Dollar Tree 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT

VALUE for All Seasons

Table of contents

-

Page 1

VALUE for All Seasons 20 0 8 A N N UA L R E P O R T -

Page 2

... offers value merchandise at prices $1 and above at its 143 Deal$ stores. Contents Letter to Shareholders from the Chief Executive Officer...2 Narrative ...6 Management's Discussion & Analysis of Financial Condition and Results of Operations ...13 Report of Independent Registered Public Accounting... -

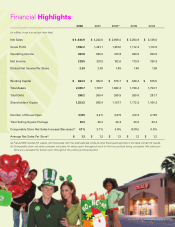

Page 3

... years reported in the table contain 52 weeks. (b) Comparable store net sales compare net sales for stores open throughout each of the two periods being compared. Net sales per store are calculated for stores open throughout the entire period presented. DOLLAR TREE, INC. • 2008 ANNUAL REPORT... -

Page 4

... to state that we are the only Fortune 500 Company to have achieved this milestone "a dollar at a time." Today, as in each of the 23 years since our founding in 1986, everything at Dollar Tree stores is priced at $1 - or less - every day. Our diluted earnings per share were $2.53, an increase of 21... -

Page 5

...of party supplies, seasonal decor, gifts, stationery, and higher-margin variety merchandise. Specifically, we have added more health and beauty care products, household cleaning supplies, food, beverages, and grocery items. For example, we added freezers and coolers to 135 Dollar Tree stores in 2008... -

Page 6

... to 135 stores. Early in the year, we restructured our debt, locking in a $250 million term loan until 2013, and adding the flexibility of a $300 million revolving credit line, if needed. We did not use the revolving credit line in 2008. Dollar Tree has long believed that share repurchase can... -

Page 7

... open new Dollar Tree stores - including new Deal$ stores, which is an exciting and progressing concept. We have the capital available to support our growth plans, while generating substantial free cash. And our prudent cash management strategy in 2008 has put us in a strong position going into 2009... -

Page 8

8 DOLLAR TREE, INC. • 2008 ANNUAL REPORT 6 -

Page 9

..., gift bags and gift wrap. Each item is priced at $1 every day - or less! Expanding our tender types to include Debit cards, EBT, Visa and Discover Credit cards has provided additional convenience to customers and helped increase traffic and average transaction size. Dollar Tree also accepts Food... -

Page 10

8 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 11

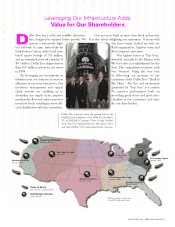

... shareholders. Dollar Tree executives rang the opening bell at the NASDAQ Stock Market in July 2008. Eric Bernbach, VP of NASDAQ Corporate Client Group; Michael Dick, "Top Gun" Regional Director; Bob Sasser, CEO; and Gary Philbin, COO, participated in the ceremony. Ridgefield, Washington February... -

Page 12

... as the Company continues to expand, more job opportunities are created. Dollar Tree has added new jobs in each of In our 3,600 stores, nine distribution centers, buying and assortment planning teams, systems, logistics, supplychain and our Store Support Center, Dollar Tree's 45,000 associates work... -

Page 13

DOLLAR TREE, INC. • 2008 ANNUAL REPORT 11 -

Page 14

... distributed at U.S. military bases stateside. Dollar Tree and its associates support our troops and their families throughout the year with Easter basket drives, back-to-school supply collections, and emergency need collections. Our stores average more than $1.3 million in annual sales, and nearly... -

Page 15

... at existing store locations; • the average size of our stores to be added in 2009 and beyond; • the effect of a slight shift in merchandise mix to consumables and the increase in freezers and coolers on gross profit margin and sales; • the effect that expanding tender types accepted by our... -

Page 16

...'s Discussion and Analysis, we explain the general financial condition and the results of operations for our company, including: • what factors affect our business; • what our net sales, earnings, gross margins and costs were in 2008, 2007 and 2006; 14 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 17

... stores opened in 2008 was approximately 8,100 selling square feet (or about 10,300 gross square feet). The average new store size decreased slightly in 2008 from approximately 8,500 selling square feet (or about 10,800 gross square feet) for new stores in 2007. For 2009, we continue to plan to open... -

Page 18

... an opportunity to leverage our Dollar Tree infrastructure in the testing of new merchandise concepts, including higher price points, without disrupting the single-price point model in our Dollar Tree stores. We have opened new Deal$ stores, including some in new markets, and as of January 31, 2009... -

