... over 70 orders for the 427, scheduled for first delivery in 1999. 4% 6% 65% 3% 2% 11% 1% 8% TOTAL AIRCRAFT (dollars in millions) REVENUES OPERATING INCOME OPERATING MARGIN 1998 1997 % CHANGE $3,189 $ 338 10.6% $3,025 $ 313 10.3% 5% 8% Bell Helicopter Geographic Revenue by Destination 8 -

Page 13

Bell Helicopter's military V-22 and commercial BA 609 tiltrotor aircraft have the potential to redefine the way we fly. The Bell 427, the newest member in Bell's family of commercial helicopters, is well equipped for a variety of applications including executive and commuter transport, cargo ... -

Page 14

... $4 billion - a level that exceeds twice the company's annual aircraft delivery rate - Cessna Aircraft continues to enjoy unprecedented growth...by providing factory-direct support through company-owned Citation Service Centers. In 1998, Cessna expanded its family of business jets from six models to ... -

Page 15

A new addition to Cessna's product lineup, the Citation Sovereign offers the largest cabin of any traditional mid-size business jet, great versatility and excellent performance. 11 -

Page 16

... the Market. Global Balance. With its growth exceeding the automotive market, Textron Automotive Company (TAC) increased its revenues 13 percent in 1998. A cornerstone of this growth is customer satisfaction, evidenced by numerous awards received from DaimlerChrysler, General Motors, Ford, Audi and... -

Page 17

Textron Automotive Company develops breakthrough technologies to achieve growth. Innovations include a better-performing instrument panel, a RITecâ„¢ fan shroud that saves space under the hood and a more environmentally friendly plastic fuel tank. (clockwise, from top) 13 -

Page 18

... Screw brings an excellent reputation with the automotive OEMs and superb manufacturing processes. Germany-based Sükosim and Peiner - also acquired in 1998 - offer market leadership and greater access to the European automotive and industrial markets. TFS is also partnering with Taiwan's San Shing... -

Page 19

David Brown products include industrial gears, fluid handling pumps and mechanical and hydraulic transmission systems used in a wide range of applications - from industrial machinery, such as conveyors (pictured here), to transportation applications, such as rail traction gears. Sükosim offers ... -

Page 20

...acquisition process, positions the Industrial segment to deliver strong double-digit annual revenue growth over the next five years. GOLF, TURF-CARE ... (17%) 3% 64% 25% 1% 3% 1% INDUSTRIAL REVENUES (dollars in millions) 1998 1997 % CHANGE $3,722 $ 410 11.0% $3,181 $ 346 10.9% 17% 18... -

Page 21

Avdel Cherry's strong customer relationship with Intel, combined with superb manufacturing capabilities at Elco, led to new business at Elco, now one of two licensed fastener manufacturers on Intel's next-generation Pentium® II processor. Turf-Care and Specialty Products' Johnson Creek facility ... -

Page 22

...AIRCRAFT (21%) EQUIPMENT (25%) GOLF (16%) OTHER (10%) 20 Consecutive Years of Income Growth ($ in millions) FINANCE REVENUES (dollars in millions) 1998 1997 % CHANGE $ 367 $3,612 $ 113 30.8% 16.2% $ 350 $3,069 $ 108 30.9% 16.8% 5% 18% 5% RECEIVABLES OPERATING INCOME $1.4 78 79 80 81 82... -

Page 23

Product expertise and quality service are cornerstones to every TFC lending transaction - from the financing of golf courses and related Textron products to the refinancing of a Dunkin' Donuts® franchise. 19 -

Page 24

educating the work force of tomorrow Textron's Charitable Giving EDUCATION for the ADVANCEMENT of WOMEN and MINORITIES (55%) Textron's commitment to excellence extends beyond our businesses to our charitable giving program. In this area, we direct special attention to educating the work force of ... -

Page 25

... report Business Segment Data Management's Discussion and Analysis Report of Management, Report of Independent Auditors Consolidated Financial Statements Quarterly Data Selected Financial Information Management Team Textron Business Directory 22 23 33 34 56 57 58 60 1998 TEXTRON ANNUAL REPORT... -

Page 26

... $179 (17%) INDUSTRIAL $410 (39%) FINANCE $113 (11%) 0 0 0 0 0 0 0 (0) $ 0 0 (0) $ 0 0 (0) $ 0 0 - $ 0 0 - $ 0 0 - $ 0 0 - $ 0 0 - $ 0 0 - $ 0 Prior year amounts have been reclassified to conform to the current year's segment presentation. 22 1998 TEXTRON ANNUAL REPORT -

