Dollar General 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

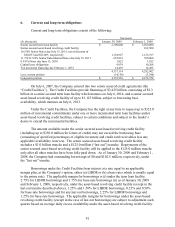

As of February 1, 2008, the average interest rate for borrowings under the revolving credit

facility was 6.35%. The interest rate for borrowings under the term loan facility was 3.44% and

6.22% (without giving effect to the interest rate swaps discussed in Note 7) as of January 30,

2009 and February 1, 2008, respectively.

In addition to paying interest on outstanding principal under the Credit Facilities, the

Company is required to pay a commitment fee to the lenders under the asset-based revolving

credit facility for any unutilized commitments. The commitment fee rate is 0.375% per annum.

The commitment fee rate will be reduced (except with regard to the last out tranche) to 0.25%

per annum at any time that the unutilized commitments under the asset-based credit facility are

equal to or less than 50% of the aggregate commitments under the asset-based revolving credit

facility. The Company also must pay customary letter of credit fees.

The senior secured credit agreement for the term loan facility requires the Company to

prepay outstanding term loans, subject to certain exceptions, with percentages of excess cash

flow, proceeds of non-ordinary course asset sales or dispositions of property, and proceeds of

incurrences of certain debt. In addition, the senior secured credit agreement for the asset-based

revolving credit facility requires the Company to prepay the asset-based revolving credit facility,

subject to certain exceptions, with proceeds of non-ordinary course asset sales or dispositions of

property and any borrowings in excess of the then current borrowing base. Beginning September

30, 2009, the Company is required to repay installments on the loans under the term loan credit

facility in equal quarterly principal amounts in an aggregate amount per annum equal to 1% of

the total funded principal amount at July 6, 2007, with the balance payable on July 6, 2014.

All obligations under the Credit Facilities are unconditionally guaranteed by substantially

all of the Company’ s existing and future domestic subsidiaries (excluding certain immaterial

subsidiaries and certain subsidiaries designated by the Company under the Credit Facilities as

“unrestricted subsidiaries”).

All obligations and guarantees of those obligations under the term loan credit facility are

secured by, subject to certain exceptions, a second-priority security interest in all existing and

after-acquired inventory and accounts receivable; a first priority security interest in substantially

all of the Company’ s and the guarantors’ tangible and intangible assets (other than the inventory

and accounts receivable collateral); and a first-priority pledge of the capital stock held by the

Company. All obligations under the asset-based revolving credit facility are secured by all

existing and after-acquired inventory and accounts receivable, subject to certain exceptions.

The Credit Facilities contain certain covenants, including, among other things, covenants

that limit the Company’s ability to incur additional indebtedness, sell assets, incur additional

liens, pay dividends, make investments or acquisitions, or repay certain indebtedness.

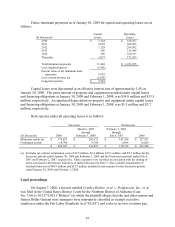

For the year ended January 30, 2009, the Company had borrowings of $0 and repayments

of $102.5 million, and for the 2007 Successor period the Company had borrowings of $1.522

billion and repayments of $1.420 billion, under the asset based revolving credit facility. For the

year ended February 2, 2007, the Company had borrowings of $2.013 billion and repayments of

$2.013 billion, under a prior revolving credit facility. As of January 30, 2009 and February 1,

2008, respectively, the Company had $0 and $102.5 million in borrowings, $51.0 million and