Dollar General 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

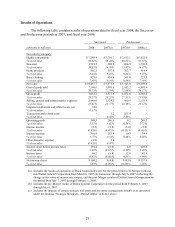

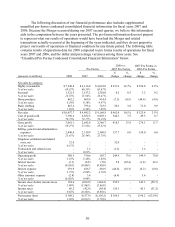

At the beginning of 2008, we defined four operating priorities as follows: 1) drive

productive sales growth, 2) increase our gross margins, 3) leverage process improvements and

information technology to reduce costs, and 4) strengthen and expand Dollar General's culture of

serving others. These continue to be our principal operating priorities in 2009. Coupled with the

changes we made to our operations during the year in connection with these priorities, which are

discussed in more detail below, we achieved the following financial highlights in fiscal 2008:

• Total sales in fiscal 2008 were $10.5 billion, a 10.1% increase from 2007. Sales in

same-stores increased 9.0% and were driven by increases in customer traffic and

average transaction amount. Average sales per square foot for all stores in 2008 were

approximately $180, up from $165 in 2007. Sales increases of highly consumable

products outpaced our more discretionary categories, likely the result of both our

merchandising initiatives, which were more focused on consumables, and the

negative effect of the economy on consumer discretionary spending.

• Gross profit, as a percentage of sales, was 29.3% in 2008. During the year, we made

progress in reducing our inventory shrinkage and improving the efficiencies of our

distribution and transportation processes as well as leveraging fixed distribution costs.

Improvements in our pricing systems and processes also permitted us to make more

timely price changes to compensate for unavoidable cost increases, and for the year,

markdowns declined.

• SG&A, as a percentage of sales, for fiscal 2008 was 23.4%. This compares to 23.8%

in the 2007 Successor period and 24.5% in the 2007 Predecessor period. Our

increased sales levels favorably impacted SG&A, as a percentage of sales, in addition

to a reduction in workers’ compensation expense, resulting from safety initiatives

implemented over the last several years, and reduced advertising expense. The 2007

Predecessor period included SG&A of $45.0 million, or 115 basis points, related to

closing underperforming stores.

• We recorded litigation expense of $32 million to reflect the settlement and related

expenses, net of insurance proceeds, of a class action lawsuit filed as a result of the

Merger in 2007. We determined that the settlement was in our best interests to avoid

costly and time consuming litigation.

• Interest expense of $391.9 million in 2008 relates primarily to interest on debt

incurred to finance the Merger. We repaid all borrowings under our revolving credit

facility in the first quarter of 2008 and incurred no additional borrowings during the

year. In January 2009, we further reduced our total long-term obligations by

repurchasing $44.1 million of senior subordinated notes.

• For fiscal 2008, we reported net income of $108.2 million. This compares to a net

loss of $4.8 million in the 2007 Successor period and a net loss of $8.0 million in the

2007 Predecessor period, each of which included significant costs related to the

Merger and other strategic initiatives as more fully described in the discussion below

of 2008 vs 2007.