Costco 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

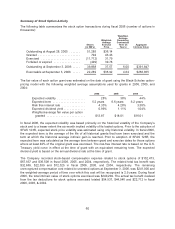

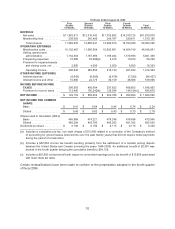

52 Weeks Ended August 28, 2005

First

Quarter

12 Weeks

Second

Quarter

12 Weeks

Third

Quarter

12 Weeks

Fourth

Quarter

16 Weeks Total

52 Weeks

REVENUE

Net sales .................. $11,342,611 $12,415,442 $11,750,892 $16,370,125 $51,879,070

Membership fees ........... 238,059 245,499 249,787 339,811 1,073,156

Total revenue ............ 11,580,670 12,660,941 12,000,679 16,709,936 52,952,226

OPERATING EXPENSES

Merchandise costs .......... 10,132,487 11,056,064 10,503,661 14,654,749 46,346,961

Selling, general and

administrative ............ 1,134,353 1,187,986 1,168,404 1,570,596 5,061,339

Preopening expenses ....... 10,385 22,996(a) 9,475 10,374 53,230

Provision for impaired assets

and closing costs, net ...... 2,800 4,000 3,000 6,593 16,393

Operating income ......... 300,645 389,895 316,139 467,624 1,474,303

OTHER INCOME (EXPENSE)

Interest expense ............ (9,642) (8,980) (8,476) (7,339) (34,437)

Interest income and other .... 15,590 24,779 30,159 38,568 109,096

INCOME BEFORE INCOME

TAXES ................... 306,593 405,694 337,822 498,853 1,548,962

Provision for income taxes . . . 113,440 100,242(b) 128,034 144,154(c) 485,870

NET INCOME ................ $ 193,153 $ 305,452 $ 209,788 $ 354,699 $ 1,063,092

NET INCOME PER COMMON

SHARE:

Basic ..................... $ 0.41 $ 0.64 $ 0.44 $ 0.74 $ 2.24

Diluted .................... $ 0.40 $ 0.62 $ 0.43 $ 0.73 $ 2.18

Shares used in calculation (000’s)

Basic ..................... 465,869 474,221 478,248 476,636 473,945

Diluted .................... 489,284 493,700 493,282 491,392 492,035

Dividends per share ........... $ 0.100 $ 0.100 $ 0.115 $ 0.115 $ 0.430

(a) Includes a cumulative pre-tax, non-cash charge of $15,999 related to a correction of the Company’s method

of accounting for ground leases (entered into over the past twenty years) that did not require rental payments

during the period of construction.

(b) Includes a $52,064 income tax benefit resulting primarily from the settlement of a transfer pricing dispute

between the United States and Canada (covering the years 1996-2003). An additional benefit of $2,091 was

booked in the fourth quarter bringing the cumulative benefit to $54,155.

(c) Includes a $20,592 net tax benefit with respect to unremitted earnings and a tax benefit of $13,895 associated

with lower state tax rates.

Certain reclassifications have been made to conform to the presentation adopted in the fourth quarter

of fiscal 2006.

70