Page 27

... 96 11% 97 16% 98 12% income of Textron's four business segments aggregated $1.040 billion in 1998, up 13% from 1997, as a result of continued improved financial results across all business segments. ... results in the single-engine piston aircraft business. 1998 TEXTRON ANNUAL REPORT 23 -

Page 28

.... These revenue increases were partially offset by the impact of a strike at General Motors in 1998 and the impact of customer price reductions. The increase in income reflected the above factors and ...of a restructuring effort which began in the second quarter 1997. 24 1998 TEXTRON ANNUAL REPORT -

Page 29

...by the divestitures of Speidel in the fourth quarter 1997 and Fuel Systems in the second quarter 1998, the impact of a strike at General Motors on Textron Fastening Systems and a one-month ...a litigation settlement of $10 million associated with the Aircraft segment. 1998 TEXTRON ANNUAL REPORT 25 -

Page 30

...Operating Cash Flows Textron's financial position continued to be strong at the end of 1998. During 1998, cash flows from operations was the primary source of funds for operating needs ... funds for Textron Finance. Both Textron Manufacturing and Textron Finance have 26 1998 TEXTRON ANNUAL REPORT -

Page 31

... variable-rate debt to long-term fixed-rate debt and vice versa. The overall objective of Textron's interest rate risk management is to achieve a prudent 1998 TEXTRON ANNUAL REPORT 27 -

Page 32

... and the fixed rate it paid on interest rate exchange agreements increased its reported interest expense by $2 million in 1998; $1 million in 1997 and $3 million in 1996. Foreign Exchange Risks and...is not expected to have a material impact on the company's business. 28 1998 TEXTRON ANNUAL REPORT -

Page 33

...analysis quantitative risk measure as opposed to the value-at-risk measure disclosed in the 1997 Annual Report. The following table illustrates the hypothetical change in the fair value of the Company's ... will likely be paid over the next five to ten years. 1998 TEXTRON ANNUAL REPORT 29 -

Page 34

... and Textron personnel complete an assessment of the implementation of the Program at the corporate headquarters and each business unit by March 31, 1999. 30 1998 TEXTRON ANNUAL REPORT -

Page 35

...and $2.2 billion at the end of 1997. Backlog for the Aircraft segment was approximately 78% and 79% of Textron's commercial backlog at the end of 1998 and 1997, respectively, and 73% and 71% of Textron's U.S. Government backlog at the end of 1998 and 1997, respectively. 1998 TEXTRON ANNUAL REPORT 31 -

Page 36

...statements of fiscal years beginning after December 15, 1998. In April 1998, the Accounting Standards Executive Committee issued Statement of Position 98-5, "Reporting on the Costs of Start-Up Activities." SOP... quality and control costs when entering new markets. 32 1998 TEXTRON ANNUAL REPORT -

Page 37

...and objectivity of the financial data presented in this Annual Report. The consolidated financial statements have been prepared in... balance sheets of Textron Inc. as of January 2, 1999 and January 3, 1998, and the related consolidated statements of income, cash flows and changes in shareholders... -

Page 38

...in the period ended January 2, 1999 (In millions except per share amounts) 1998 1997 1996 Textron Manufacturing Revenues Costs and Expenses Cost of sales Selling and ... 1.00 $ 3.68 $ 2.25 1.13 $ 3.38 $ 2.19 1.10 $ 3.29 $ 1.82 (.31) $ 1.51 $ 1.78 (.31) $ 1.47 34 1998 TEXTRON ANNUAL REPORT -

Page 39

... shareholders' equity Total liabilities and shareholders' equity See notes to the consolidated financial statements. 1998 TEXTRON ANNUAL $ 31 1,160 1,640 1,176 348 4,355 2,185 2,119 1,277 9,936 22... 24 931 3,786 (96) 4,658 1,661 2,997 $13,721 REPORT 6 7 24 830 3,362 (62) 4,167 939 3,228 $11,330 35 -

Page 40

...each of the three years in the period ended January 2, 1999 (In millions) 1998 Consolidated 1997 1996 Cash flows from operating activities: Income from continuing operations Adjustments to...consolidation are described in Note 1 to the consolidated financial statements. 36 1998 TEXTRON ANNUAL REPORT -

