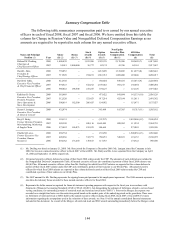

Dollar General 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.148

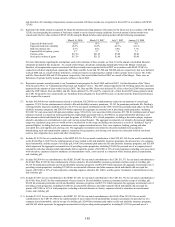

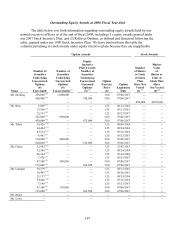

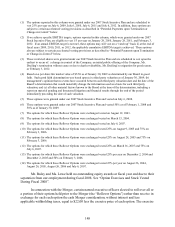

(1) The options reported in this column were granted under our 2007 Stock Incentive Plan and are scheduled to

vest 25% per year on July 6, 2009, July 6, 2010, July 6, 2011 and July 6, 2012. In addition, these options are

subject to certain accelerated vesting provisions as described in “Potential Payments upon Termination or

Change-in-Control” below.

(2) If we achieve specific EBITDA targets, options reported in this column, which were granted under our 2007

Stock Incentive Plan, are eligible to vest 1/3 per year on January 29, 2010, January 28, 2011, and February 3,

2012. If an annual EBITDA target is not met, these options may still vest on a “catch up” basis if, at the end of

fiscal years 2009, 2010, 2011, or 2012, the applicable cumulative EBITDA target is achieved. These options

also are subject to certain accelerated vesting provisions as described in “Potential Payments upon Termination

or Change-in-Control” below.

(3) These restricted shares were granted under our 2007 Stock Incentive Plan and are scheduled to vest upon the

earliest to occur of: a change in control of the Company, an initial public offering of the Company, Mr.

Dreiling’ s termination without cause or due to death or disability, Mr. Dreiling’ s resignation for good reason,

or February 3, 2012.

(4) Based on a per share fair market value of $5.50 as of January 30, 2009 as determined by our Board in good

faith. Such good faith determination was based upon (a) a third party valuation as of January 30, 2009; (b)

management’ s opinion that no events have occurred between such third party valuation date and the date of the

Board’ s determination that would materially change the information used as a basis for such third party

valuation; and (c) all other material factors known to the Board at the time of the determination, including a

report on material pending and threatened litigation and financial results through the end of the period

immediately preceding the date of such valuation.

(5) These options were granted under our 2007 Stock Incentive Plan and vested on July 6, 2008.

(6) These options were granted under our 2007 Stock Incentive Plan and vested 50% as of February 1, 2008 and

50% as of January 30, 2009.

(7) The options for which these Rollover Options were exchanged vested on August 12, 2003.

(8) The options for which these Rollover Options were exchanged vested on March 13, 2004.

(9) The options for which these Rollover Options were exchanged vested on July 6, 2007.

(10) The options for which these Rollover Options were exchanged vested 25% on August 9, 2005 and 75% on

February 3, 2006.

(11) The options for which these Rollover Options were exchanged vested 25% on August 24, 2005 and 75% on

February 3, 2006.

(12) The options for which these Rollover Options were exchanged vested 25% on March 16, 2007 and 75% on

July 6, 2007.

(13) The options for which these Rollover Options were exchanged vested 25% per year on December 2, 2004 and

December 2, 2005 and 50% on February 3, 2006.

(14) The options for which these Rollover Options were exchanged vested 25% per year on August 26, 2004,

August 26, 2005, August 26, 2006 and July 6, 2007.

Mr. Buley and Ms. Lowe held no outstanding equity awards at fiscal year end due to their

separation from our employment during fiscal 2008. See “Option Exercises and Stock Vested

During Fiscal 2008”.

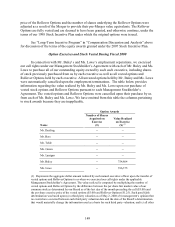

In connection with the Merger, certain named executive officers elected to roll over all or

a portion of their options held prior to the Merger (the “Rollover Options”) rather than receive in

exchange for each such option the cash Merger consideration, without interest and less

applicable withholding taxes, equal to $22.00 less the exercise price of each option. The exercise