Dell 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

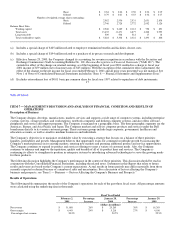

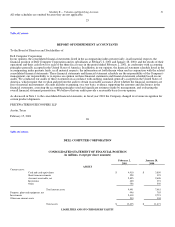

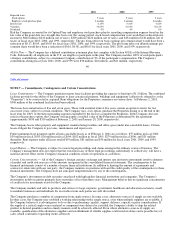

Fiscal Year — The Company's fiscal year is the 52- or 53-week period ending on the Friday nearest January 31.

Principles of Consolidation — The accompanying consolidated financial statements have been prepared in accordance with generally

accepted accounting principles and include the accounts of the Company and its consolidated subsidiaries. All significant

intercompany transactions and balances have been eliminated.

Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires the

use of management's estimates. These estimates are subjective in nature and involve judgments that affect the reported amounts of

assets and liabilities, the disclosure of contingent assets and liabilities at fiscal year end and the reported amounts of revenues and

expenses during the fiscal year. Actual results could differ from those estimates.

Cash and Cash Equivalents — All highly liquid investments with original maturities of three months or less at date of purchase are

carried at cost plus accrued interest, which approximates fair value, and are considered to be cash equivalents. All other investments

not considered to be a cash equivalent are separately categorized as investments.

Investments — The Company's debt securities and publicly traded equity securities are classified as available-for-sale and are reported

at fair market value using the specific identification method. All other investments are recorded at cost. Unrealized gains and losses

are reported, net of taxes, as a component of stockholders' equity. Unrealized losses are charged against income when a decline in the

fair market value of an individual security is determined to be other-than-temporary. Realized gains and losses on investments are

included in investment and other income, net when realized.

Inventories — Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out basis.

Property, Plant and Equipment — Property, plant and equipment are carried at depreciated cost. Depreciation is provided using the

straight-line method over the estimated economic lives of the assets, which range from 10 to 30 years for buildings and two to five

years for all other assets. Leasehold improvements are amortized over the shorter of five years or the lease term. Gains or losses

related to retirements or disposition of fixed assets are recognized in the period incurred. The Company performs reviews for the

impairment of fixed assets whenever events or changes in circumstances indicate that the carrying amount of an asset may not be

recoverable. The Company capitalizes eligible internal-use software development costs incurred subsequent to the completion of the

preliminary project stage. Development costs are amortized over the shorter of the expected useful life of the software or five years.

31

Table of Contents

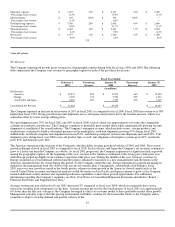

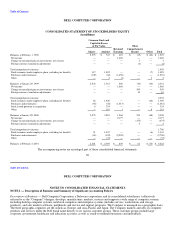

Goodwill and Other Intangibles — Amortization of goodwill and other intangibles is charged to income on a straight-line basis over

the periods estimated to benefit, ranging from three to eight years. Goodwill and other intangibles are reviewed for impairment on an

undiscounted basis whenever events or circumstances indicate that the carrying amount of an asset may not be recoverable.

Foreign Currency Translation — The majority of the Company's international sales are made by international subsidiaries, which

have the U.S. dollar as their functional currency. Local currency transactions of international subsidiaries, which have the U.S. dollar

as the functional currency are remeasured into U.S. dollars using current rates of exchange for monetary assets and liabilities and

historical rates of exchange for nonmonetary assets. Gains and losses from remeasurement are included in investment and other

income, net. The Company's subsidiaries that do not have the U.S. dollar as their functional currency translate assets and liabilities at

current rates of exchange in effect at the balance sheet date. The resulting gains and losses from translation are included as a

component of stockholders' equity. Revenue and expenses from the Company's international subsidiaries are translated using the

monthly average exchange rates in effect for the period in which the items occur.

Foreign Currency Hedging Instruments — The Company enters into foreign currency exchange contracts to hedge its foreign

currency risks. These contracts are designated at inception as a hedge and measured for effectiveness both at inception and on an

ongoing basis. Realized and unrealized gains or losses and premiums paid on foreign currency purchased option contracts that are

designated and effective as hedges of probable anticipated, but not firmly committed, foreign currency transactions are deferred and

recognized in income as a component of net revenue, cost of revenue and/or operating expenses in the same period as the hedged

transaction. Forward contracts designated as hedges of probable anticipated or firmly committed transactions are accounted for on a

mark-to-market basis, with realized and unrealized gains or losses recognized in the accompanying Consolidated Statement of Income.

Equity Instruments Indexed to the Company's Common Stock — Proceeds received from the sale of equity instruments and amounts

paid to purchase equity instruments are recorded as a component of stockholders' equity. Subsequent changes in the fair value of the

equity instrument contracts are not recognized. If the contracts are ultimately settled in cash, the amount of cash paid or received is

recorded as a component of stockholders' equity.

Revenue Recognition — Product revenue is recognized when both title and risk of loss transfers to the customer, provided that no

significant obligations remain. Provision is made for an estimate of product returns and doubtful accounts, based on historical

experience. Revenue from separately priced extended warranty and service programs is deferred and recognized over the respective

service or extended warranty period when the Company is the obligor. Revenue from sales involving multiple elements is allocated to

each element based on their respective fair values and recorded as revenue as each element is delivered.