Page 41

Textron Manufacturing* Textron Finance 1998 1997 1996 1998 1997 1996 $ 443 $ 372 $ 306 $ 70 $ 68 $ 58 (8) 187 282 66 1 (54) 87 (18) 6 108... - - - (3) (3) (202) 5 345 (220 29) - 101 4 3 7 149 25 See notes to the consolidated financial statements. 1998 TEXTRON ANNUAL REPORT 37 -

Page 42

...) - (1) (34) $ $ $ (96) 608 (34) 574 $ 253 (122) $ 131 *Shares issued at the end of 1998, 1997, 1996, and 1995 were as follows (in thousands): $2.08 Preferred - 247; 270; 312; and 336 shares, respectively; $1.40 ...See notes to consolidated financial statements. 38 1998 TEXTRON ANNUAL REPORT -

Page 43

...receivables, product liability, workers compensation, environmental, and warranty reserves, and amounts reported under long-term contracts. Management's estimates are based on the facts and...$190 million of debt was assumed as a result of these acquisitions. 1998 TEXTRON ANNUAL REPORT 39 Dispositions -

Page 44

...43) 1,214 $8,732 Fuel Systems Textron was sold to Woodward Governor Company for $160 million in cash in June 1998, at a pretax gain of $97 million ($54 million after-tax). In 1997, Textron completed the sale of... for $180 million in cash plus a subordinated note. 40 1998 TEXTRON ANNUAL REPORT -

Page 45

... finance leases and leveraged leases were as follows: (In millions) 1998 1997 Finance and leveraged lease receivables Estimated residual values on equipment and...from leveraged leases Net investment in leases 1998 TEXTRON ANNUAL $ 590 559 1,149 (379) 770 (256) $ 514 REPORT $ 537 556 1,093 (371) 722... -

Page 46

... 3 - $75 Textron had both fixed-rate and variable-rate loan commitments totaling $432 million at year-end 1998. Because interest rates on these commitments are not set until the loans are funded, Textron is not exposed to ... are recorded when identified. TEXTRON ANNUAL REPORT Contracts 42 1998 -

Page 47

...million at January 2, 1999 and $329 million at January 3, 1998. Goodwill is periodically reviewed for impairment by comparing the carrying amount... 1998, 1997, and 1996, respectively. Comparable rates during the years 1998, 1997, and 1996 were 5.8%, 5.8%, 5.7%, respectively. 1998 TEXTRON ANNUAL REPORT... -

Page 48

... remaining term January 3, 1998 Foreign Currency Transactions (Dollars in millions) Notional amount Notional amount Textron Manufacturing Textron Finance (expires in 1999) $ - 250 - 6.26% 6.26% - 0.6 0.6 $275 450 $725 9.01% 6.02% 7.15% 1.5 1.2 1.3 $250 44 1998 TEXTRON ANNUAL REPORT -

Page 49

...debt from 8.37% to 8.33%. The variable-pay interest rate exchange agreements in effect at the end of 1998 expire as follows: $62 million (9.73%) in 1999, $124 million (9.89%) in 2001, and $449 ... dollar equivalent using the exchange rate at the balance sheet date. 1998 TEXTRON ANNUAL REPORT 45 -

Page 50

... Gain/(Loss) January 2, 1999 British Pound Canadian Dollar German Mark French Franc Other Total January 3, 1998 British Pound Canadian Dollar German Mark French Franc Other Total 9. Textron-obligated $ 45 228 135 1...plan is 10,000,000. 10. Shareholders' Equity 46 1998 TEXTRON ANNUAL REPORT -

Page 51

... million in 1998, $65...40 million in 1998, $37 ...million or $.06 per share in 1998, $11 million or $.07 ... value of an option granted in 1998, 1997, and 1996, respectively, ... granted in 1998, 1997, and... 1998 ... the end of 1998 and 1997 are... $37 $38 - $50 $51 - $80 January 3, 1998: $11 - $32 $33 - $50 $51 - $... -

Page 52

...end 1998, 3,... 2, 1999 Income Average Shares January 3, 1998 Income Average Shares December 28, 1996 Income... In 1998, Textron adopted FAS 130, "Reporting Comprehensive Income." FAS 130 establishes new rules for the reporting and... which prior to adoption were reported separately in shareholders' equity, ... -

Page 53

... in effect at year-end 1998 approximated $67 million for 1999...1998, 1997, and 1996 were as follows: (In millions) 1998 1997 1996 12. Research and Development Company funded Customer funded Total research and development $219 394 $613 $222 380 $602 $185 391 $576 1998 TEXTRON ANNUAL REPORT... -

