Delta Airlines 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

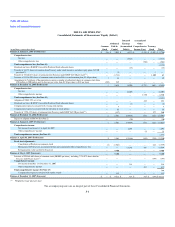

Table of Contents

Index to Financial Statements

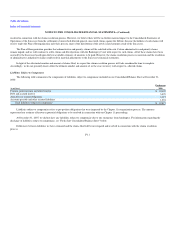

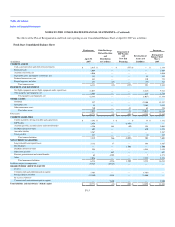

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(3) We revalued our assets and liabilities at estimated fair value as a result of fresh start reporting. This resulted in a $238 million gain, primarily reflecting the fair value of newly recognized

intangible assets, which was partially offset by reductions in the fair value of tangible property and equipment.

(4) Estimated claims for the four months ended April 30, 2007 relate to the restructuring of the financing arrangements for 143 aircraft, the rejection of two aircraft leases and adjustments to

prior claims estimates. Estimated claims for the year ended December 31, 2006 relate to the restructuring of the financing arrangements for 188 aircraft and the rejection of 16 aircraft

leases. Estimated claims for the year ended December 31, 2005 relate to the restructuring of the financing arrangements of seven aircraft, the rejection of 50 aircraft leases and the

repossession of 15 aircraft.

(5) In connection with amendments to our contract carrier agreements with Chautauqua Airlines, Inc. ("Chautauqua") and Shuttle America Corporation ("Shuttle America"), both subsidiaries

of Republic Airways Holdings, Inc. ("Republic Holdings"), which, among other things, reduced the rates we pay those carriers, we recorded (a) a $91 million allowed general, unsecured

claim and (b) a $37 million net charge related to our surrender of warrants to purchase up to 3.5 million shares of Republic Holdings common stock. Additionally, in connection with an

amendment to our contract carrier agreement with Freedom Airlines, Inc. ("Freedom"), a subsidiary of Mesa Air Group, Inc., which, among other things, reduced the rates we pay that

carrier, we recorded a $35 million allowed general, unsecured claim.

(6) In accordance with the Plan of Reorganization, we made $130 million in lump-sum cash payments to approximately 39,000 eligible non-contract, non-management employees. We

also recorded an additional charge of $32 million related to our portion of payroll related taxes associated with the issuance, as contemplated by the Plan of Reorganization, of

approximately 14 million shares of common stock to these employees. For additional information regarding the stock grants, see Note 12.

(7) Allowed general, unsecured claims of $83 million for the four months ended April 30, 2007 and $2.1 billion for the year ended December 31, 2006 in connection with Comair's and

Delta's respective comprehensive agreements with ALPA reducing pilot labor costs.

(8) Reflects interest earned due to the preservation of cash during our Chapter 11 proceedings.

(9) For the four months ended April 30, 2007, we recorded a net $43 million gain, primarily reflecting a $126 million net gain in connection with our settlement agreement with the

Massachusetts Port Authority ("Massport") which was partially offset by a net $80 million charge from an allowed general, unsecured claim under the Cincinnati Airport Settlement

Agreement. For additional information regarding our settlement agreement with Massport and the Cincinnati Airport Settlement Agreement, see Notes 6 and 8.

(10) Allowed general, unsecured claims in connection with agreements reached with committees representing pilot and non-pilot retired employees reducing their postretirement healthcare

benefits.

(11) Reflects a charge for rejecting substantially all of our stock options in our Chapter 11 proceedings. For additional information regarding this matter, see Note 2.

(12) $2.2 billion and $801 million allowed general, unsecured claims in connection with our settlement agreements with the PBGC and a group representing retired pilots, respectively.

Charges for these claims were offset by $1.3 billion in settlement gains associated with the derecognition of previously recorded Pilot Plan and pilot non-qualified plan obligations upon

each plan's termination. For additional information regarding our settlement agreements and the termination of those plans, see Note 10.

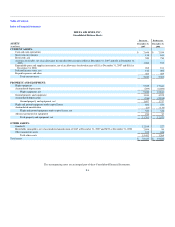

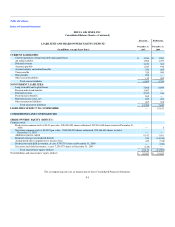

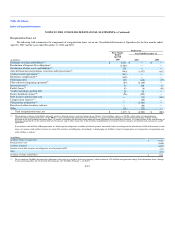

Fresh Start Consolidated Balance Sheet

As previously noted, upon emergence from Chapter 11, we adopted fresh start reporting, which required us to revalue our assets and liabilities to fair

value. In estimating fair value, we based the estimates and assumptions on guidance prescribed by SFAS No. 157, "Fair Value Measurements" ("SFAS 157").

SFAS 157, among other things, defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements.

For additional information about SFAS 157, see Note 3.

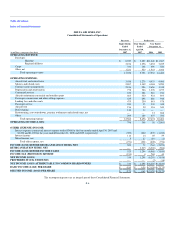

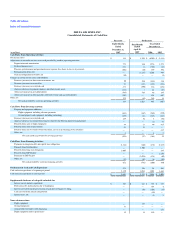

To facilitate the calculation of the enterprise value of the Successor, management developed a set of financial projections for the Successor using a

number of estimates and assumptions. The enterprise and corresponding reorganization value of the Successor was based on financial projections using

various valuation methods, including (1) a comparison of our projected performance to the market values of comparable

F-13