Dollar Tree 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

DOLLAR TREE, INC. • 2008 ANNUAL REPORT

Notes to Consolidated Financial Statements continued

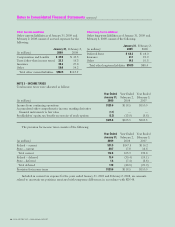

NOTE 7 - SHAREHOLDERS’ EQUITY

Preferred Stock

The Company is authorized to issue 10,000,000 shares of Preferred Stock, $0.01 par value per share. No preferred

shares are issued and outstanding at January 31, 2009 and February 2, 2008.

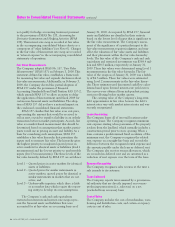

Net Income Per Share

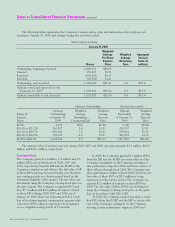

The following table sets forth the calculation of basic and diluted net income per share:

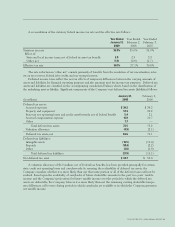

Year Ended Year Ended Year Ended

January 31, February 2, February 3,

(in millions, except per share data) 2009 2008 2007

Basic net income per share:

Net income $229.5 $201.3 $192.0

Weighted average number of shares outstanding 90.3 95.9 103.2

Basic net income per share $2.54 $2.10 $1.86

Diluted net income per share:

Net income $229.5 $201.3 $192.0

Weighted average number of shares outstanding 90.3 95.9 103.2

Dilutive effect of stock options and restricted stock

(as determined by applying the treasury stock method) 0.5 0.5 0.6

Weighted average number of shares and

dilutive potential shares outstanding 90.8 96.4 103.8

Diluted net income per share $2.53 $ 2.09 $ 1.85

At January 31, 2009, February 2, 2008, and February 3, 2007, 0.5 million, 0.4 million, and 1.5 million stock

options, respectively are not included in the calculation of the weighted average number of shares and dilutive

potential shares outstanding because their effect would be anti-dilutive.

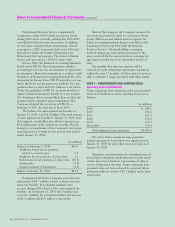

Share Repurchase Programs

In December 2006, the Company entered into two

agreements with a third party to repurchase approxi-

mately $100.0 million of the Company’s common

shares under an Accelerated Share Repurchase

Agreement.

The first $50.0 million was executed in an

“uncollared” agreement. In this transaction the

Company initially received 1.7 million shares based on

the market price of the Company’s stock of $30.19 as

of the trade date (December 8, 2006). A weighted

average price of $32.17 was calculated using stock

prices from December 16, 2006 – March 8, 2007. This

represented the calculation period for the weighted

average price. Based on this weighted average price,

the Company paid the third party an additional $3.3

million on March 8, 2007 for the 1.7 million shares

delivered under this agreement.

The remaining $50.0 million was executed under

a “collared” agreement. Under this agreement, the

Company initially received 1.5 million shares through

December 15, 2006, representing the minimum num-

ber of shares to be received based on a calculation

using the “cap” or high-end of the price range of the

collar. The number of shares received under the agree-

ment was determined based on the weighted average

market price of the Company’s common stock, net of

a predetermined discount, during the time after the

initial execution date through March 8, 2007. The cal-

culated weighted average market price through March

8, 2007, net of a predetermined discount, as defined in

the “collared” agreement, was $31.97. Therefore, on

March 8, 2007, the Company received an additional

0.1 million shares under the “collared” agreement

resulting in 1.6 million total shares being repurchased

under this agreement.

On March 29, 2007, the Company entered into

an agreement with a third party to repurchase $150.0

million of the Company’s common shares under an

Accelerated Share Repurchase Agreement. The entire

$150.0 million was executed under a “collared” agree-

ment. Under this agreement, the Company initially