Dollar Tree 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

One key to our relevance in both good times and bad is an increased selection of basic

consumable products, items that are needed every day. During the past few years, we have

grown our store size to accommodate the addition of these “needs-based” products to

our previously mostly discretionary product mix of party supplies, seasonal decor, gifts,

stationery, and higher-margin variety merchandise. Specifically, we have added more health

and beauty care products, household cleaning supplies, food, beverages, and grocery items.

For example, we added freezers and coolers to 135 Dollar Tree stores in 2008; at the end of

the year, we had frozen and refrigerated foods in 1,107 Dollar Tree stores compared to

972 stores at the end of 2007. Although these products are lower margin, they are faster

turning and drive footsteps into our stores on a more frequent basis.

The expansion of payment type acceptance also continues to contribute positively to

our results. Debit card acceptance was rolled out to all stores by mid-2006, yet our debit

card penetration continued to increase in 2008. Visa credit card acceptance was extended

to all of our stores in October 2007. As expected, credit card penetration increased

throughout 2008, and we expect the penetration of credit as well as debit to continue

increasing throughout 2009.

With our increased mix of food items, Food Stamps have also become more relevant.

We currently accept Food Stamps in 2,200 qualified stores, compared with 1,054 stores

last year, and that number will continue to grow as we roll out frozen and refrigerated

product to more stores.

Logistics efficiency was more important than ever as we faced record high fuel costs in

2008. Our logistics team found ways to save costs through greater cube utilization of our

trailers and increased less-than-trailer-load consolidation. In addition, backhauls increased

more than 10% and Distribution Center productivity improved almost 15% over the prior

year. I am very proud of the team; it was a great performance in a challenging environment.

In 2008, inventory turns continued to increase – for the fourth consecutive year. Our

current distribution network has the capacity to handle $6.7 billion in sales volume with no addi-

tional investment. Accordingly, every new store we open makes our network more efficient.

Also in 2008, our already solid and scaleable infrastructure was further strengthened.

Our technology team opened a new data center without interruption. We also launched

a new assortment planning tool and integrated it into the buying process. This new tool

more closely links the buying to the selling at store levels – enabling more efficient

merchandise allocations, increased customer satisfaction, improved sell through, and

increased inventory turns.

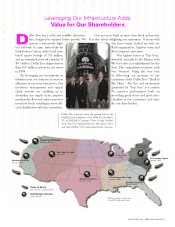

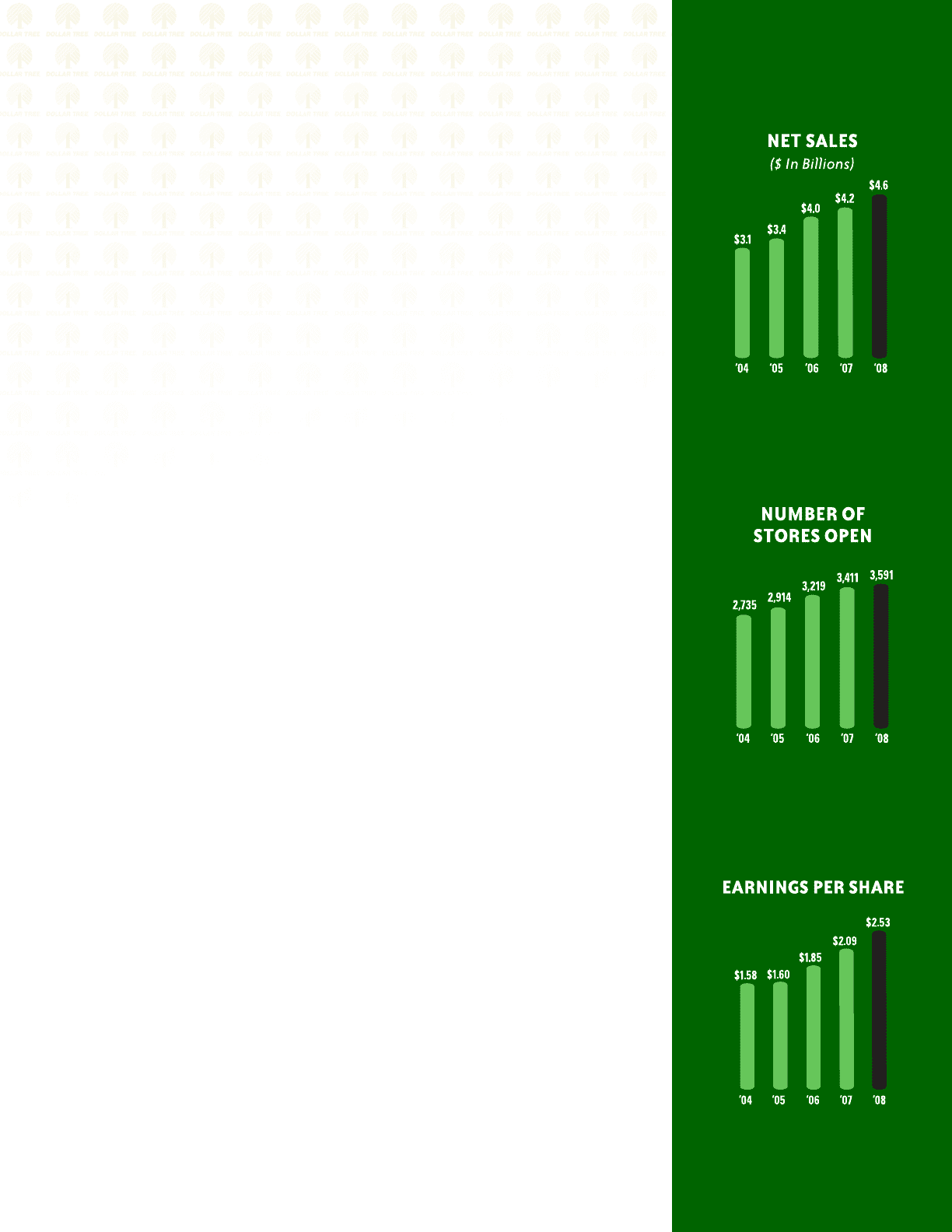

Our second priority for 2008 was to optimize our real estate network. This year, we

opened 211 new Dollar Tree stores and 20 new Deal$ stores, finishing the year with 3,591

stores. We also expanded and relocated another 86 stores and grew total square footage

6.7%. Our new stores averaged 10,310 square feet, which is within our targeted size range

of 10,000 to 12,000 square feet. California is our number-one state with 267 stores,

followed by Texas with 227 stores, and Florida with 217 stores. We have plenty of room to

grow: 36 states have less than 100 Dollar Tree stores.

Developing our Deal$ concept was our third priority for 2008. In addition to opening

20 new Deal$ stores, we also expanded the size and skill base of our Deal$ team, including

bringing on new leadership. We focused on developing a more compelling assortment of

high value merchandise for the Deal$ customer, and are seeing positive response. We

believe that Deal$ fills a unique void in the value retail segment, and as we continue to

develop the model, it will give us the ability to serve even more customers in more markets.

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

3