Page 54

...plans amounted to approximately $40 million, $36 million and $32 million in 1998, 1997, and 1996, respectively. Defined benefits under salaried plans are based ...) - $(766) $ 452 (157) 24 8 $ 327 $ 340 (122) 11 7 $ 236 $ - (762) - - $(762) $ - (766) - - $(766) 50 1998 TEXTRON ANNUAL REPORT -

Page 55

... those used by Textron's defined benefit pension plans. The 1998 health care cost trend rate, which is the weighted average annual assumed rate of increase in the per capita cost of ... cost components Effect on postretirement benefit obligation $ 6 64 $ (5) (52) 1998 TEXTRON ANNUAL REPORT 51 -

Page 56

...tax liabilities of $1,775 million and $1,576 million, respectively, at the end of 1998 and $1,517 million and $1,362 million, respectively, at the end of 1997. The... distributed, 1998 taxes, net of foreign tax credits, would be increased by approximately $68 million. 52 1998 TEXTRON ANNUAL REPORT -

Page 57

...in a current market exchange. January 2, 1999 Carrying value Estimated fair value January 3, 1998 Carrying value Estimated fair value (In millions) Assets: Textron Finance: Finance receivables Other... liabilities will likely be paid over the next five to ten years. 1998 TEXTRON ANNUAL REPORT 53 -

Page 58

...Reporting In 1998, Textron adopted FAS 131, "Segments of an Enterprise and Related Information." FAS 131 established standards for the way enterprises report...reportable...reportable...1998...1998 1997 Assets 1996 1998...$312 (In millions) 1998 Amortization (1) 1997 1996 1998 1997 Depreciation 1996 Aircraft ... -

Page 59

... of 1998 and 1997 were the following: (In millions) January 2, 1999 January 3, 1998 Information - Textron Manufacturing Current Liabilities Salary, wages and employer taxes Customer deposits Other Total accrued liabilities $ 226 195 753 $1,174 $170 137 546 $853 1998 TEXTRON ANNUAL REPORT 55 -

Page 60

Quarterly Data (Unaudited) (Dollars in millions except per share amounts) Q4 Q3 1998 Q2 Q1 Q4 Q3 1997 Q2 Q1 Revenues Aircraft Automotive Industrial Finance Total revenues... year amounts have been reclassified to conform to the current year's segment presentation. 56 1998 TEXTRON ANNUAL REPORT -

Page 61

...Information (Dollars in millions except where otherwise noted and per share amounts) 1998 1997 1996 1995 1994 1993 1992 Revenues Aircraft Automotive Industrial Finance Total revenues... have been reclassified to conform to the current year's segment presentation. 1998 TEXTRON ANNUAL REPORT 57 -

Page 62

Board of Directors Lewis B. Campbell John A. Janitz H. Jesse Arnelle Teresa Beck R. Stuart Dickson Lawrence K. Fish Joe T. Ford Paul E. Gagné John D. Macomber Dana G. Mead Brian H. Rowe Sam F. Segnar Jean Head Sisco John W. Snow Martin D. Walker Thomas B. Wheeler Executive ... -

Page 63

... Lee Hsien Yang Vice President International Textron Inc. USA Former Chairman HSBC Holdings plc United Kingdom President and Chief Executive Officer Singapore Telecommunications Ltd. Singapore 1998 TEXTRON ANNUAL REPORT 59 -

Page 64

... W. Staple President Charles R. O'Brien President Elco Textron Engineered Products Textron Aerospace Fasteners William R. Jahnke President George W. Dettloff President Edmund W. Staple President James R. Stenberg President 60 1998 TEXTRON ANNUAL REPORT -

Page 65

... President L.T. Walden, Jr. President Textron Turf Care and Specialty Products Americas Philip J. Tralies President Textron Turf Care and Specialty Products Europe Harold C. Pinto Managing Director 1998 TEXTRON ANNUAL REPORT 61 -

Page 66

... and lease of Textron and independent products including: equipment, aircraft, golf and timeshare; also provides syndication activity, third-party asset management and portfolio servicing. 62 1998 TEXTRON ANNUAL REPORT -

Page 67

..., Lexington, MA Company Publications and General Information To receive a copy, without charge, of Textron's Forms 10-K and 10-Q, proxy statement, Annual Report and the most recent company news and earnings press releases, please call 1-888-TXT-LINE or direct written correspondence to Textron... -

Page 68

Annual Report 1998 Textron Inc. 40 Westminster Street Providence, RI 02903 (401) 421-2800