Delta Airlines 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

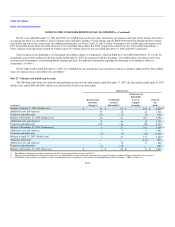

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

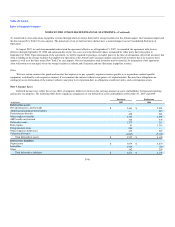

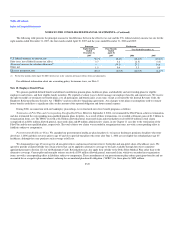

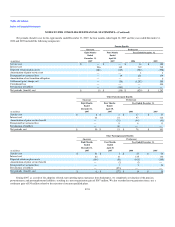

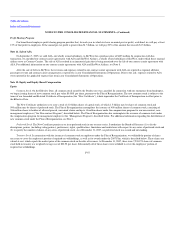

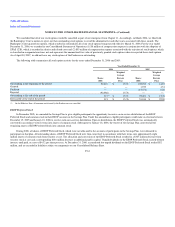

Assumed healthcare cost trend rates have an effect on the amounts reported for the other postretirement benefit plans. A 1% change in the healthcare

cost trend rate used in measuring the APBO for these plans at December 31, 2007, would have the following effects:

(in millions)

1%

Increase

1%

Decrease

Increase (decrease) in total service and interest cost $ 23 $ (4)

Increase (decrease) in the APBO 3 (40)

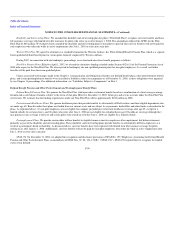

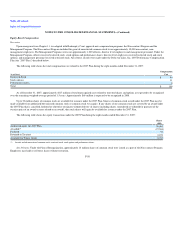

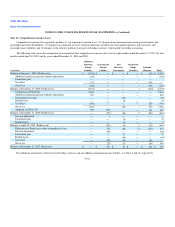

Pension Plan Assets

The weighted-average asset allocation for our pension plans at December 31, 2007 and September 30, 2006 is as follows:

Successor Predecessor

2007 2006

U.S. equity securities 35% 34%

Non-U.S. equity securities 15% 14%

High quality bonds 20% 18%

Convertible and high yield bonds 8% 8%

Private equity 15% 17%

Real estate 7% 9%

Total 100% 100%

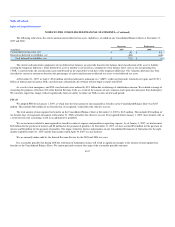

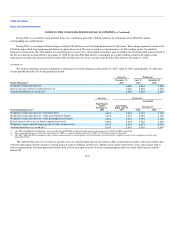

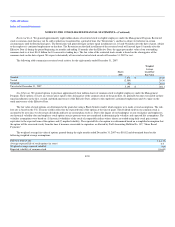

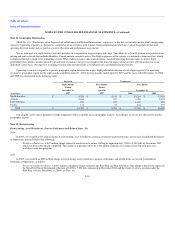

The investment strategy for pension plan assets is to utilize a diversified mix of global public and private equity portfolios, public and private fixed

income portfolios, and private real estate and natural resource investments to earn a long-term investment return that meets or exceeds a 9% annualized return

target. The overall asset mix of the portfolio is more heavily weighted in equity-like investments, including portions of the bond portfolio, which consist of

convertible and high yield securities. Active management strategies are utilized throughout the program in an effort to realize investment returns in excess of

market indices. Also, option and currency overlay strategies are used in an effort to generate modest amounts of additional income. A bond duration extension

program utilizing fixed income derivatives is employed in an effort to better align the market value movements of a portion of the pension plan assets to the

related pension plan liabilities.

Target investment allocations for the pension plan assets are as follows:

U.S. equity securities 27—41%

Non-U.S. equity securities 12—18%

High quality bonds 15—21%

Convertible and high yield bonds 5—11%

Private equity 15%

Real estate 10%

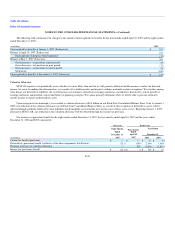

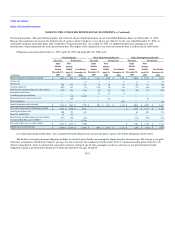

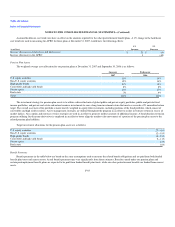

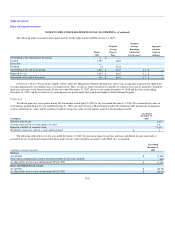

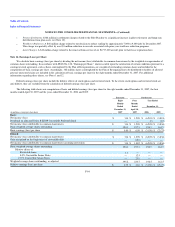

Benefit Payments

Benefit payments in the table below are based on the same assumptions used to measure the related benefit obligations and are paid from both funded

benefit plan trusts and current assets. Actual benefit payments may vary significantly from these estimates. Benefits earned under our pension plans and

certain postemployment benefit plans are expected to be paid from funded benefit plan trusts, while our other postretirement benefits are funded from current

assets.

F-55