Page 19

... 31, 2009 New stores Acquired leases Expanded or relocated stores Closed stores February 2, 2008 208 32 102 (48) 227 4 86 (51) Of the 1.9 million selling square foot increase in 2008 approximately 0.3 million was added by expanding existing stores. Gross Profit. Gross profit margin decreased to... -

Page 20

.... Historically, we have satisfied our seasonal working capital requirements for existing stores and have funded our store opening and distribution network expansion programs from internally generated funds and borrowings under our credit facilities. 18 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 21

... of credit, payable quarterly. The term loan is due and payable in full at the five year maturity date of the Agreement. The Agreement also bears an administrative fee payable annually. The Agreement, among other things, requires the maintenance of cer- DOLLAR TREE, INC. • 2008 ANNUAL REPORT 19 -

Page 22

... to approximately 175 stores. We believe that we can adequately fund our working capital requirements and planned capital expenditures for the next few years from net cash provided by operations and potential borrowings under our existing credit facility. 20 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 23

...obligations are primarily for distribution center equipment and computer equipment at the store support center. Credit Agreement. On February 20, 2008, we entered into a five-year $550.0 million unsecured Credit Agreement (the Agreement). The Agreement provides for a $300.0 million revolving line of... -

Page 24

...at cost and the resulting gross margins are computed by applying a calculated cost-to-retail ratio to the retail value of inventories. The retail inventory method is an averag- Derivative Financial Instruments On March 20, 2008, we entered into two $75.0 million interest rate swap agreements. These... -

Page 25

... in acquired stores in the year following an acquisition. We periodically adjust our shrink estimates to address these factors as they become apparent. Our management believes that our application of the retail inventory method results in an inventory valuation that reasonably approximates cost and... -

Page 26

...• The timing of new store openings; • The net sales contributed by new stores; • Changes in our merchandise mix; and • Competition. Our highest sales periods are the Christmas and Easter seasons. Easter was observed on April 8, 2007, March 23, 2008, and will be observed on April 12, 2009. We... -

Page 27

... with the interest rate fluctuations on our Demand Revenue Bonds. Under this $17.6 million swap, no payments are made by parties under the swap for monthly periods in which the variable-interest rate is greater than the predetermined knock-out rate. DOLLAR TREE, INC. • 2008 ANNUAL REPORT 25 -

Page 28

... the terms of the interest rate swap agreement on an annual basis. Due to many factors, management is not able to predict the changes in the fair values of our interest rate swaps. These fair values are obtained from our outside financial institutions. 26 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 29

... of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 26, 2009 expressed an unqualified opinion on the effectiveness of the Company's internal control over financial reporting. Norfolk, Virginia March 26, 2009 DOLLAR TREE, INC. • 2008 ANNUAL REPORT 27 -

Page 30

... 1.85 Net sales Cost of sales (Note 4) Gross profit Selling, general and administrative expenses (Notes 4, 8 and 9) Operating income Interest income Interest expense (Notes 5 and 6) Income before income taxes Provision for income taxes (Note 3) Net income Basic net income per share (Note 7) Diluted... -

Page 31

... Sheets (in millions, except share data) January 31, 2009 February 2, 2008 ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred tax assets (Note 3) Prepaid expenses and other current assets Total current assets Property, plant and equipment... -

Page 32

... of stock under Employee Stock Purchase Plan (Note 9) Exercise of stock options, including income tax benefit of $13.0 (Note 9) Repurchase and retirement of shares (Note 7) Stock-based compensation, net (Notes 1 and 9) Balance at February 2, 2008 Net income for the year ended January 31, 2009 Other... -

Page 33

...cash equivalents: Merchandise inventories Other assets Accounts payable Income taxes payable Other current liabilities Other liabilities Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Purchase of short-term investments Proceeds from sale of short... -

Page 34

... distribution centers are located in Chesapeake, Virginia. The Company also operates distribution centers in Mississippi, Illinois, California, Pennsylvania, Georgia, Oklahoma, Utah and Washington. The Company's stores are located in all 48 contiguous states. The Company's merchandise includes food... -

Page 35

... as merchandise inventories. Total warehousing and distribution costs capitalized into inventory amounted to $26.9 million and $26.3 million at January 31, 2009 and February 2, 2008, respectively. No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (SFAS 144). The Company... -

