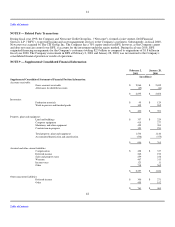

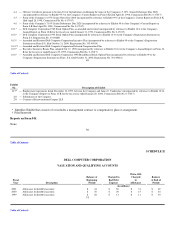

Dell 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

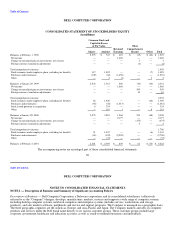

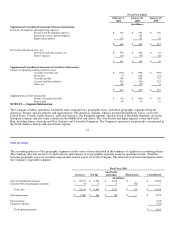

Common Stock

Authorized Shares — As of February 2, 2001, the Company is authorized to issue seven billion shares of common stock.

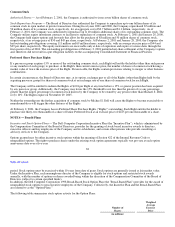

Stock Repurchase Program — The Board of Directors has authorized the Company to repurchase up to one billion shares of its

common stock in open market or private transactions. During fiscal years 2001 and 2000, the Company repurchased 65 million and

56 million shares of its common stock, respectively, for an aggregate cost of $2.7 billion and $1.1 billion, respectively. As of

February 2, 2001, the Company was authorized to repurchase up to 40 million additional shares of its outstanding common stock. The

Company utilizes equity instrument contracts to facilitate its repurchase of common stock. At February 2, 2001 and January 28, 2000,

the Company held equity options and forwards that allow for the purchase of 88 million and 50 million shares of common stock,

respectively, at an average price of $50 and $45 per share, respectively. At February 2, 2001 and January 28, 2000, the Company also

had outstanding put obligations covering 111 million and 69 million shares, respectively, with an average exercise price of $44 and

$39 per share, respectively. The equity instruments are exercisable only at date of expiration and expire at various dates through the

first quarter of fiscal 2004. The outstanding put obligations at February 2, 2001 permitted net share settlement at the Company's option

and, therefore, did not result in a put obligation liability on the accompanying Consolidated Statement of Financial Position.

Preferred Share Purchase Rights

If a person or group acquires 15% or more of the outstanding common stock, each Right will entitle the holder (other than such person

or any member of such group) to purchase, at the Right's then current exercise price, the number of shares of common stock having a

market value of twice the exercise price of the Right. If exercisable, the Rights contain provisions relating to merger or other business

combinations.

In certain circumstances, the Board of Directors may, at its option, exchange part or all of the Rights (other than Rights held by the

acquiring person or group) for shares of common stock at an exchange rate of one share of common stock for each Right.

The Company will be entitled to redeem the Rights at $.001 per Right at any time before a 15% or greater position has been acquired

by any person or group. Additionally, the Company may lower the 15% threshold to not less than the greater of (a) any percentage

greater than the largest percentage of common stock known by the Company to be owned by any person (other than Michael S. Dell)

or (b) 10%. The Rights expire on November 29, 2005.

Neither the ownership nor the further acquisition of common stock by Michael S. Dell will cause the Rights to become exercisable or

nonredeemable or will trigger the other features of the Rights.

At February 2, 2001, the Company has no Preferred Share Purchase Rights ("Rights") outstanding. Each Right entitles the holder to

purchase one thirty-two thousandth of a share of Junior Preferred Stock at an exercise price of $225 per one-thousandth of a share.

NOTE 6 — Benefit Plans

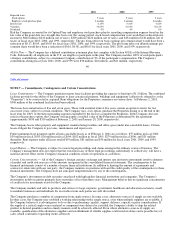

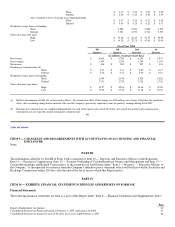

Incentive and Stock Option Plans — The Dell Computer Corporation Incentive Plan (the "Incentive Plan"), which is administered by

the Compensation Committee of the Board of Directors, provides for the granting of stock-based incentive awards to directors,

executive officers and key employees of the Company and its subsidiaries, and certain other persons who provide consulting or

advisory services to the Company.

Options granted may be either incentive stock options within the meaning of Section 422 of the Internal Revenue Code or

nonqualified options. The right to purchase shares under the existing stock option agreements typically vest pro-rata at each option

anniversary date over a five-year

38

Table of Contents

period. Stock options must be exercised within 10 years from date of grant. Stock options are generally issued at fair market value.

Under the Incentive Plan, each nonemployee director of the Company is eligible for stock options and restricted stock awards

annually, with the number of options or shares awarded being within the discretion of the Compensation Committee of the Board of

Directors (subject to certain specified limits).

In addition, the Dell Computer Corporation 1998 Broad-Based Stock Option Plan (the "Broad-Based Plan") provides for the award of

nonqualified stock options to non-executive employees of the Company. Collectively, the Incentive Plan and the Broad-Based Plan

are referred to as the "Option Plans."

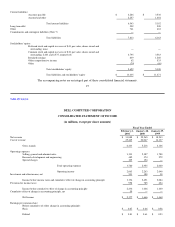

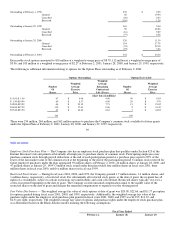

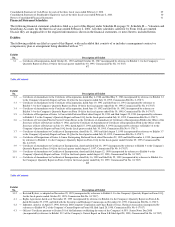

The following table summarizes stock option activity for the Option Plans:

Weighted

Average

Number of Exercise

Shares Price

(in millions)