Dell 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

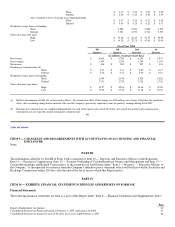

Foreign Currency Instruments

The Company uses foreign currency purchased option contracts to reduce its exposure to currency fluctuations involving probable

anticipated, but not firmly committed, transactions. It also uses forward contracts to reduce exposure to transactions with firm foreign

currency commitments. These transactions include international sales by U.S. dollar functional currency entities, foreign currency

denominated purchases of certain components and intercompany shipments to certain international subsidiaries. The risk of loss

associated with purchased options is limited to premium amounts paid for the option contracts. Foreign currency purchased options

generally expire in 12 months or less. At February 2, 2001, the Company held purchased option contracts with a notional amount of

$2 billion, a net asset value of $67 million and a combined net realized and unrealized deferred loss of $4 million. At January 28,

2000, the Company held purchased option contracts with a notional amount of $2 billion, a net asset value of $75 million and a

combined net realized and unrealized deferred gain of $5 million. The risk of loss associated with forward contracts is equal to the

exchange rate differential from the time the contract is entered into until the time it is settled. Transactions with firm foreign currency

commitments are generally hedged using foreign currency forward contracts for periods not exceeding three months. At February 2,

2001, the Company held forward contracts with a notional amount of $888 million, a net liability value of $49 million and a net

realized and unrealized deferred loss of $1 million. At January 28, 2000, the Company held forward contracts with a notional amount

of $818 million, a net asset value of $17 million and a net realized and unrealized deferred gain of $1 million.

35

Table of Contents

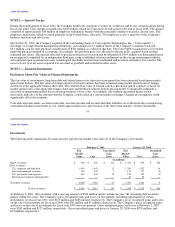

Long-term Debt and Interest Rate Risk Management

In April 1998, the Company issued $200 million 6.55% fixed rate senior notes due April 15, 2008 (the "Senior Notes") and

$300 million 7.10% fixed rate senior debentures due April 15, 2028 (the "Senior Debentures"). Interest on the Senior Notes and Senior

Debentures is paid semi-annually, on April 15 and October 15. The Senior Notes and Senior Debentures rank pari passu and are

redeemable, in whole or in part, at the election of the Company for principal, any accrued interest and a redemption premium based on

the present value of interest to be paid over the term of the debt agreements. The Senior Notes and Senior Debentures generally

contain no restrictive covenants, other than a limitation on liens on the Company's assets and a limitation on sale-leaseback

transactions.

Concurrent with the issuance of the Senior Notes and Senior Debentures, the Company entered into interest rate swap agreements

converting the Company's interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate

characteristics to its cash and investments portfolio. The interest rate swap agreements have an aggregate notional amount of

$200 million maturing April 15, 2008 and $300 million maturing April 15, 2028. The floating rates are based on three-month London

interbank offered rates ("LIBOR") plus 0.41% and 0.79% for the Senior Notes and Senior Debentures, respectively. As a result of the

interest rate swap agreements, the Company's effective interest rates for the Senior Notes and Senior Debentures were 7.20% and

7.54%, respectively, for fiscal year 2001.

The Company has designated the issuance of the Senior Notes and Senior Debentures and the related interest rate swap agreements as

an integrated transaction. Accordingly, the differential to be paid or received on the interest rate swap agreements is accrued and

recognized as an adjustment to interest expense as interest rates change.

The difference between the Company's carrying amounts and fair value of its long-term debt and related interest rate swaps was not

material at February 2, 2001 and January 28, 2000.

Financing Arrangements

The Company maintains a $250 million revolving credit facility, which expires in June 2002. Commitment fees for this facility are

payable quarterly and are based on specific liquidity requirements. Commitment fees paid in fiscal years 2001, 2000 and 1999 were

not material. At February 2, 2001 and January 28, 2000 this facility was unused.

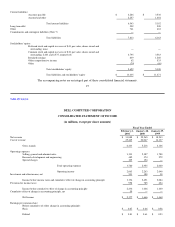

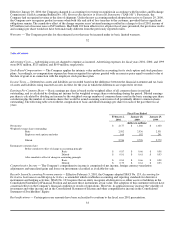

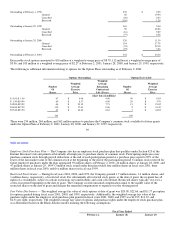

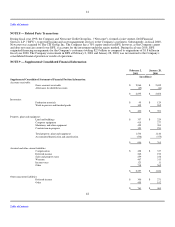

NOTE 4 — Income Taxes

The provision for income taxes consists of the following:

Fiscal Year Ended

February 2, January 28, January 29,

2001 2000 1999

(in millions)

Current:

Domestic $ 964 $ 1,008 $ 567

Foreign 168 84 86

Deferred (174) (307) (29)

Provision for income taxes $ 958 $ 785 $ 624