Delta Airlines 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

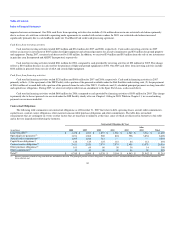

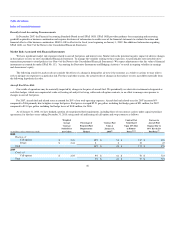

(in millions, unless otherwise stated)

Weighted

Average

Contract

Strike Price

per Gallon

Percentage of

Projected Fuel

Requirements

Hedged

Contract Fair

Value at

January 31,

2008(1)

Contract Fair

Value Based

Upon 10% Rise

in Futures

Prices(1)(2)

Increase in

Aircraft Fuel

Expense Due to

10% Rise in Jet

Fuel Price(3)

2010

Crude oil

Call options $ 2.04 2% $ 16 $ 17 $ 787

Total 2% $ 16 $ 17 $ 787

(1) Contract fair value includes the cost of premiums paid.

(2) Projection based upon average futures prices per gallon by contract settlement month.

(3) Projection based upon estimated average jet fuel price per gallon of $2.70, $2.81 and $2.93 and estimated aircraft fuel consumption of 2.5 billion gallons, 2.6 billion gallons and 2.7

billion gallons for 2008, 2009 and 2010, respectively, inclusive of the impact of fuel hedge instruments.

For additional information regarding our exposure to market risks, see Note 4 of the Notes to the Consolidated Financial Statements.

Interest Rate Risk

Our exposure to market risk from volatility in interest rates is primarily associated with our long-term debt obligations. Market risk associated with our

fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future earnings, respectively, from an increase in

interest rates. We had $4.5 billion of fixed-rate debt and $3.8 billion of variable-rate debt at December 31, 2007. At December 31, 2007 and 2006, a 10%

increase in average annual interest rates would have decreased the estimated fair value of our fixed-rate long-term debt by $332 million and $114 million,

respectively, and increased interest expense on our variable-rate long-term debt by $19 million and $24 million, respectively. At December 31, 2007 and

2006, we did not have any interest rate swaps or contractual arrangements that would reduce our interest expense. For additional information on our long-term

debt, see Note 6 of the Notes to the Consolidated Financial Statements.

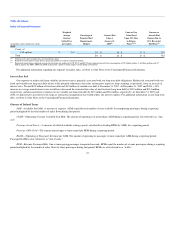

Glossary of Defined Terms

ASM—Available Seat Mile. A measure of capacity. ASMs equal the total number of seats available for transporting passengers during a reporting

period multiplied by the total number of miles flown during that period.

CASM—(Operating) Cost per Available Seat Mile. The amount of operating cost incurred per ASM during a reporting period, also referred to as "unit

cost".

Passenger Load Factor—A measure of utilized available seating capacity calculated by dividing RPMs by ASMs for a reporting period.

Passenger Mile Yield—The amount of passenger revenue earned per RPM during a reporting period.

RASM—(Operating or Passenger) Revenue per ASM. The amount of operating or passenger revenue earned per ASM during a reporting period.

Passenger RASM is also referred to as "unit revenue."

RPM—Revenue Passenger Mile. One revenue-paying passenger transported one mile. RPMs equal the number of revenue passengers during a reporting

period multiplied by the number of miles flown by those passengers during that period, RPMs are also referred to as "traffic".

47