Delta Airlines 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

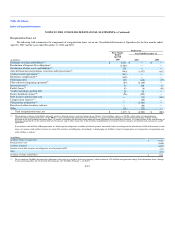

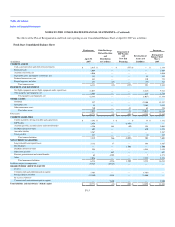

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Effective January 1, 2007, we adopted FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB

Statement No. 109" ("FIN 48"), which clarifies the accounting and disclosure for uncertainty in tax positions, as defined. FIN 48 is intended to reduce the

diversity in practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. The adoption of FIN 48

resulted in a $30 million charge to accumulated deficit that is reported as a cumulative effect adjustment for a change in accounting principle to the opening

balance sheet position of shareowners' deficit at January 1, 2007. For additional information regarding FIN 48, see Note 9.

In September 2006, the FASB issued SFAS 157. This Statement, among other things, defines fair value, establishes a framework for measuring fair

value and expands disclosure about fair value measurements. SFAS 157 is intended to eliminate the diversity in practice associated with measuring fair value

under existing accounting pronouncements. SFAS 157 is effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal

years. We were required to adopt SFAS 157 on April 30, 2007 in connection with the adoption of fresh start reporting. For additional information regarding

recurring and nonrecurring fair value measurements, see Note 3.

In June 2006, the FASB ratified the Emerging Issues Task Force ("EITF") consensus on EITF Issue No. 06-03, "How Taxes Collected From Customers

and Remitted to Governmental Authorities Should Be Presented in the Income Statement ("EITF 06-03"). The scope of EITF 06-03 includes any tax assessed

by a governmental authority that is directly imposed on a revenue-producing transaction between a seller and a customer, and provides that a company may

adopt a policy of presenting taxes either gross within revenue or on a net basis. For any such taxes that are reported on a gross basis, a company should

disclose the amounts of those taxes for each period for which an income statement is presented if those amounts are significant. This statement is effective for

interim and annual reporting periods beginning after December 15, 2006. We adopted EITF 06-03 on January 1, 2007. Various taxes and fees on the sale of

tickets to customers are collected by us as an agent and remitted to the respective taxing authority. These taxes and fees have been presented on a net basis in

the accompanying Consolidated Statements of Operations and recorded as a liability until remitted to the respective taxing authority.

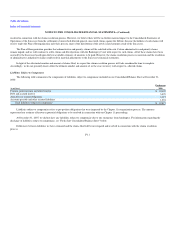

Cash and Cash Equivalents

We classify short-term, highly liquid investments with maturities of three months or less when purchased as cash and cash equivalents. These

investments are recorded at cost, which approximates fair value.

Short-Term Investments

At December 31, 2007 and 2006, our short-term investments were primarily comprised of auction rate securities. In accordance with SFAS No. 115,

"Accounting for Certain Investments in Debt and Equity Securities" ("SFAS 115"), we record these investments as trading securities at fair value on our

Consolidated Balance Sheets. For additional information about our accounting for trading securities, see "Investments in Debt and Equity Securities" in this

Note.

Restricted Cash

Restricted cash included in current assets on our Consolidated Balance Sheets totaled $520 million and $750 million at December 31, 2007 and 2006,

respectively. Restricted cash recorded in other noncurrent assets on our Consolidated Balance Sheets totaled $15 million and $52 million at December 31,

2007 and 2006, respectively.

At December 31, 2007, our restricted cash balance primarily relates to cash held in a grantor trust for the benefit of Delta pilots to fund the Pilot

Obligation. At December 31, 2006, our restricted cash primarily related to cash held as collateral by credit card processors and interline clearinghouses and to

support certain projected insurance obligations. Restricted cash is recorded at cost, which approximates fair value.

F-18