Dollar General 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

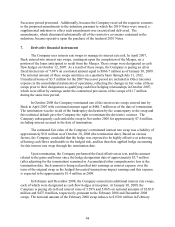

On December 4, 2008, a complaint was filed in the United States District Court for the

Western District of Tennessee (Tressa Holt, et al v. Dollar General Corporation, et al., Case

No.1:08-cv-01298 JDB) in which the plaintiff, on behalf of herself and a putative class of non-

exempt store employees, alleges that the Company violated the Fair Labor Standards Act by

failing to pay for all hours worked, including overtime hours. At this time, it is not possible to

predict whether the court will permit this action to proceed collectively. However, the Company

believes that this action is not appropriate for collective treatment and that the Company’ s wage

and hour policies and practices comply with the FLSA. The Company plans to vigorously defend

this action; however, no assurances can be given that the Company will be successful in the

defense on the merits or otherwise, and, if it is not successful, the resolution of this action could

have a material adverse effect on the Company’ s financial statements as a whole.

Subsequent to the announcement of the agreement relating to the Merger, the Company

and its directors were named in seven putative class actions alleging claims for breach of

fiduciary duty arising out of the Company’ s proposed sale to KKR. Each of the complaints

alleged, among other things, that the Company’ s directors engaged in “self-dealing” by agreeing

to recommend the transaction to the Company’ s shareholders and that the consideration available

to such shareholders in the transaction is unfairly low. On motion of the plaintiffs, each of these

cases was transferred to the Sixth Circuit Court for Davidson County, Twentieth Judicial

District, at Nashville. By order dated April 26, 2007, the seven lawsuits were consolidated in the

court under the caption, “In re: Dollar General,” Case No. 07MD-1. On June 13, 2007, the court

denied the Plaintiffs’ motion for a temporary injunction to block the shareholder vote that was

then held on June 21, 2007. On June 22, 2007, the Plaintiffs filed their amended complaint

making claims substantially similar to those outlined above. The court on November 6, 2008

certified a class of all persons who held stock in the Company on the date of the Merger. The

defendants filed for summary judgment.

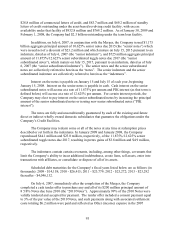

On November 24, 2008, all defendants, including the Company, reached an agreement in

principle to settle this lawsuit, subject to final documentation and court approval. The Company

determined that the agreement would be in the best interest of the Company to avoid costly and

time consuming litigation. Based on the agreement in principle, the Company recorded a charge

of approximately $34.5 million in the third quarter of 2008 in connection with the proposed

settlement, net of anticipated insurance proceeds of $7.5 million. In the fourth quarter, the

Company ultimately collected $10 million in insurance proceeds ($2.5 million more than the

anticipated amount), and on February 2, 2009, the Company funded the settlement. On February

11, 2009, the court approved the terms of the settlement. The additional $2.5 million in insurance

proceeds received in the fourth quarter of 2008 has been recorded as a reduction of Litigation

settlement and related costs, net in the 2008 statement of operations. Additional adjustments, not

expected to be material, may be made to the estimated additional legal fees and costs.

From time to time, the Company is a party to various other legal actions involving claims

incidental to the conduct of its business, including actions by employees, consumers, suppliers,

government agencies, or others through private actions, class actions, administrative

proceedings, regulatory actions or other litigation, including under federal and state employment

laws and wage and hour laws. The Company believes, based upon information currently

available, that such other litigation and claims, both individually and in the aggregate, will be