Dell 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

diversifies the investment portfolio by investing in multiple types of investment-grade securities and through the use of different

investment brokers. The Company's investment portfolio is partially invested in short-term securities with at least an investment-grade

rating to minimize

23

Table of Contents

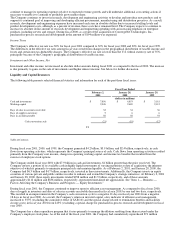

interest rate and credit risk as well as to provide for an immediate source of funds. Based on the Company's investment portfolio and

interest rates at February 2, 2001, a 100 basis point increase or decrease in interest rates would result in a decrease or increase of

$56 million, respectively, in the fair value of the investment portfolio. Changes in interest rates may affect the fair value of the

investment portfolio; however, the Company will not recognize such gains or losses unless the investments are sold.

The Company also invests in equity securities of companies in order to enhance and extend the Company's direct business model and

core business initiatives. The Company has an active venture capital program, through which the Company makes strategic equity

investments in privately and publicly held technology companies. Because these companies are typically early-stage companies with

products or services that are not yet fully developed or that have not yet achieved market acceptance, these investments are inherently

risky. See "Item 1 — Business — Factors Affecting the Company's Business and Prospects — Equity Investments."

Factors Affecting the Company's Business and Prospects

There are numerous factors that affect the Company's business and the results of its operations. These factors include general

economic and business conditions; the level of demand for the Company's products and services; the level and intensity of competition

in the technology industry and the pricing pressures that have resulted; the ability of the Company to timely and effectively manage

periodic product transitions, as well as component availability and cost; the ability of the Company to develop new products based on

new or evolving technology and the market's acceptance of those products; the ability of the Company to manage its inventory levels

to minimize excess inventory, declining inventory values and obsolescence; the product, customer and geographic sales mix of any

particular period; the Company's ability to recover its investments in venture capital activities; and the Company's ability to effectively

manage its operating costs. For a discussion of these and other factors affecting the Company's business and prospects, see "Item 1 —

Business — Factors Affecting the Company's Business and Prospects."

Recently Issued Accounting Pronouncements

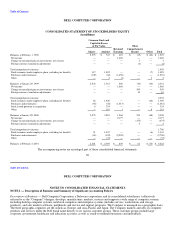

Effective February 3, 2001, the Company adopted SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as

amended, which establishes accounting and reporting standards for derivative instruments and hedging activities. SFAS No. 133

requires that an entity recognize all derivatives as either assets or liabilities in the Consolidated Statement of Financial Position and

measure those instruments at fair value. The adoption of this statement will not have a material effect on the Company's financial

condition or results of operations. However, its application may increase the volatility of investment and other income, net in the

Consolidated Statement of Income and other comprehensive income in the Consolidated Statement of Stockholders' Equity.

ITEM 7A — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Response to this item is included in "Item 7 — Management's Discussion and Analysis of Financial Condition and Results of

Operations — Market Risk."

24

Table of Contents

ITEM 8 — FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Page

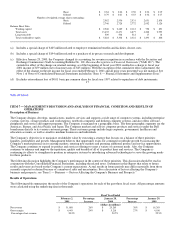

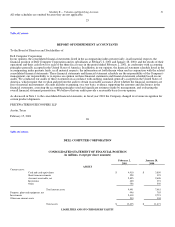

Financial Statements:

Report of Independent Accountants 26

Consolidated Statement of Financial Position at February 2, 2001 and January 28, 2000 27

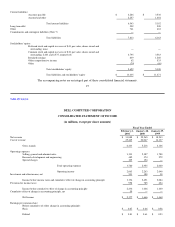

Consolidated Statement of Income for each of the three fiscal years ended February 2, 2001 28

Consolidated Statement of Cash Flows for each of the three fiscal years ended February 2, 2001 29

Consolidated Statement of Stockholders' Equity for each of the three fiscal years ended February 2, 2001 30

Notes to Consolidated Financial Statements 31

Financial Statement Schedule:

For each of the three fiscal years ended February 2, 2001