Dollar Tree 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

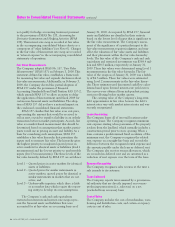

tions. The Court ordered notice to be sent to female

individuals employed by the Company as a store man-

ager between February 1, 2006 and January 30, 2009

(3,320 in number) to participate as a member of a

potential class. A second notice was sent to 215 female

store managers in California employed during the

period March 1, 2006 through February 27, 2009. The

opt in period ends April 23, 2009, so the Company

does not know at this date the number of persons who

will elect to opt in. Discovery is now ongoing. The

Company expects that the Court will consider a

motion to decertify the collective action and other

defensive motions at a future date. The case has not

been set for trial.

In May and June of 2008, 29 present or former

female store managers filed claims with the Norfolk,

Virginia office of the EEOC alleging employment dis-

crimination pursuant to Title VII of the Civil Rights

Act on the grounds that women store managers

throughout the Company are paid less than their male

counterparts. Eventually the EEOC issued Right to

Sue letters to the complaining parties. All are repre-

sented by the attorneys for the plaintiffs in the exist-

ing pay discrimination case, who, following the letters,

sought to amend the existing Complaint to include

the Title VII charges. The Court presently has that

matter under consideration.

The Company will vigorously defend itself in

these lawsuits. The Company cannot give assurance,

however, that one or more of these lawsuits will not

have a material adverse effect on its results of opera-

tions for the period in which they are resolved.

40

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

Notes to Consolidated Financial Statements continued

to decertify the collective action and other defensive

motions late this summer. If the Court eventually cer-

tifies a class, the case has been scheduled for trial in

January 2010.

In April 2007, the Company was served with a

lawsuit filed in federal court in the state of California

by one present and one former store manager. They

claim they should have been classified as non-exempt

employees under both the California Labor Code and

the Fair Labor Standards Act. They filed the case as a

class action on behalf of California-based store man-

agers employed by the Company for the four years

prior to the filing of the suit. The Company was there-

after served with a second suit in a California state

court which alleges essentially the same claims as

those contained in the federal action and which like-

wise seeks class certification of all California store

managers. The Company has removed the case to the

same federal court as the first suit, answered it and the

two cases have been consolidated. The plaintiffs’

motion to seek class certification should be decided

this spring or summer. No trial date has been scheduled.

In July 2008, the Company was served with a

lawsuit filed in federal court in the state of Alabama

by one present and one former store manager, both

females, alleging that they and other female store

managers similarly situated were deprived of their

rights under the Equal Pay Act, 29 U.S.C. 206(d) in

that they were paid less than male store managers for

performing jobs of equal skill and effort. They seek an

unspecified amount of monetary damages, back pay,

injunctive and other relief. The Company has

answered the Complaint denying the plaintiffs’ allega-

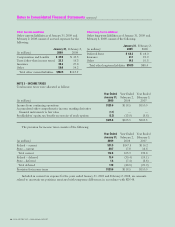

NOTE 5 – LONG-TERM DEBT

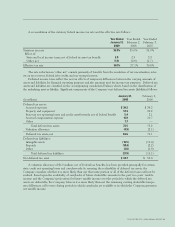

Long-term debt at January 31, 2009 and February 2, 2008 consists of the following:

January 31, February 2,

(in millions) 2009 2008

$550.0 million Unsecured Credit Agreement, interest payable monthly at

LIBOR, plus 0.50%, which was 1.21% at January 31, 2009, principal payable

upon expiration of the facility in February 2013 $250.0 —

$450.0 million Unsecured Revolving Credit Facility, interest payable monthly at

LIBOR, plus 0.475%, principal payable upon expiration of the facility in

March 2009, amount refinanced in 2008 —$250.0

Demand Revenue Bonds, interest payable monthly at a variable rate which was

1.50% at January 31, 2009, principal payable on demand, maturing June 2018 17.6 18.5

Total-term debt $267.6 $268.8

Maturities of long-term debt are as follows: 2009 - $17.6 million and 2013 - $250.0 million.