Page 36

...are directly imposed on revenueproducing transactions (i.e., sales tax) on a net (excluded from revenues) basis. Cost of Sales The Company includes the cost of merchandise, warehousing and distribution costs, and certain occupancy costs in cost of sales. 34 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 37

... grant using the Black Scholes option pricing model. The fair value of the RSUs is determined using the closing price of the Company's common stock on the date of grant. Net Income Per Share Basic net income per share has been computed by dividing net income by the weighted average number of shares... -

Page 38

... 2007 $116.2 16.6 132.8 (19.1) (2.8) (21.9) $110.9 Included in current tax expense for the years ended January 31, 2009 and February 2, 2008, are amounts related to uncertain tax positions associated with temporary differences, in accordance with FIN 48. 36 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 39

...rate Year Ended February 2, 2008 35.0% 2.9 (0.8) 37.1% Year Ended February 3, 2007 35.0% 3.3 (1.7) 36.6% 35.0% 3.0 (1.9) 36.1% The rate reduction in "other, net" consists primarily of benefits from the resolution of tax uncertainties, interest on tax reserves, federal jobs credits and tax exempt... -

Page 40

... rate was $9.8 million (net of the federal tax benefit). The following is a reconciliation of the Company's total gross unrecognized tax benefits for the year-to-date period ended January 31, 2009: (in millions) Balance at February 2, 2008 $55.0 Additions, based on tax positions related to current... -

Page 41

... decide whether DOLLAR TREE, INC. • 2008 ANNUAL REPORT 39 Technology Assets The Company has commitments totaling approximately $3.2 million to purchase store technology assets for its stores during 2009. Letters of Credit In March 2001, the Company entered into a Letter of Credit Reimbursement... -

Page 42

... one former store manager. They claim they should have been classified as non-exempt employees under both the California Labor Code and the Fair Labor Standards Act. They filed the case as a class action on behalf of California-based store managers employed by the Company for the four years prior to... -

Page 43

... line of credit and an annual administrative fee payable quarterly. This facility was terminated in February 2008 and replaced by the Agreement. Demand Revenue Bonds On May 20, 1998, the Company entered into an unsecured Loan Agreement with the Mississippi Business Finance Corporation (MBFC) under... -

Page 44

.... The number of shares received under the agreement was determined based on the weighted average market price of the Company's common stock, net of a predetermined discount, during the time after the initial execution date through March 8, 2007. The calculated weighted average market price through... -

Page 45

... high-end of the price range of the collar. The number of shares received under the agreement was determined based on the weighted average market price of the Company's common stock, net of a predetermined discount, during the time after the initial execution date through a period of up to four and... -

Page 46

...of each stock option granted equals the market price of the Company's stock at the date of grant. The options generally vest over a three-year period and have a maximum term of 10 years. The EOEP is available only to the Chief Executive Officer and certain other executive officers. These officers no... -

Page 47

... in years 6.0 6.0 6.0 Expected volatility 45.7% 28.4% 30.2% Annual dividend yield - - - Risk free interest rate 2.8% 4.5% 4.8% Weighted average fair value of options granted during the period $13.45 $14.33 $10.93 Options granted 558,293 386,490 342,216 DOLLAR TREE, INC. • 2008 ANNUAL REPORT 45 -

Page 48

... stock price on the grant date in accordance with FAS 123R. In 2006, the Company granted less than 0.1 million RSUs from the EOEP and the EIP to certain officers of the Company, contingent on the Company meeting certain performance targets in 2006 and 46 DOLLAR TREE, INC. • 2008 ANNUAL REPORT -

Page 49

... of merchandise including items that sell for more than $1. Substantially all Deal$ stores acquired continue to operate under the Deal$ banner while providing the Company an opportunity to leverage its Dollar Tree infrastructure in the testing of new merchandise concepts, including higher price... -

Page 50

...in 2006. This acquisition is immaterial to the Company's operations as a whole and therefore no proforma disclosure of financial information has been presented. The following table summarizes the allocation of the purchase price to the fair value of the assets acquired. (in millions) Inventory Other... -

Page 51

... *Dates are subject to change. INVESTORS' INQUIRIES Requests for interim and annual reports, Forms 10-K, or more information should be directed to: Shareholder Services Dollar Tree, Inc. 500 Volvo Parkway Chesapeake, VA 23320 (757) 321-5000 Or from the investor relations section of our company web... -

Page 52

VALUE for All Seasons TM 500 Volvo Parkway • Chesapeake, Virginia 23320 • Phone (757) 321-5000 www.DollarTree.com