Dollar General 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.170

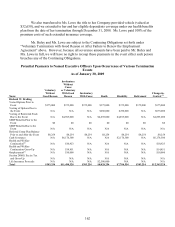

outstanding equity owned by him. Specifically, we purchased at $5.00 per share (less any

applicable option exercise price) 13,721 shares of Dollar General common stock that he

previously purchased from us for $5.00 per share, 40,000 vested options with an exercise price of

$5.00 per share and 74,693 vested options with an exercise price of $1.25 per share. The per

share purchase price equaled the fair market value of our common stock on the last day of the

month preceding the call, as determined in good faith by our Board of Directors pursuant to the

terms of our Management Stockholder’ s Agreement with Mr. Gibson. All such vested options

were cancelled upon their purchase by us, and all 360,000 unvested options held by Mr. Gibson

were automatically cancelled upon the end of his employment with us.

We also exercised our call rights with respect to equity held by Mr. Buley and Ms. Lowe,

all as disclosed under “Option Exercises and Stock Vested During 2008” in Item 11 above.

Interlocks. Mr. Dreiling serves and, for a portion of fiscal 2008, Mr. Bere served as a

director of Buck Holdings, LLC for which Messrs. Calbert, Agrawal and Jones (our

Compensation Committee members) serve as executive officers.

Relationships with the Investors. Goldman, Sachs & Co. and KKR provide management

and advisory services to us and our affiliates pursuant to a monitoring agreement with us and

Parent executed in connection with the Merger (the “Monitoring Agreement”). Under the terms

of the Monitoring Agreement, among other things, we are obligated to pay to those entities an

aggregate annual management fee plus all reasonable out of pocket expenses incurred in

connection with the provision of services under the agreement. We paid to those entities an

aggregate management fee of approximately $5.1 million in fiscal 2008, $1.1 million of which

was paid to Goldman, Sachs & Co. and $4.0 million of which was paid to KKR. We also

reimbursed KKR approximately $391,086 in expenses. We expect to incur an aggregate annual

fee for fiscal 2009 of approximately $5.4 million plus expenses. Thereafter, the annual

management fee will increase 5% per year. The Monitoring Agreement also provides that such

entities will be entitled to receive a fee equal to 1% of the gross transaction value in connection

with certain subsequent financing, acquisition or disposition of assets or equity interests,

recapitalization and other similar transactions, as well as a termination fee in the event of an

initial public offering or under certain other circumstances. All such fees are to be split based

upon an agreed upon formula, which results in an initial split of 78.38% of this fee payable to

KKR and 21.62% payable to Goldman, Sachs & Co.

In connection with entering into the Monitoring Agreement, on July 6, 2007 we and

Parent also entered into a separate indemnification agreement with the parties to the Monitoring

Agreement, pursuant to which we agreed to provide customary indemnification to such parties

and their affiliates.

In 2008, we paid approximately $1.1 million to KKR for expenses incurred in connection

with the recruitment of Mr. Dreiling to serve as our Chief Executive Officer, including fees paid

to executive search firms and fees paid to a management assessment firm.

Affiliates of KKR (among other entities) are lenders under, and Citicorp North America,

Inc. serves as administrative agent and collateral agent for, our $2.3 billion senior secured term